Sales Commission to Rise from 3.5% to 6% on September 17, Bungae Money Introduced

A "Benefit" at First Glance... 2.5% Refund Disappears Upon Withdrawal

Liabilities Decrease, Profits Increase... Private Equity Fund Exit Strategy?

There is a growing perception that 'Bungae Money,' the cyber currency introduced by Bungaejangter alongside an increase in sales commissions, is a disguised tactic presented as a benefit. Although Bungaejangter claims that the introduction of Bungae Money is intended to enhance transaction convenience and provide greater benefits to sellers, the substantial hike in fees increases the burden on sellers, and the system is designed so that even the refunded portion disappears upon withdrawal, effectively giving with one hand and taking away with the other. Some voices in the industry suggest that this is a financial maneuver by the private equity fund (PEF) that acquired Bungaejangter, aiming to overcome hundreds of billions of won in losses and facilitate an exit (investment recovery).

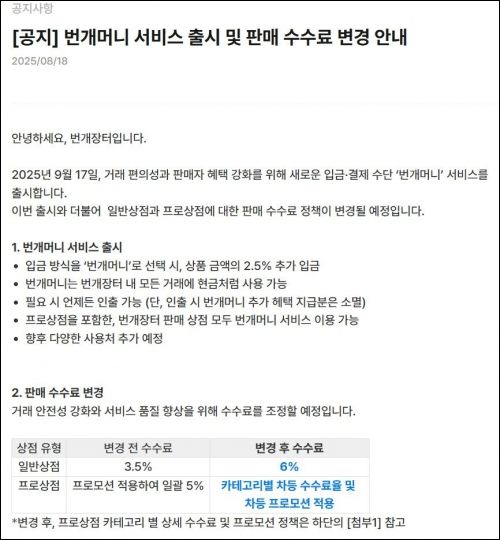

According to industry sources on the 22nd, Bungaejangter announced through a notice on the 18th that it would raise its sales commission rates. The commission for general stores (individual sellers) will increase from the current 3.5% to 6%, while pro stores (professional sellers) will see a differentiated rate by category, rising from a flat 5% to between 6% and 10%. The new rates will take effect on the 17th of next month.

On the same day, with the introduction of the new cyber currency 'Bungae Money,' the method for settling sales proceeds will change. There are two options. If the seller chooses to settle with Bungae Money, 6% of the product price is deducted as a commission, and then 2.5% is refunded in Bungae Money. For example, if an individual seller sells a product for 100,000 won, 6,000 won is deducted as a commission, 2,500 won is credited as Bungae Money, and the final amount of 96,500 won is deposited into the seller's electronic wallet. If the seller chooses to receive payment via bank transfer as before, only the 6% commission is deducted with no refund, resulting in a total deposit of 94,000 won.

Bungae Money can be used like cash within Bungaejangter, but the refunded portion (2,500 won) is closer to points or mileage that cannot be converted into cash. Bungaejangter maintains that this refund is a 'benefit' that returns part of the 6% commission to the seller instead of deducting the full amount.

The problem is that when Bungae Money is withdrawn from the wallet and converted to cash, the entire refunded portion is forcibly forfeited. According to Bungaejangter, a significant number of users are individual sellers. Unlike professional sellers who trade continuously, individual sellers are more likely to withdraw their earnings as cash immediately, making it likely that the refunded portion will simply expire unused. In effect, there is no practical difference from the bank transfer method that deducts the full 6% commission. With the fee hike and the disappearance of the refund benefit, critics argue that the company is merely paying lip service to offering benefits.

An accountant at a tax firm explained, "Points or mileage are treated as provisions in accounting and are recognized as liabilities for the company. If the refunded portion expires, the liability decreases, and the same amount is recorded as non-operating income (miscellaneous profit), which can increase net profit for the period." Ultimately, the company has designed a structure that not only boosts revenue through higher commissions but also reaps additional gains from the expiration of refunds, potentially improving its financial statements.

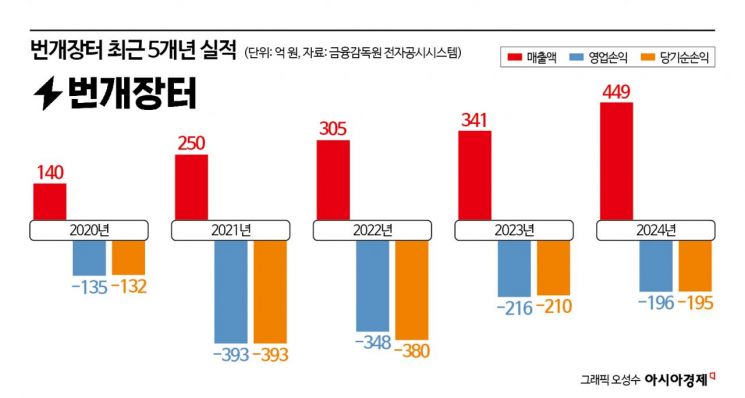

This controversy over underhanded tactics is seen as closely tied to the exit strategy of the private equity fund that acquired Bungaejangter. Since Praxis Capital Partners, a private equity fund manager, acquired management control of Bungaejangter for about 150 billion won in 2020, the company has never turned a profit. While revenue steadily increased from 14 billion won in 2020 to 44.9 billion won last year, operating losses ranged from at least 13.5 billion won to as much as 39.3 billion won during the same period. Moreover, the company has continued to post net losses of hundreds of billions of won each year, meaning it has not actually generated any real cash.

Considering that the average recovery period for domestic private equity funds was 5.2 years as of last year, it is interpreted that the company is seeking to overcome its deficit by expanding revenue centered on transaction fees. Bungaejangter has consistently increased its transaction fee revenue. In 2020, transaction fees accounted for 25.6% of total revenue, about half the share of advertising revenue (50.5%), but by last year, the share of transaction fees had grown to 50.5%, making it the company's core profit source. This contrasts with Danggeun, a competing used-goods platform, which increased its advertising revenue share to 99% and succeeded in turning a profit.

A Bungaejangter representative stated, "The fee increase is intended to generate profits for platform operations, but Bungae Money should be viewed as an additional bonus to promote used-goods trading. Please see it as a measure to create a virtuous cycle in transactions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.