Establishment of the 'National Growth Fund' Spurs Hopes for a Second 'Venture Boom'

"Potential Overlap in Support Areas... Needs Effective Coordination"

"BDC Lacks Mandatory Management Consulting, U.S. System Offers Useful Reference"

From the second half of the year, large-scale policy measures to revitalize venture investment will be fully implemented. Along with the creation of the 100 trillion won 'National Growth Fund', the government will allow retirement pensions to invest in ventures, and introduce Business Development Companies (BDC), among other systems designed to boost liquidity. However, there are also concerns that issues such as overlapping policies and investor protection must be addressed simultaneously.

Government Pushes for a 'Major Shift' in Venture Investment... Maximizing Liquidity for Venture Companies

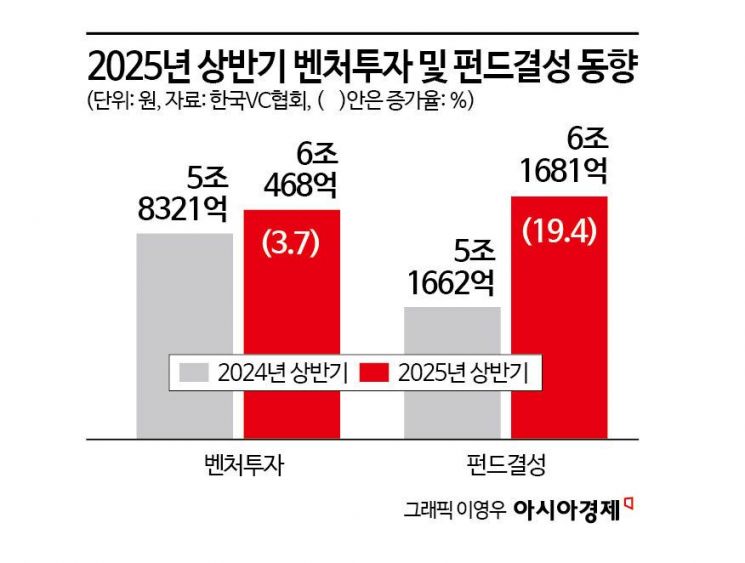

According to the Ministry of SMEs and Startups on August 25, the total amount of venture investment in the first half of this year reached 6.0468 trillion won, a 3.7% (214.7 billion won) increase compared to the same period last year. Venture capital companies and funds executed 2.7259 trillion won, while new technology finance companies and policy financial institutions supplied 3.3208 trillion won, meaning policy finance accounted for more than half of the total. The amount of newly created funds also increased by 19.4% year-on-year to 6.1681 trillion won. This marks the full-scale expansion of 'quantitative growth' led by the government and policy finance.

However, as of 2023, the proportion of venture investment to Korea's gross domestic product (GDP) was only 0.14%, which is significantly lower than Israel (1.27%) and the United States (0.47%). In this context, on August 22, the Lee Jaemyung administration unveiled a series of policies to stimulate venture investment during a joint briefing of economic growth strategy ministries.

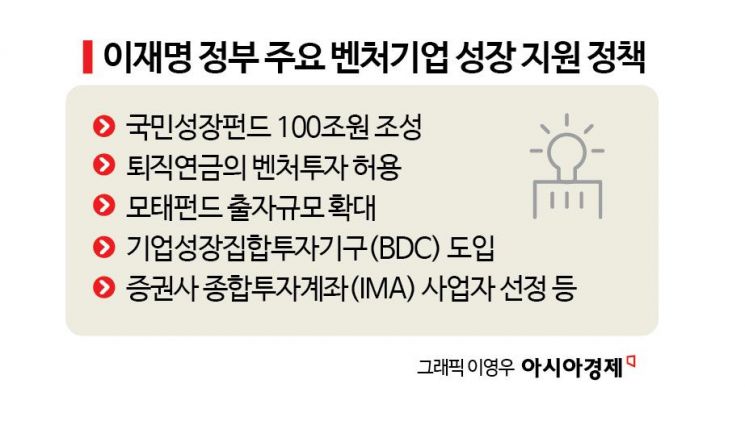

First, the government is simultaneously pursuing the opening of the venture investment market and expanding the supply of capital. The long-awaited institutionalization of retirement pension investment in ventures will be realized, and Business Development Companies (BDC), a type of public offering fund that individuals can participate in, will also be introduced. The scale of financial support will increase significantly. The Korea Fund of Funds will make its largest-ever investment, and by combining the Advanced Strategic Industry Fund with private capital, the government plans to create a 100 trillion won National Growth Fund. In addition, as part of strengthening financial investment infrastructure, the first IMA (Integrated Investment Account) operator among major domestic securities firms will be selected in the second half of the year.

Challenges Remain: Overlapping Policies and Lack of Investor Protection

In the startup and venture capital (VC) sectors, which have struggled for years with investment and exit difficulties, expectations are rising for a second venture boom. However, some point out that for the market to grow healthily, issues such as overlapping policy funding and the establishment of investor protection mechanisms must be resolved.

This awareness has also been shared recently in the National Assembly. During a Political Affairs Committee meeting to review bills such as the establishment of a 50 trillion won Advanced Strategic Fund and the introduction of BDCs, Choo Kyungho, a member of the People Power Party, said, "There are already a great many systems supporting venture investment funds and the like, so will these new funds and BDCs also be eligible for support? The areas supported by the public sector could overlap significantly. I hope the distinctions are made clear and the system is organized effectively."

In response, a Financial Services Commission official said, "We agree that there are many policy funds," and added, "It is also very important to clearly define the roles of each policy fund. We will make sure to address these issues during the review of venture policy and fund creation."

At the same meeting, Park Beomgye, a member of the Democratic Party, pointed out, "There may be overlapping or even contradictory aspects. If a (venture) investment fund participates at a 50% level, are we not trying to create regulations so that the remaining 50% from the public sector can also support that investment fund?" He highlighted the possibility of one fund supporting another. The Financial Services Commission official replied, "Support may or may not be provided," and explained, "When VCs or private equity funds (PE) invest in new technologies, this fund can play a role."

Han Areum, a researcher at the Korea Capital Market Institute, stated in a recent report regarding the introduction of BDCs in Korea, "While the investment ratio in unlisted companies has been regulated, there is no obligation for management consulting," and added, "It is necessary to supplement post-investment management and value enhancement measures by combining regulations on investment targets and behaviors, as is done in the United States." She also emphasized, "There is a need to systematize disclosure, evaluation, and liquidity management. In the US, listed BDCs are required to disclose information at the same level as listed companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)