Pessimistic Scenario:

U.S.-China Trade Tensions Flare Up Again

Korea's Growth Rate Could Drop to 1.4% Next Year

If the Optimistic Scenario Applies,

Korea Expected to Grow 1.7% Next Year

Depending on domestic and international tariff variables, next year's growth rate outlook may be revised downward by up to 0.2 percentage points. South Korea has yet to finalize tariff rates on major export items such as semiconductors, and tariff negotiations with major countries that significantly impact the Korean economy, including China, also remain uncertain. However, it has been analyzed that the impact of tariff variables on this year's growth rate outlook will be limited, as the tariff paths under different scenarios are expected to diverge from the baseline outlook starting in the fourth quarter of this year.

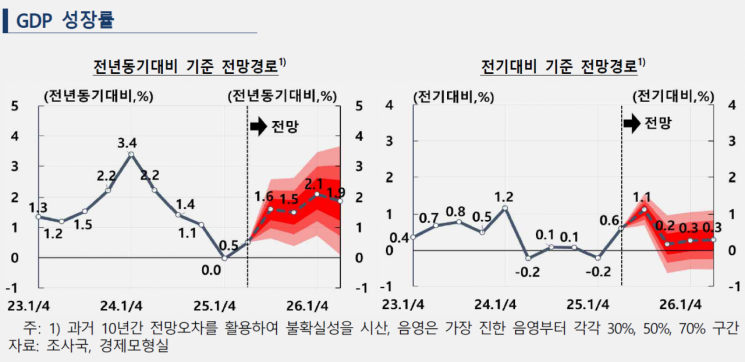

The Bank of Korea, in its revised economic outlook released on the 28th, projected economic growth rates of 0.9% for this year and 1.6% for next year. In the baseline scenario, U.S. tariff policy assumes that current country-specific and item-specific tariffs will be maintained. For South Korea, the mutual tariff rate was set at 15%, up from the 10% projected in May. This reflects the agreement between the United States and the European Union to cap tariffs on semiconductors and pharmaceuticals at 15%, as well as South Korea's receipt of most-favored-nation treatment for semiconductors and pharmaceuticals. Tariffs on steel and aluminum were also raised from 25% to 50%, and the range of affected items was expanded. The tariff on automobiles was reduced from 25% to 15%. Tariffs on semiconductors and pharmaceuticals were assumed to be 15%, higher than the 10% baseline in May, and the implementation was postponed from the third quarter of this year to sometime in 2026.

Under these assumptions, by the end of next year, the average U.S. tariff rate will be 18%, and the average tariff rate on Chinese goods will be around 45%. For South Korea, an average tariff rate of 16% was assumed in all scenarios.

Pessimistic Scenario: Renewed U.S.-China Trade Tensions... Korea's Growth Next Year Could Be Limited to 1.4%

The pessimistic scenario assumes a resurgence of global trade tensions. It is based on the premise that U.S.-China tensions reignite and negotiations with other countries break down. After the tariff grace period ends, mutual tariffs between the U.S. and China are reinstated, and China responds with retaliatory tariffs. The scenario also assumes that, during the review of the United States-Mexico-Canada Agreement (USMCA), inter-country conflicts intensify, resulting in a significant reduction of tariff exemptions starting in the second half of next year.

In this case, by the end of next year, the average U.S. tariff rate would rise to 25%, 7 percentage points higher than the baseline scenario. The tariff rate on Chinese goods would reach 59%, 14 percentage points higher than the baseline. Due to the negative impact on global growth, South Korea's domestic growth rate next year is projected to be 1.4%, 0.2 percentage points lower than the baseline outlook, while the inflation rate is forecast to decrease by 0.1 percentage points to 1.8%.

If the Optimistic Scenario Applies, Korea Expected to Grow 1.7% Next Year

The optimistic scenario envisions a further easing of trade tensions. It assumes that the U.S. and China reach a trade agreement before China's tariff grace period expires in November, and that negotiations with Canada and Mexico proceed smoothly, resulting in the withdrawal of fentanyl-related tariffs. In this case, the average U.S. tariff rate would decline by the end of this year, but, as assumed in the baseline scenario, tariffs on semiconductors and pharmaceuticals would be imposed, causing the average tariff to gradually rise over the course of next year.

By the end of next year, the average U.S. tariff rate would be 15%, 3 percentage points lower than the baseline scenario. The tariff rate on Chinese goods would drop sharply to 25%, a decrease of 20 percentage points compared to the baseline. As a result, with global growth rising, South Korea's domestic growth rate next year is projected to be 0.1 percentage points higher than the baseline outlook. The impact on the inflation rate is expected to be limited.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.