Monthly Compulsory Auctions Hit Record High Since 2010

Debt Defaults Surge Amid Economic Downturn, Driving More Properties to Auction

Loss of the "Last Line of Defense" in Real Estate Sounds Alarm for Ordinary Citizens

Total Auction Applica

The number of properties seized through court auctions due to individuals and businesses being forced to forfeit real estate amid a "credit crunch" has reached an all-time monthly high. The proportion of compulsory auctions in the overall auction market is also approaching 40%, prompting analysts to warn that this is a clear signal that the economy for ordinary citizens is under serious strain.

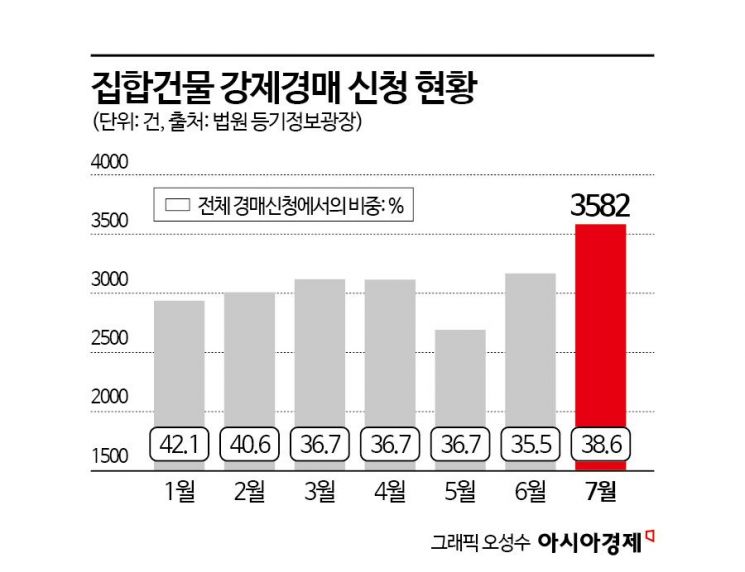

According to the Court Registration Information Plaza on August 20, the number of applications for compulsory auction commencement registration for collective buildings (such as apartments, officetels, and multi-family housing) reached 3,582 cases in July. This represents a 13.1% increase compared to the previous month (3,167 cases) and a 12.3% rise from the same period last year (3,138 cases). It is also 1.75 times higher than in July 2022 (2,044 cases). Since the court began compiling related statistics in 2010, this is the highest monthly figure on record. The previous record was 3,471 cases in May last year. After maintaining a level of around 3,000 cases this year, the number has now surpassed that "ceiling."

Compulsory auction refers to an auction requested by a creditor in court to recover debts not secured by real estate collateral. It is carried out when there is an enforceable title, such as a final court judgment. This mainly occurs due to two independent causes: failure to return jeonse deposits and defaults on personal debts. In contrast, voluntary auctions are initiated to enforce real estate collateral rights and do not require a separate court judgment.

View of apartment and villa complexes in downtown Seoul from Seoul Sky, the observation deck of Lotte World Tower in Songpa-gu, Seoul. Photo by Yonhap News.

View of apartment and villa complexes in downtown Seoul from Seoul Sky, the observation deck of Lotte World Tower in Songpa-gu, Seoul. Photo by Yonhap News.

Kang Eunhyun, head of the Auction Research Institute at Myungdo Law Firm, analyzed, "Incidents involving jeonse deposit accidents, such as jeonse fraud, peaked in 2023 and have since declined. However, the continued increase in compulsory auctions suggests a sharp rise in compulsory auctions due to debt defaults." He added, "Given that 70% of the assets of Korean citizens are in real estate, real estate can be considered the 'last bastion.' The fact that these are being liquidated through auctions indicates that economic entities such as ordinary citizens and self-employed individuals are collapsing under the weight of their debt."

The proportion of compulsory auctions has also surged over the past one to two years. As of last month, compulsory auctions accounted for 38.6% of all auctions. In the past, voluntary auctions typically made up around 70% of all auctioned properties, while compulsory auctions accounted for about 30%. However, over the last one to two years, the share of compulsory auctions has climbed to the 40% range. Kang noted, "There is a limit to rolling over debt, so it is highly likely that the current upward trend will continue. The increase in compulsory auctions has also driven the total volume of auctioned properties to record levels."

Indeed, the overall auction market, including compulsory auctions, is showing concerning trends. In July, the number of new auction applications totaled 10,488, a 13.4% increase from the previous month (9,248 cases), marking the highest monthly volume so far this year. While the supply has increased, the number of bidders has decreased. According to auction data specialist GG Auction, the average number of bidders per auction last month was 7.8, down from 9.0 the previous month. During the same period, the national apartment auction success rate fell from 42.7% to 39.9%, and the successful bid price ratio dropped from 87.6% to 85.9%, resulting in a "triple decline." The market is believed to have contracted due to the June 27 lending regulations, which capped housing auction loan limits in the Seoul metropolitan area at 600 million won and imposed a requirement to move in within six months.

Experts predict that, considering it takes about six months to a year from the auction application to the actual bidding process, the surge in auctioned properties this year will flood the auction market starting in the first half of next year. Lee Joohyun, senior research fellow at GG Auction, stated, "If the current trend continues throughout the second half of this year, even more properties will hit the auction market in the first half of next year." He interpreted the current increase in auction applications as "a negative signal that the economic downturn is rapidly impacting the broader economy for ordinary citizens."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.