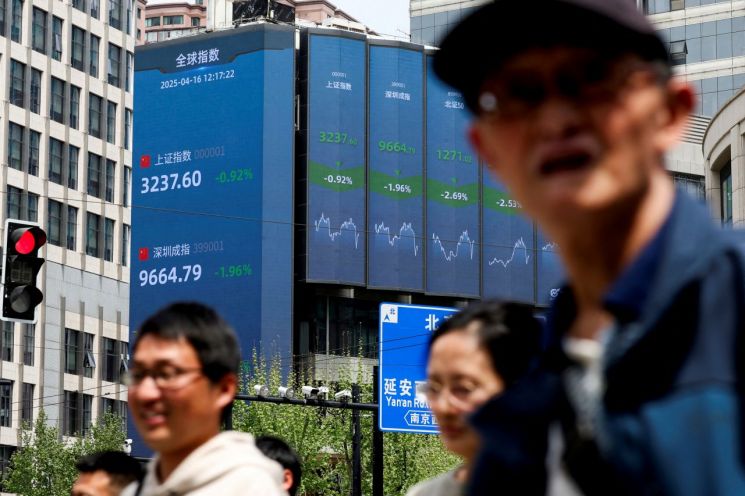

Recently, as Chinese economic indicators have fallen short of market expectations, there are forecasts that the upward momentum of Greater China stock markets-which have been repeatedly hitting record highs this year-may weaken. As a result, it is suggested that in the third quarter, investors should focus more on sectors and individual stocks rather than indices.

On August 18, Kim Kyunghwan, a researcher at Hana Securities, stated in a report titled "China's Economy and Stock Price Divergence at a Yearly High: What Does It Signal?" that, "We still maintain our outlook for record highs in the fourth quarter," but also recommended, "In the third quarter, given the exhaustion of both domestic and external catalysts, it is advisable to focus on sectors and individual stocks rather than indices." He assessed that, "Technology stocks, beneficiaries of supply-side reform (such as steel and eco-friendly industries), and leading new consumption stocks will be relatively resilient among sectors, while the Hang Seng Tech Index will remain relatively strong among indices."

China's July economic indicators-including production, consumption, investment, real estate, services, unemployment rate, new loans, and the Purchasing Managers' Index (PMI)-all came in below both the June figures and market expectations, except for exports. Kim noted, "Based on July economic data, the estimated real GDP growth rate (year-on-year) is 4.7-4.9%, which is significantly lower than the first half's 5.3%," and pointed out that "the lackluster effective demand highlighted in the July economic indicators and policy events, along with the policy stance focused on stability and structural transition, could weaken the momentum of Greater China stock markets in the third quarter."

Specifically, he emphasized that both manufacturing and infrastructure investment growth rates in July turned negative year-on-year for the first time since the Wuhan crisis in 2020. The growth rate of retail sales in July also hit a yearly low of 3.7%, as the boost from "Yi Gu Huan Xin" policy-related items weakened. All real estate-related indicators also slowed. Even in the export sector, which exceeded market expectations for two consecutive months, uncertainty remains high for the third quarter. He diagnosed, "From August onward, regional tariff hikes and diminishing front-loading effects could clearly exert downward pressure."

In addition, the policy signals from authorities are also not viewed as positive for the stock market in the third quarter. Kim analyzed, "In the third quarter, China's policy stance is more focused on 'supply' than 'demand,' and on 'stability and structural transition' rather than 'short-term stimulus'." This is evident in the July Politburo meeting and a series of policy announcements, including: the full implementation of the "campaign to curb wasteful price competition" and the promotion of price signals; policies to promote household lending and expand service sector supply; the enactment of the Private Economy Promotion Law, regulatory easing, and investment promotion; expansion of central government investment projects and urban redevelopment; and a weakening stance on reserve requirement ratio and interest rate cuts.

Kim stated, "This reflects factors such as the first-half growth rate exceeding the annual target, signs of escaping structural pessimism after reopening, and confidence in the initial results of fiscal expansion and asset market support since the second half of 2024." However, he also pointed out, "These are not enough to outweigh market concerns about a slowdown in domestic demand in the second half." He predicted, "The upward momentum of Greater China stock markets will continue to weaken in the third quarter," and added, "While I remain optimistic about structural positives such as household inflows in the second half, major indices are likely to digest short-term overheating as we move through the August earnings season and September political events."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.