Domestic Market Saturated: Three Major Chicken Franchises Eye Overseas Expansion

BBQ Leads the Way as Kyochon and BHC Pursue Aggressive Growth

"At Least Three to Five Years Needed to Establish Overseas Operations"

Chicken franchise companies are aggressively expanding their overseas stores. BBQ was the first mover, targeting international markets since the early 2000s. Now, Kyochon Chicken and BHC are also increasing the number of countries and stores they operate in, capturing the attention of global consumers. As the domestic market has reached its limits, competition among chicken franchises to find new opportunities abroad is expected to intensify.

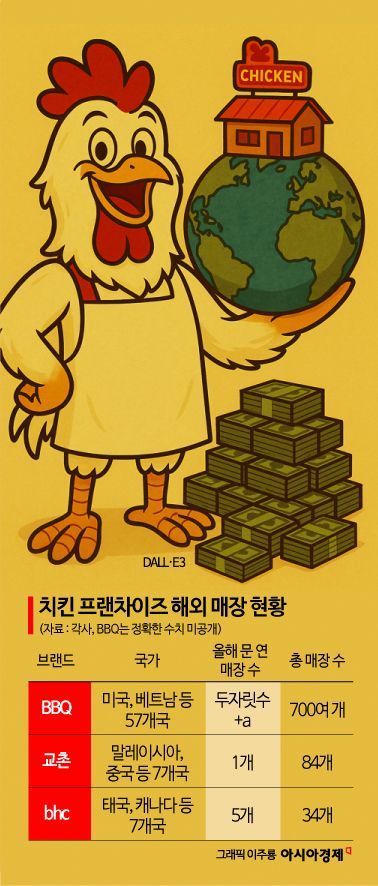

According to the industry on August 21, the three major domestic chicken franchises-BHC, BBQ, and Kyochon-are currently operating a total of around 800 overseas stores.

BBQ is the most proactive in its overseas expansion. BBQ currently operates about 700 overseas stores in 57 countries, including the United States, Canada, Costa Rica, Panama, the Bahamas, the Philippines, Malaysia, Japan, and Fiji. In particular, the company has identified the United States as a key market, operating about 250 stores across 32 states. This year as well, BBQ has opened more than ten new overseas stores.

BHC, which is the market leader domestically but a latecomer to overseas expansion, is also actively opening new international locations. In 2022, BHC had only one overseas store, but it now operates a total of 34 stores in seven countries, accelerating its international expansion. This year, the company opened a total of five new stores, including two in the United States and three in Malaysia. A BHC representative explained, "In the second half of the year, we are preparing to open additional new stores in Southeast Asia, including Thailand and Singapore."

As of the first half of this year, Kyochon operates a total of 84 stores in seven countries. This year, the company opened a new store in Shenzhen, China, and plans to reopen its Los Angeles store in the United States after completing renovations in the second half of the year. A Kyochon representative said, "Over the past year, we have focused on strengthening QSC (Quality, Service, Cleanliness), so we have refrained from aggressive expansion," but added, "Our goal is to increase the number of overseas stores to more than 100 by the end of the year."

The reason chicken franchises are turning their attention overseas is that the domestic market is already saturated, making further expansion difficult. The number of brands and stores in the domestic chicken industry peaked three to four years ago and has been declining since. According to the Fair Trade Commission's 'Franchise Business Status Statistics,' there were 669 domestic chicken brands as of 2023. The numbers have been decreasing by about 2% each year, from 701 in 2021 to 683 in 2022.

However, the overseas business performance of the three major chicken companies still needs to be monitored. According to Genesis's consolidated audit report, the holding company of BBQ, the U.S. subsidiary (BBDOTQ USA) posted sales of 107.6 billion KRW last year, a 40% increase from the previous year. However, it recorded a net loss of about 800 million KRW, turning into the red. Genesis BBQ's global sales, which include revenue from selling sauces and other raw materials in the United States, Shanghai, and Vietnam, as well as MF (Master Franchise) royalty income, totaled 22.2 billion KRW.

BBQ, which has entered 57 countries, states that its total global sales are not fully reflected in Genesis BBQ Global's figures. A BBQ representative explained, "According to our internal data, the total overseas sales from all countries in 2023 amounted to about 110 billion KRW," and added, "Last year, we estimate that figure increased by 30-40% to around 160 billion KRW."

Unlike BBQ, Kyochon and BHC count all overseas consumer sales, royalties, and raw material sales as overseas revenue. Last year, their overseas sales amounted to 19.47 billion KRW and 4.32 billion KRW, respectively.

An industry official commented, "Distribution and logistics supply chains, rental costs, and regulatory environments are completely different at home and abroad, so it takes at least three to five years after stabilization to turn a profit. Nevertheless, interest in Korean-style chicken continues to grow, and with high growth potential, efforts to strengthen overseas markets are expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)