Jollibee?Elevation Consortium Requests Valuation Adjustment After Norang Tongdak Due Diligence

Rising Store Closure Rates and Declining Sales Per Store Affecting Deal

The sale process of Norang Tongdak is not gaining momentum. This is because the Elevation Equity Partners-Jollibee Foods alliance, which is seeking to acquire the company, has demanded a lower sale price. However, since Jollibee, a foreign company, has completed its due diligence, there is a high possibility that the deal will go through. Analysts point out that Norang Tongdak's high closure rate and declining sales per store make the brand less attractive in terms of stability, which could significantly lower its valuation.

According to the franchise industry on the 21st, the Elevation-Jollibee consortium, which completed due diligence on Norang Tongdak, is said to have requested that the acquisition price be lowered to the low 100 billion won range.

Previously, Norang Tongdak had set its desired sale price in the 200 billion won range last year. This is three times higher than the 70 billion won paid by Q Capital Partners and KStone Asia when they acquired Norang Food in 2020.

Q Capital Partners and KStone Asia, which own 100% of Norang Food, the operator of Norang Tongdak, selected the Elevation-Jollibee consortium as the preferred bidder in June and began due diligence this month. Jollibee, the largest food service company in the Philippines, has recently drawn attention as a major player in the domestic food and beverage (F&B) market after acquiring low-cost coffee franchise Compose Coffee with Elevation last year for 470 billion won.

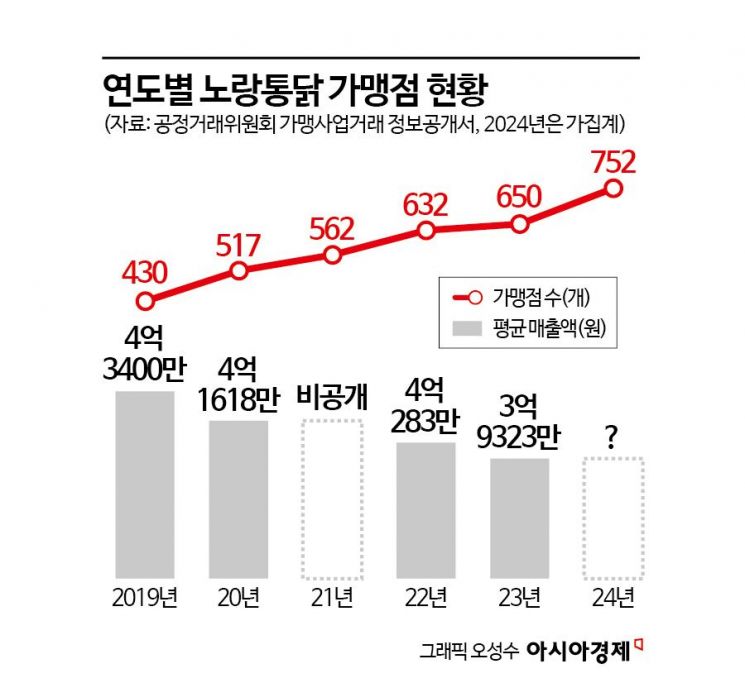

The industry had expected a high sale price for Norang Tongdak, as its performance has been on an upward trend since being acquired by private equity funds. Norang Tongdak opened its first store in Busan in 2009 and began franchising in 2010, quickly growing into one of the top 10 large-scale chicken franchises. Sales jumped from 50.2 billion won in 2019, before the acquisition, to 106.7 billion won last year, while operating profit increased from 6.5 billion won to 12.7 billion won over the same period. The number of franchise stores, which was around 500 at the beginning of 2020, rose to 752 last year.

This is why various domestic and international investors have joined the race to acquire Norang Tongdak. Theborn Korea, led by CEO Baek Jongwon, was also mentioned as a potential buyer but reportedly withdrew after internal review.

It is analyzed that although the number of new stores is increasing, the sharp rise in closures has reduced Norang Tongdak's investment appeal. According to the Fair Trade Commission's franchise disclosure documents, the number of franchise transfers at Norang Tongdak increased by 119%, from 48 in 2019 to 105 in 2023, while the number of closures surged by 2,067%, from 3 in 2019 to 65 in 2023. In contrast, the number of new openings fell by 56%, from 189 in 2019 to 83 in 2023.

Sales per store are also on the decline. The average annual sales per franchise store decreased by 9%, from 434 million won in 2019 to 393.23 million won in 2023. This means that sales did not increase in proportion to the number of stores. Norang Tongdak raised menu prices by 1,000 to 2,000 won in 2022, but this failed to prevent the decline in sales per store. Last year, the company again raised prices for some menu items by 1,000 won, and in June this year, increased the price of all chicken menu items by 2,000 won.

An industry insider commented, "The fact that sales have declined despite price increases is a signal that the brand's power is weakening," and added, "Raising prices may provide only short-term profitability and could lead to a weaker market position in the long run."

The current market estimates Norang Tongdak's appropriate sale price to be in the 110 billion to 140 billion won range, but it is expected to fall further. Typically, franchise companies are valued at 8 to 10 times their EBITDA in M&A transactions. However, if growth stagnates or franchisee conflicts are severe, the multiple can drop to as low as 3 to 5 times. Last year, the company recorded an EBITDA of about 14 billion won.

An M&A expert said, "Recently, the franchise industry has faced significant profitability pressures due to an economic slowdown, reduced consumer spending, and rising costs, so Jollibee may see this as the best time to buy at the lowest price," adding, "If store closure rates have been high recently, there is a strong justification for demanding a discount, so the final price could be at least 20 to 30% lower than the initial offer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.