Food tech startup Jeongyukgak and eco-friendly distributor Chorokmaeul are exploring the possibility of being sold as part of court rehabilitation proceedings. The market is closely watching whether both companies will be sold together or if only Chorokmaeul will find a new owner.

According to the court and industry sources on August 27, Jeongyukgak and Chorokmaeul submitted an application for approval of a "pre-approval M&A" to the Seoul Bankruptcy Court on August 18. The court will make a final decision on whether to grant approval after hearing the opinions of the creditors' council and the management committee. This has caused some delay in reaching a conclusion. In particular, since Jeongyukgak has already ceased operations, the court is reportedly deliberating whether to include it in the joint sale or to leave only Chorokmaeul as the target for sale.

Some creditors believe that liquidation would be a better option for Jeongyukgak. A court official stated, "The court is reviewing the opinions of creditors and stakeholders," adding, "It is difficult to make a definitive statement, as the decision rests with the court." It is reported that Samil PricewaterhouseCoopers, the sale manager, has already sent a request for proposal (RFP) to potential bidders for Chorokmaeul.

Jeongyukgak: From "Rising Star" to "Distressed Company"

Jeongyukgak was once considered a "rising star" in the food tech industry. Founded in 2016 by CEO Kim Jaeyeon, a KAIST graduate, the company promoted itself as an online meat platform and built its own logistics system and delivery network. As of 2022, its corporate value was estimated at 400 billion won, with accumulated investments exceeding 100 billion won.

However, aggressive investments and borrowing proved detrimental. In 2021, cash reserves increased to 24.3 billion won through borrowing and investment, but land and facility investments (30 billion won) and the acquisition of Chorokmaeul (88.7 billion won) depleted the funds. By the end of 2023, the cash balance was only 5.7 million won.

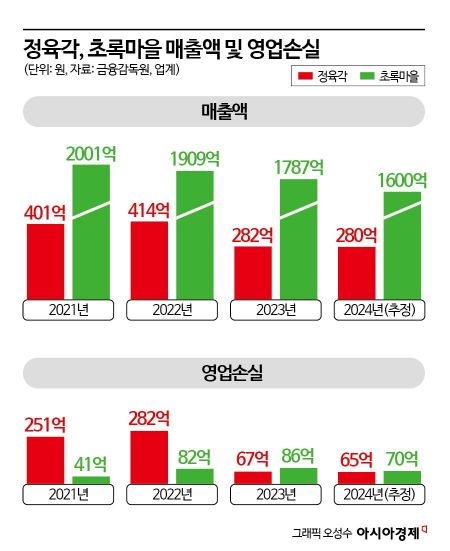

The company’s performance also deteriorated significantly. Sales dropped from 40.1 billion won in 2021 and 41.4 billion won in 2022 to 28.2 billion won in 2023, with last year’s sales estimated to be around 28 billion won. Operating losses were recorded at 25.1 billion won in 2021, 28.2 billion won in 2022, and 6.7 billion won in 2023, with last year’s deficit also expected to be around 6.5 billion won.

The financial structure is also weak. Assets decreased from 80.5 billion won in 2022 to 59.8 billion won in 2023, while liabilities increased to 90.8 billion won. Of the 64.2 billion won in current liabilities, 51.4 billion won are short-term loans. Major loans include a Shinhan Capital bridge loan (32 billion won at an annual rate of 8.5%), a Shinhan Bank operating loan (10 billion won at 4.7% per annum), Chorokmaeul borrowings (5.6 billion won at 5-6% per annum), and an Authentic Brands Korea loan (3 billion won at 12% per annum). Interest expenses account for more than 10% of sales, meaning that even if the company turns a profit, earnings are effectively consumed by interest payments.

Chorokmaeul: Nationwide Network Fails to Deliver

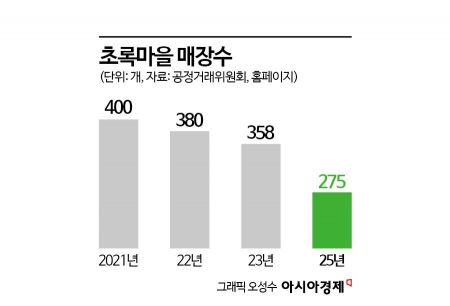

Chorokmaeul, which started as "Hankyoreh Plus" in 1999, changed its name in 2009 and became a leader in the organic and eco-friendly food market. At one point, the company had more than 400 franchise stores nationwide, but it could not escape chronic deficits. After passing through Daesang Holdings, Jeongyukgak acquired a 99.57% stake in 2022 for 88.7 billion won, but this did not turn things around.

Sales declined from 200.1 billion won in 2021 to 190.9 billion won in 2022 and 178.8 billion won in 2023. Last year’s sales are estimated to have remained around 160 billion won. Operating losses were 4.1 billion won in 2021, 8.2 billion won in 2022, and 8.6 billion won in 2023, with last year’s deficit also around 7 billion won. Accumulated deficits total 18.7 billion won, with total liabilities at 54 billion won and a debt ratio of 557%. Year-end cash stood at about 60 million won.

The business foundation is also weakening. The number of stores nationwide decreased from 400 in 2021 to 358 in 2023, with only 275 remaining today. Over 120 stores have disappeared in just three and a half years. The combination of franchisee departures and shrinking consumer demand has weakened the brand’s competitiveness. In addition, unsettled payments to partners and franchisees have ballooned to over 20 billion won, further eroding trust. When factoring in store rent and employee salaries, the actual repayment burden is analyzed to be much higher.

The Remaining Variable: "New Owner"

The Seoul Bankruptcy Court decided to commence rehabilitation proceedings for both Jeongyukgak and Chorokmaeul on July 4. All of Jeongyukgak’s approximately 100 employees were advised to resign on the day of the application. There are about 196 creditors for Jeongyukgak and 738 for Chorokmaeul. The court has requested submission of a rehabilitation plan by the 29th of next month.

The Gimpo logistics center, which is being prepared for sale (valued at about 30 billion won), is tied up as collateral and under provisional seizure by creditors. According to the registry, Korea Development Bank (34 billion won), Shinhan Capital (5 billion won), Daesang Holdings (2.56 billion won), and Doosan Engineering & Construction (600 million won) have established collateral rights. In addition, provisional seizures have been filed by partners such as E-Land Retail (3 billion won), Megazone Cloud (4 billion won), and the Daejeon-Chungnam Swine Cooperative (700 million won). The National Tax Service and local governments have also imposed seizures.

The industry outlook is pessimistic. A distribution industry official commented, "While Jeongyukgak and Chorokmaeul still have brands and assets, their debts and stakeholder relationships are far too complex. Even if a buyer emerges, resolving debt restructuring and partner issues will be a major challenge."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.