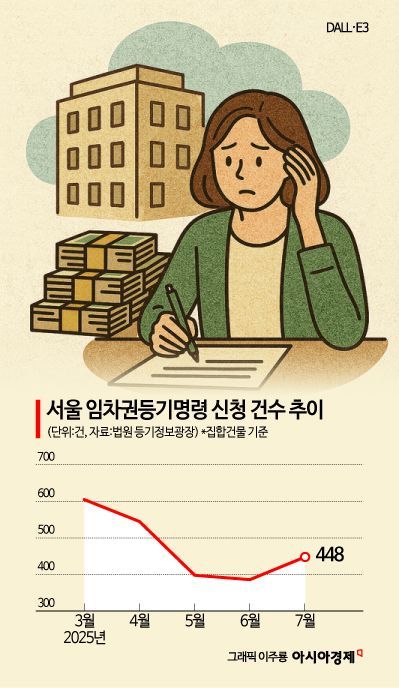

448 Applications Filed in July, Up 16% from Previous Month

After Declining Since March, Numbers Rise Again

Reduced Limits on Jeonse and Exit Loans Drive Increase

Park Jin-ho (34, alias), who lives in an apartment in Yeongdeungpo-gu, Seoul, is deeply worried that he may not get his deposit back when his jeonse contract expires at the end of August. After the landlord's plan to return the deposit by finding a new tenant fell through, Park has been losing sleep at night, fearing he may not be able to move out. The landlord almost signed a contract with a tenant who would pay the remaining jeonse deposit using the Newlywed Couple Bogeumjeon Jeonse Loan, but due to loan regulations, the limit was reduced and there is now no way to return the deposit. Park decided to apply for a tenant's right registration order after moving out and monitor the situation.

According to the Court Registration Information Plaza on the 25th, the number of tenant's right registration order applications for collective buildings (officetels, apartments, row houses, and multi-family houses) in Seoul last month reached 448, a 16% increase from the previous month. A tenant's right registration order is a system that specifies in the real estate register that there is an outstanding deposit claim when the tenant has not received all or part of the deposit after the contract ends. Even if the tenant loses the right of residence or preferential repayment by moving out without receiving the deposit, this serves as grounds for recovering the deposit in the future.

The number of applications surged as the limits for jeonse loans and jeonse exit loans in the Seoul metropolitan area were reduced due to the June 27 regulations. For young people, the limit for the Bogeumjeon Jeonse Loan was reduced from 200 million won to 150 million won, and for newlyweds, from 300 million won to 250 million won. The guarantee ratio for jeonse loans provided by the Korea Housing and Urban Guarantee Corporation (HUG) was also lowered from 90% to 80% in the metropolitan area, making it harder to obtain loans. Multi-homeowners are now completely ineligible for such loans. In addition, the limit for jeonse exit loans, which landlords use to return deposits, was reduced from 200 million won to 100 million won. This means that both the loan limits for new tenants who would return the existing tenant's deposit and for landlords have been significantly reduced.

Before the regulations, the number of applications had been on a downward trend, recording 605 in March, 545 in April, 398 in May, and 386 in June. This is analyzed as a result of reduced fears of jeonse fraud and a continued preference for monthly rent. Yoon Sumin, a real estate specialist at NH Nonghyup Bank, explained, "It is true that immediately after the loan regulations were implemented, there was a short-term increase in cases where disputes could arise due to restrictions on loans related to deposit returns. In particular, the risk of being unable to return deposits in high-value jeonse contracts has increased."

Experts predict that the increase in the number of applications will continue in the short term. With the ongoing shortage of housing supply in Seoul, and the June 27 loan regulations effectively blocking 'gap investment' (buying with a jeonse tenant in place), concerns about instability in the jeonse supply and demand are expected to grow. The logic is that as jeonse supply decreases and demand rises, some tenants may have to prepare their deposits in cash. However, this also means that it will become even more difficult for ordinary people to live in jeonse housing.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)