Homesys Leads Sales with Rental Products like Water Purifiers

Rice Cooker Market Stagnant for a Decade... Diversification Strategy

Bed Sales Up 218%... Strong Growth in New Products

Cuckoo, a company synonymous with the domestic rice cooker market, is shedding its image as a “rice cooker company” and expanding its presence across the broader home appliance sector. In particular, its affiliate Cuckoo Homesys, which leads the rental business for products such as water purifiers, air purifiers, and dryers, is driving performance and widening the revenue gap with the traditional powerhouse, Cuckoo Electronics.

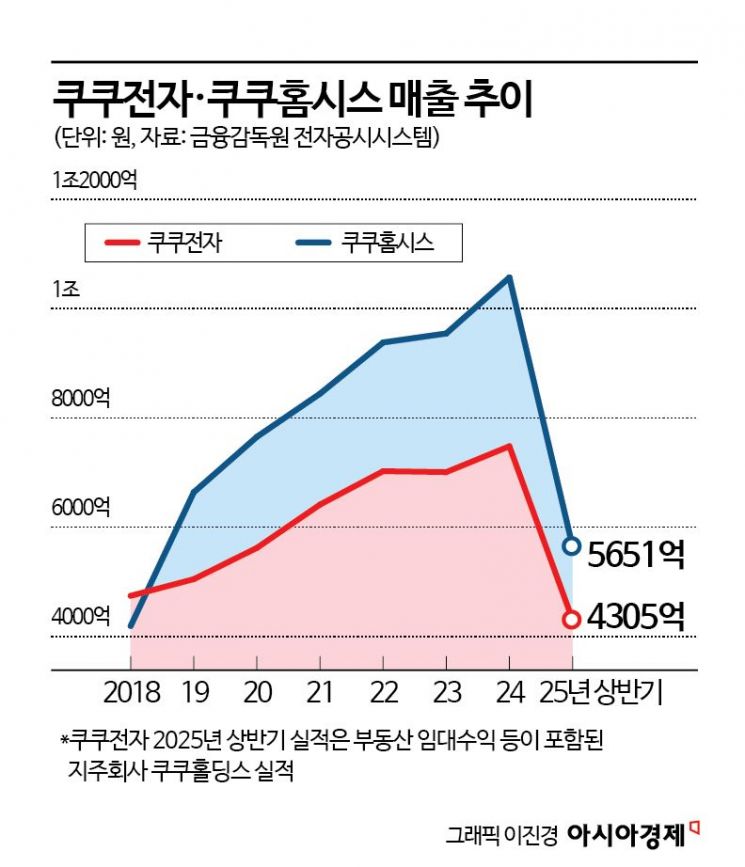

According to the Financial Supervisory Service’s electronic disclosure system on August 27, Cuckoo Holdings and Cuckoo Homesys recorded sales of 430.5 billion won and 565.1 billion won, respectively, in the first half of this year. The Cuckoo business is largely divided into Cuckoo Electronics (handling rice cookers and other electric appliances), which was newly established through a physical split from the holding company Cuckoo Holdings in 2017, and Cuckoo Homesys (water purifiers and rentals), which was created via a spin-off. Considering that Cuckoo Holdings, as a holding company, generated about 8.2 billion won in external sales from leasing and royalties in the first half of the year, the combined sales of Cuckoo Electronics and Cuckoo Homesys are estimated to exceed 140 billion won.

Although Cuckoo holds a dominant image as a “rice cooker company,” with a domestic market share of about 70%, Cuckoo Homesys, which focuses on rentals, is now leading in performance. Immediately after the split in 2018, Cuckoo Electronics led with 474.1 billion won in sales, ahead of Homesys’s 418.8 billion won, but the ranking reversed from 2019 onward. The gap has widened each year since. While Cuckoo Electronics saw modest growth from 702.4 billion won in 2022 to 748 billion won last year, Homesys’s sales jumped from 938.1 billion won to 1.0572 trillion won. Operating profit also reflected this divergence, with Cuckoo Electronics and Homesys recording 96 billion won and 164.8 billion won, respectively, last year.

Cuckoo Electronics’ sluggish performance is closely tied to stagnation in the domestic rice cooker market. According to industry estimates, the rice cooker market has remained virtually flat at around 600 billion won since 2014. The two main players, Cuckoo and Cuchen, have adopted contrasting strategies in response. While Cuchen is strengthening its core product competitiveness through technological advancements such as “low-sugar rice mode,” Cuckoo has sought new growth by diversifying its product lineup. The company is transforming itself from a manufacturer specializing in rice cookers to a provider of essential home appliances.

A Cuckoo representative explained, “We are diversifying our portfolio in line with market trends,” adding, “This reflects our management philosophy of delivering the best products according to consumer needs.”

The company’s strategy is clear from its aggressive launch of new products in the first half of this year. This summer alone, Cuckoo introduced a cat litter box, a home espresso machine, and an artificial intelligence (AI) robot vacuum cleaner. Beyond simply expanding its lineup, Cuckoo aims to capture a wide range of demand by incorporating rental models and responding to trends in eco-friendly and smart appliances. Sales growth has been strong as well: sales of cordless vacuum cleaners increased by 36% year-on-year in the first half, while sales of Restino beds surged by 218% over the same period.

An industry insider commented, “With the domestic rice cooker market stagnating and low-priced products flooding overseas markets, it is difficult to achieve growth with rice cookers alone. This is a successful case of portfolio diversification.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.