'KODEX US S&P500,' Samsung Asset Management's flagship US index ETF, has reached 5 trillion won in net assets. Analysts attribute its rising credibility to strong returns and a low tracking error rate.

On August 25, Samsung Asset Management announced that the net assets of KODEX US S&P500 had grown to 5.0436 trillion won. The ETF, which was listed in April 2021, surpassed the 5 trillion won mark in just over four years and four months. After exceeding 3 trillion won in December 2024, it attracted an additional 2 trillion won in just eight months.

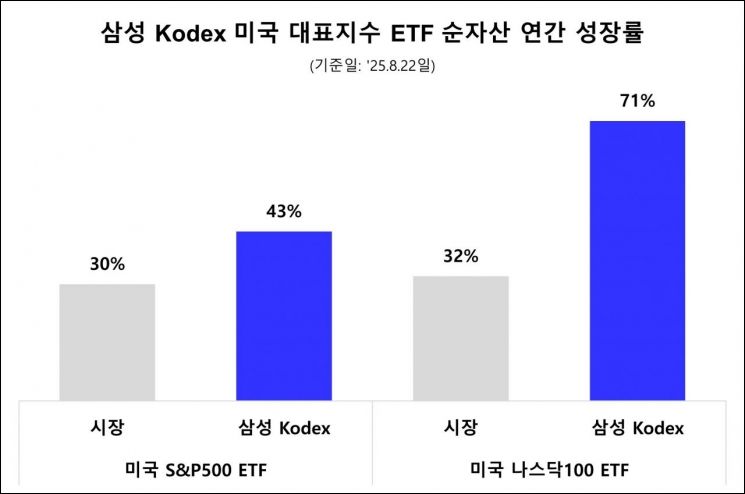

KODEX US Nasdaq100, which was listed on the same day, also grew its net assets to 2.9876 trillion won, marking a 71% increase compared to the end of last year. The combined net assets of these two ETFs now stand at 8.0312 trillion won, up approximately 185% from about 2.8219 trillion won a year ago.

The driving forces behind this growth include not only low total fees but also outstanding performance in returns-reflecting all costs-and tracking error rate, which measures management capability. KODEX US S&P500 recorded a one-year return of 20.1% and a two-year return of 54.4%. KODEX US Nasdaq100 achieved a one-year return of 24.1% and a two-year return of 62.3%. Both ETFs maintain the highest returns among their peers.

When evaluating ETFs, tracking error is as important as returns. It measures how accurately an ETF follows the performance of its benchmark index. Both KODEX US flagship index ETFs have posted the lowest tracking error rates among similar ETFs in the industry, providing investors with confidence that they can capture index performance directly.

KODEX US S&P500 invests in 500 leading US blue-chip companies, such as Apple, Nvidia, UnitedHealth Group, and Visa, offering broad sector diversification. KODEX US Nasdaq100 focuses on technology stocks like Microsoft, Apple, and Nvidia, aiming for high-growth momentum. These ETFs have become a staple and standard for individual investors seeking overseas exposure, and are now considered essential holdings in both standard and individual/retirement pension accounts.

Lim Taehyuk, Head of ETF Management at Samsung Asset Management (Managing Director), stated, "For domestic investors, investing in the S&P500 and Nasdaq100 indices has already become both a basic and main product. Given the diverse lineup of US flagship index products, it is important for investors to consider ETFs that have proven themselves in terms of returns and tracking error."

The remarkable growth of Samsung Asset Management's two KODEX US flagship index ETFs has further solidified the presence of the KODEX brand in the overall ETF market. Of the six ETFs in the domestic market with net assets exceeding 5 trillion won, four are KODEX products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.