"Except for Eco-Friendly Vehicles, Maintaining Lowest Prices in U.S. Market Will Be Difficult"

"Local Production Share Weaker Than Japan and EU... Production Costs Expected to Rise"

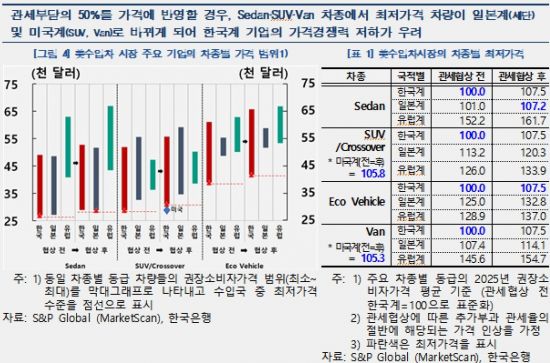

As the United States imposes a 15% tariff on Korean-made automobiles-the same rate applied to competing countries such as Japan and the European Union (EU)-an analysis has found that it will be difficult for Korean automakers to maintain their lowest price competitiveness except for eco-friendly vehicles. The relatively low proportion of local production is also expected to place Korean companies under greater pressure from production costs compared to their competitors.

On August 28, the Bank of Korea stated this in its report, "Changes in the Competitiveness of Korean Automobiles in the U.S. Market Following Tariff Imposition," which was included in the "August Economic Outlook."

With the conclusion of Korea-U.S. tariff negotiations on July 30, tariffs on Korean automobiles and parts have been set at 15%, the same as those imposed on Japan and the EU. This means that Korean automakers have lost the tariff-free benefits they have enjoyed since the Korea-U.S. Free Trade Agreement (FTA) took effect in March 2012. Considering that Japan and the EU had previously been subject to a 2.5% tariff, Korea is now at a disadvantage in terms of comparative advantage. As of last year, the United States was the largest export market for Korean automobiles, accounting for more than half of Korea's auto exports.

The Bank of Korea examined how the tariff negotiation results would affect the competitiveness of Korean automakers in the U.S. market, dividing the analysis into three areas: price competitiveness, quality competitiveness, and supply chain.

The results indicated that price competitiveness would be hit, particularly for sedan and SUV models. In the case of sedans, there is almost no price difference between Korean and Japanese brands. With the same tariff rate applied and 50% of the tariff burden reflected in prices, the lowest-priced vehicles would shift to Japanese brands. For SUVs, which are the main products of Korean companies, they are expected to maintain a competitive edge over other countries, but their prices will be higher than those of U.S.-made vehicles, which are not subject to tariffs, potentially leading to a shift in demand. Only eco-friendly vehicles such as electric and hybrid cars are expected to maintain price competitiveness.

The report also assessed that quality competitiveness is not particularly high. While the overall quality of Korean automobiles is on the rise, it still lags behind major Japanese brands. In addition, the durability quality of Korean vehicles is reportedly declining relative to competitors. The Bank of Korea stated, "Addressing this issue will require long-term investment in facilities and research and development (R&D), which could pose an additional burden to Korean companies beyond tariff costs."

Supply chain competitiveness is also considered weaker than that of competing countries. This competitiveness depends on how smoothly major companies from each country can manufacture finished vehicles in the U.S. and source parts for local production without tariff burdens. However, Korean automakers are estimated to have a relatively lower proportion of finished vehicles that can be produced locally in the U.S. compared to Japan and the EU. According to the Bank of Korea and others, Japan and the EU have local production rates exceeding 50%, while Korea's rate is below 45%. Korean companies are also known to source a lower proportion of parts locally compared to Japanese competitors. Given these factors, Korean companies are expected to face relatively greater pressure from rising production costs.

The Bank of Korea pointed out, "In today's market environment, price competitiveness in the U.S. will be relatively weaker compared to Japan and the EU, and the local production supply chain that could help avoid tariff burdens is also less robust, resulting in a greater burden from production costs." The report added, "If Korean companies continue to increase their investment in the U.S. to build local supply chains and improve quality, this could lead to a structural decline in domestic automobile production and infrastructure, posing a medium- to long-term downside risk to Korea's economic growth."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.