Number of Insured Up 68% from May to July Compared to Previous Three Months

Premium Promotions Drive Growth

Customizable DIY Plans for Essential Coverage Only

Kakao Pay Insurance's Overseas Long-Term Stay Insurance (Overseas N-Month Living Insurance) has seen a surge in subscribers, particularly among people in their 20s and 30s, just one year after its launch.

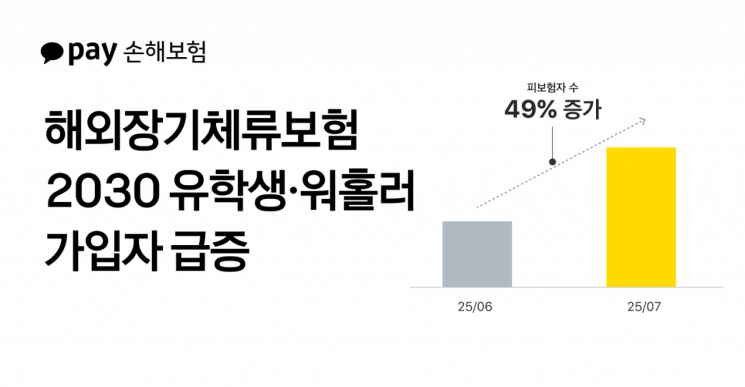

On August 19, Kakao Pay Insurance announced that the number of insured individuals for its Overseas Long-Term Stay Insurance increased by 68% over the past three months (May to July) compared to the previous three months (February to April). In July alone, the number of insured individuals rose by 49% compared to the previous month, continuing its rapid growth.

As of last month, people in their 20s and 30s accounted for 80% of all insured individuals, with those in their 20s making up 55%, representing more than half. By country, English-speaking destinations such as Australia, the United States, Canada, and the United Kingdom accounted for about 45% of enrollments, the highest proportion. This was followed by Asian countries such as Japan, Vietnam, and China. This trend is attributed to the characteristics of the 20s and 30s demographic, who are actively participating in study abroad and working holiday programs in English-speaking countries. Additionally, word-of-mouth among students, working holiday participants, and language trainees has further accelerated the increase in subscribers.

The driving forces behind this growth are 'overlapping coverage' and 'DIY customized plans.' Overseas Long-Term Stay Insurance allows for overlapping enrollment even if the individual is already covered by a school or local health insurance, enabling them to supplement insufficient coverage. In practice, users have shown a tendency to prepare for local accidents with reasonable premiums tailored to their stay environment. According to last month's data, 35% of subscribers chose the DIY option, selecting only the coverage they needed without any basic coverage, making it the most popular choice. Among these, 88% opted for the medical expense rider, which covers accident and illness treatment costs at overseas hospitals from a minimum of 10 million KRW up to a maximum of 100 million KRW.

This allows users to select only the essential coverage and reduce their financial burden. For example, if a 25-year-old woman chooses only accident medical coverage (10 million KRW) for a three-month stay in the United States, the premium would be just 20,080 KRW, and even if she increases the coverage amount to 100 million KRW, the premium would only be around 30,120 KRW. Additionally, those who enroll with two or more people can receive up to a 10% discount, and those with a history of purchasing Overseas Long-Term Stay Insurance or Overseas Travel Insurance within the past two years can receive an additional 5% discount. In fact, 33% of all users have reduced their premium burden through these re-enrollment benefits.

The enrollment and claims processes are also simple. Mobile enrollment is possible via KakaoTalk up until the day of departure. While staying abroad, users can quickly file claims through KakaoTalk from anywhere in the world, 24 hours a day. Even without returning to Korea after the policy expires, users can extend or re-enroll from their current location, allowing for flexible travel plans.

A Kakao Pay Insurance representative explained, "We believe that the customized coverage options that supplement existing insurance, reasonable premiums, and the simple KakaoTalk-based enrollment and claims process align well with the needs of people in their 20s and 30s."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.