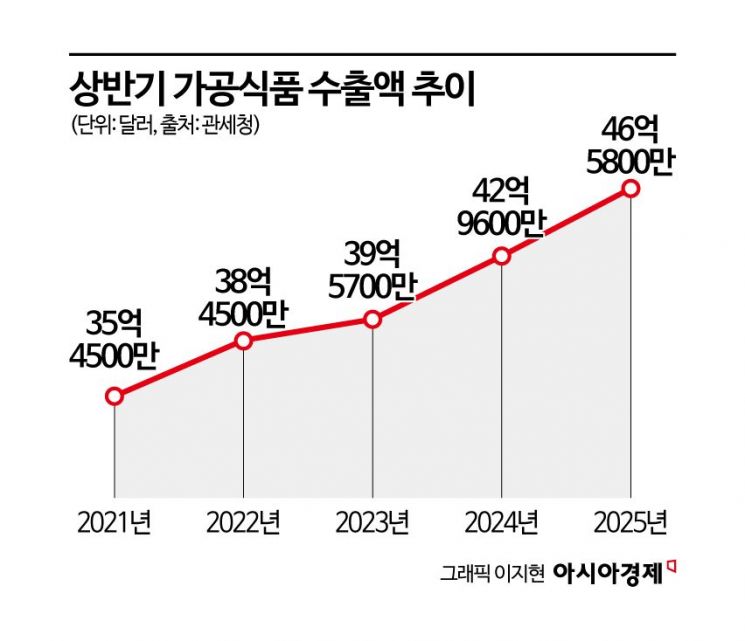

First-Half Exports Reach $4.66 Billion, Up 8% Year-on-Year

Driven by Instant Noodles, Kimchi, and Gim; Ginseng and Beverages Decline

Business Sentiment in Food Industry Expected to Improve in Q3

The upward trend in processed food exports has continued from last year into this year, setting a new record for the highest first-half export value ever. The number of employees in the food manufacturing industry also saw a slight increase compared to the previous year, maintaining the highest level in the past five years.

According to export-import trade statistics from the Korea Customs Service released on August 15, processed food exports in the first half of this year reached $4.658 billion (approximately 6.45 trillion won), marking an 8.4% increase from the same period last year ($4.296 billion) and setting a new record for first-half performance. This achievement was made despite heightened uncertainty in export conditions, such as the implementation of universal tariffs and the possibility of reciprocal tariffs under the Trump administration in the United States, demonstrating the continued export competitiveness of the domestic food industry.

Among major export categories, cereal and cereal-based products accounted for the largest share at $1.32 billion (about 1.83 trillion won), followed by prepared foods ($950 million), tobacco and tobacco substitutes ($560 million), and beverages, alcoholic drinks, and vinegar ($550 million).

Looking at the export growth rates of major product groups, instant noodles (ramyeon) saw the highest increase at 24.0%, followed by kimchi (13.2%) and gim (dried seaweed) at 8.9%. In contrast, ginseng products declined by 20.3% compared to the same period last year, while beverages (-12.6%), canned tuna (-6.0%), and processed rice products (-4.9%) also shifted to a downward trend in exports.

The increase in instant noodle exports is attributed to several factors: the growing global popularity of spicy products, increased interest in new instant noodle varieties such as spicy cream ramyeon, and the expansion into new markets including Europe and ASEAN countries. Kimchi has continued its stable export growth, being recognized as a health and fermented food in the wake of the K-Food boom and its attention as an immunity-boosting food during the COVID-19 pandemic.

Amid the ongoing growth of K-Food exports, the number of employees in the food manufacturing industry during the first half of this year reached 321,000, a 0.4% increase from the same period last year (319,700), marking the highest level in the past five years (2021-2025). Within this, the food manufacturing sector rose by 0.6% to 301,900 from 302,000, while the beverage manufacturing sector declined by 1.8% to 19,100 from 19,400 over the same period.

However, despite the increase in K-Food exports, imports have significantly exceeded exports, resulting in a continued trade deficit. In the first half of this year, processed food imports totaled $8.7 billion (approximately 12.035 trillion won), a 0.5% increase from the same period last year ($8.65 billion), reversing the recent declining trend. It is possible that exchange rate fluctuations partially contributed to this increase.

The largest import item was prepared foods ($1.39 billion), followed by edible oils ($1.3 billion), prepared animal feed ($1.11 billion), and processed vegetables and fruits ($820 million). By item, cocoa preparations saw the highest import growth at 41.7%, followed by edible oils (32.4%), dairy products (27.1%), and processed vegetables and fruits (2.9%).

Meanwhile, according to the Food Industry Business Sentiment Survey, the business outlook index for the third quarter of this year was recorded at 100.1, reflecting improved expectations compared to the previous quarter (96.1). Specifically, sectors such as oil manufacturing, fermented alcoholic beverages, fruits and vegetables, dairy and ice cream, and ready meals are expected to see relative improvement in business conditions compared to the second quarter.

In the first quarter, most sectors experienced a downturn due to a combination of factors, including reduced consumer spending amid sluggish domestic demand and economic instability caused by international factors such as rising exchange rates. However, in the third quarter, many sectors are expected to shift toward recovery, driven by the stabilization of raw material supplies and increased transactions and consumption associated with various summer events.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.