Dropped Over 8% to Barely Hold 80,000 Won

Second Quarter Results Fall Short of Market Expectations, Dragging Down Stock Price

Sharp Performance Improvement Expected in the Second Half

Although Emart managed to return to profitability in the second quarter of this year, its stock price experienced a significant decline. This was because the results fell short of market expectations. However, with the company continuing to show signs of improvement in its performance, attention is now focused on whether the stock price will recover in the second half of the year.

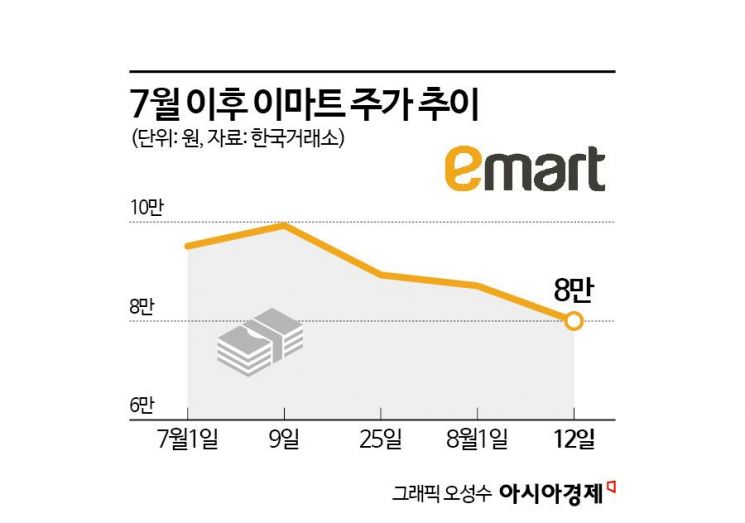

According to the Korea Exchange on August 13, Emart closed at 80,000 won the previous day, down 8.26%. During the trading session, the stock price even fell below the 80,000-won mark, marking the first time since early April this year that Emart’s share price has dropped below this level.

Emart had reached a new 52-week high of 101,800 won during intraday trading on July 9, but has since been on a downward trend, with the 80,000-won level now appearing precarious. The stock has fallen more than 21% from its high point last month.

The second quarter results were a major factor dragging down the stock price. On the previous day, Emart announced that it had posted a consolidated operating profit of 21.6 billion won in the second quarter, returning to profitability. During the same period, revenue totaled 7.039 trillion won, a 0.2% decrease compared to the same period last year, and the company recorded a net loss of 31.4 billion won. This marks the first time in four years, since 2021, that Emart has posted a second-quarter operating profit. On a standalone basis, operating profit also turned positive, reaching 15.6 billion won, while revenue grew 13.3% year-on-year to 3.9705 trillion won.

Despite returning to profitability, the sharp decline in the stock price was due to results falling short of market expectations. According to financial information provider FnGuide, the consensus forecast for Emart’s second-quarter results was 7.1825 trillion won in revenue and 31.7 billion won in operating profit.

Although the company’s core business improved its competitiveness, poor performance by some subsidiaries had a negative impact on overall results. E-commerce subsidiaries Gmarket and SSG.com both posted weak results: SSG.com’s revenue was 350.3 billion won, down 12.5% year-on-year, with operating losses widening to 31 billion won. Gmarket’s second-quarter revenue fell 28.3% to 181.2 billion won, and its operating loss also widened to 29.8 billion won. The convenience store business, Emart24, saw revenue decline by 5.0% to 532.2 billion won, and operating profit drop by 59.3% to 4.3 billion won.

However, expectations are rising that the momentum for improved performance will strengthen in the second half of the year, leading to a gradual recovery in the stock price. Park Sangjun, a researcher at Kiwoom Securities, said, "In the second half, in addition to cost reductions, performance improvement momentum will be strengthened in terms of revenue recovery, supported by domestic demand recovery and weakened operating power of major competitors. In particular, as political uncertainties ease, consumer sentiment is expected to rebound, and with the government’s second supplementary budget, domestic demand recovery will gradually become a reality."

Jang Minji, a researcher at Kyobo Securities, also commented, "The first half was a period in which performance improvement through structural reform was confirmed. In the second half, improvements in gross profit margin (GPM) through integrated purchasing, reduced losses at subsidiaries, and improved Starbucks margins will all contribute to accelerating the pace of performance improvement."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)