Yangju City in Gyeonggi Province will send out tax bills and payment slips for a total of 142,967 resident tax cases amounting to 3.899 billion KRW for the year 2025, with the payment period running until September 1.

Yangju City will send out tax bills and payment slips for a total of 142,967 resident tax cases amounting to 3.899 billion KRW for the year 2025, with the payment period running until September 1. Provided by Yangju City

Yangju City will send out tax bills and payment slips for a total of 142,967 resident tax cases amounting to 3.899 billion KRW for the year 2025, with the payment period running until September 1. Provided by Yangju City

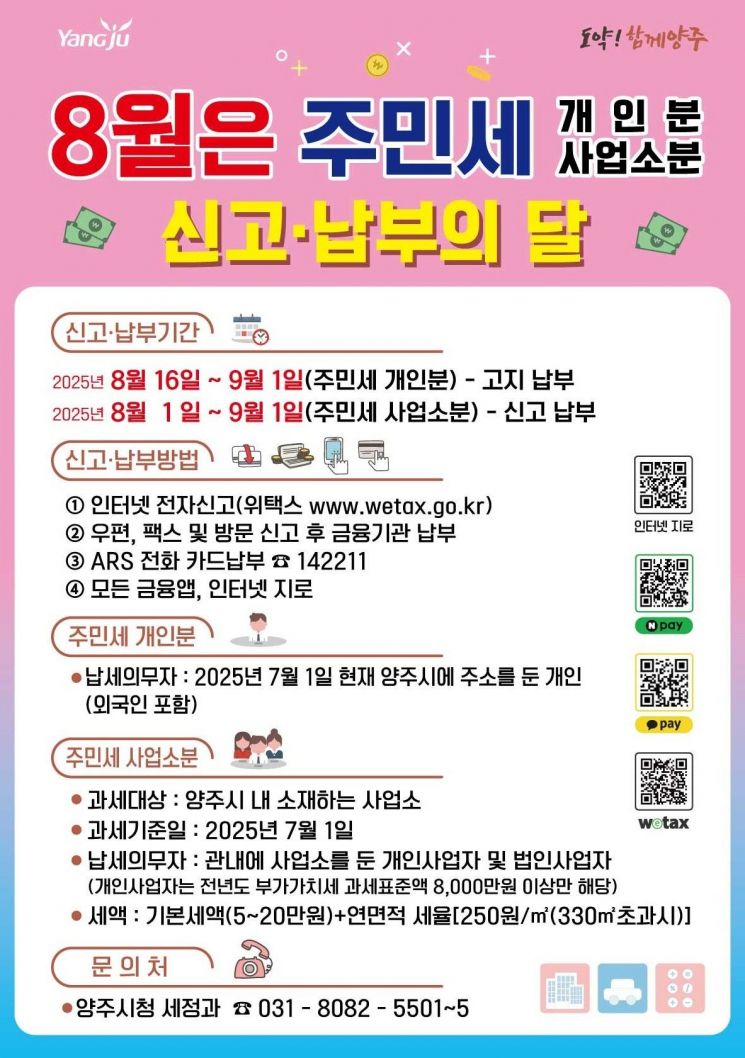

The individual resident tax is imposed on household heads who have an address in Yangju City as of July 1 each year, as well as on foreigners who have resided in the city for more than one year. The amount is 11,000 KRW, including the local education tax.

For business establishments, individual business owners are subject to a basic tax rate of 50,000 KRW, while corporations are subject to a basic tax rate ranging from 50,000 to 200,000 KRW depending on their capital or investment amount. If the total floor area of the business establishment exceeds 330 square meters, an additional 250 KRW per square meter is charged (or 500 KRW for establishments emitting pollutants).

Yangju City will also impose and notify the business establishment tax in bulk, and payment within the deadline will be recognized as having been reported and paid without the need for a separate filing. However, if the details of the tax notice differ from the actual circumstances, taxpayers must report and pay through WeTax, mail, fax, or in person.

Payment can be made through various methods even without a tax bill, including bank CD/ATM, internet or mobile banking, smartphone financial apps, ARS, and WeTax.

This year, a message promoting integrity was included on the resident tax bills to share the city’s commitment to fair taxation and integrity with citizens. In addition, the “large print tax bill” has been expanded to resident tax bills for the elderly and visually impaired.

Lee Kyungran, head of the Taxation Division, said, "If you sign up for electronic notification and automatic payment, you can receive a tax deduction of up to 1,600 KRW," adding, "We will continue to provide a variety of services so that citizens can pay their taxes easily and conveniently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.