"Can't Even Recoup the Pre-Sale Price"... Surge in Minus Premiums

"There Was a Premium Four Years Ago"...

Fading Hopes for GTX and Samsung Semiconductor

Just a few years ago, the apartment market in Pyeongtaek, Gyeonggi Province, was experiencing a 'semiconductor boom.' Recently, however, it has become the region with the steepest price decline nationwide. As of this year, the cumulative decline has exceeded -5%, marking the deepest drop among all cities, counties, and districts in the country. In the pre-sale rights market, numerous complexes are being resold at prices tens of millions of won lower than their original prices, resulting in what is known as 'Mafi' (minus premium) transactions. Analysts believe that a structural oversupply and weakened demand will make a rebound difficult in the near future.

"Can't Even Recover the Pre-Sale Price"... Mafi Transactions Surge

Pyeongtaek Hwayang Seohee Starhills Central Park Phase 2 Perspective. As of June, nearly 40% of the units remain unsold. Complex website.

Pyeongtaek Hwayang Seohee Starhills Central Park Phase 2 Perspective. As of June, nearly 40% of the units remain unsold. Complex website.

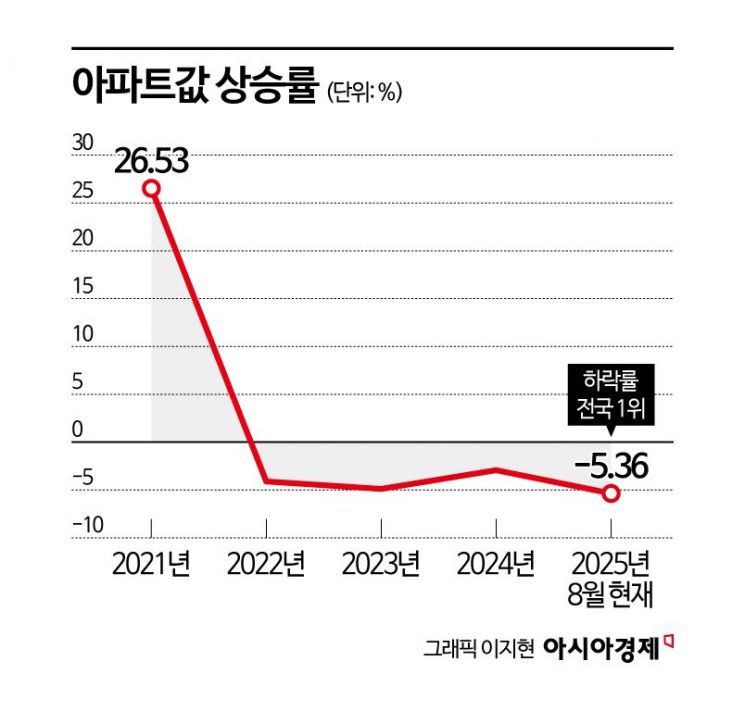

According to the Korea Real Estate Board on August 27, apartment sale prices in Pyeongtaek from January to the third week of August this year have accumulated a decline of -5.36%. This is the largest drop among all cities, counties, and districts nationwide during the same period. It is also larger than the declines in 2022 (-4.11%), 2023 (-4.89%), and last year (-2.39%). The downward trend accelerated after the June 27 lending regulations, with the third week of August recording a -0.27% drop, the largest weekly decline of the year.

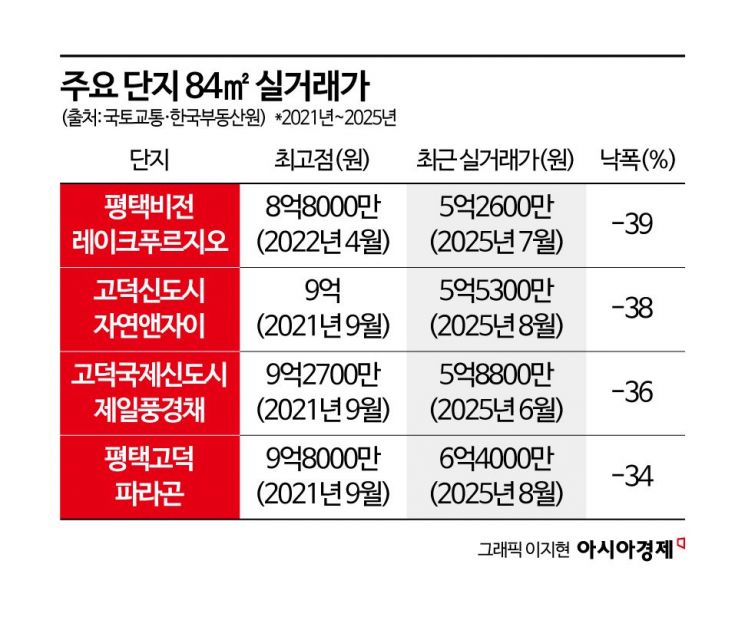

According to the Ministry of Land, Infrastructure and Transport's actual transaction price system, an 84-square-meter unit in 'Godeok Nature & Xi' in Godeok New Town changed hands for 553 million won on August 19. Compared to its previous peak (900 million won in September 2021), this is a 38% drop. 'Pyeongtaek Vision Lake Prugio' also fell 39%, from 880 million won in April 2022 to 526 million won in July this year. Other complexes, such as Godeok International New Town Jeil Punggyeongchae (927 million won to 588 million won, -36%) and Pyeongtaek Godeok Paragon (980 million won to 640 million won, -34%), have also fallen by nearly 30-40% from their previous peaks.

In the pre-sale rights market, it is difficult to find listings without a 'Mafi' discount. Newly scheduled complexes are being traded at prices tens of millions of won below their pre-sale prices. For example, an 84-square-meter pre-sale right for 'ePyeonhansesang Pyeongtaek Highcent' was traded for 391.59 million won on August 8. Compared to the pre-sale price of 452.7 million won, this is a drop of about 60 million won. Similarly, a 59-square-meter pre-sale right for 'Pyeongtaek Hwayang Humanville First City' was traded for 290.35 million won on August 18, about 30 million won lower than its pre-sale price in the 320 million won range.

"Four Years Ago, There Was a Premium"... The Impact of GTX and Samsung Semiconductor Fades

Just four years ago, Pyeongtaek was one of the top regions nationwide for real estate price increases. In 2021, the annual apartment price growth rate was 26.53%. Godeok New Town and Jije Station areas experienced a surge in subscription applications, and pre-sale rights with premiums were traded in abundance. At the time, pre-sale rights for major 84-square-meter units exceeded 900 million won, with transactions frequently commanding premiums of over 100 million won. A series of positive developments-including plans to extend the GTX-A and C lines, the construction of the Jije Station multi-modal transfer center, and the phased expansion of the Samsung Semiconductor Campus-attracted both end-users and speculative investors.

However, as supply surged and these positive factors faded, the market atmosphere reversed. According to the real estate platform 'Asil,' the appropriate annual housing demand in Pyeongtaek is about 3,000 units, but every year, 2 to 5 times that number has been supplied. This year alone, 10,010 units are set for occupancy. In 2026, 7,581 units will be supplied, and in 2027, 10,322 units are scheduled. While the supply is rapidly increasing, expectations for demand have plummeted due to delays in the GTX project and the groundbreaking of the Samsung Electronics P5 Campus. Subscription competition rates have sharply declined, and unsold units are piling up quickly. As of the end of June, there were 3,996 unsold units in Pyeongtaek, accounting for over 30% of the total 11,093 unsold units in Gyeonggi Province.

Park Won-gap, Chief Real Estate Specialist at KB Kookmin Bank, stated, "The frenzy in Pyeongtaek driven by the Samsung Electronics semiconductor boom was a case of prices reflecting future expectations in advance." He added, "When end-user demand recovery is delayed amid concentrated supply, Mafi transactions are bound to increase." He further explained, "As financial pressure mounts for those who already purchased units, some are selling at a loss. Price adjustments are likely to continue for complexes nearing occupancy in the near term."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.