Hanssem Regains Top Spot by 55.3 Billion KRW Margin

Hyundai Livart's Built-in Sales Down 30%

Outlook for Second Half Remains Cloudy Amid Declining Housing Supply

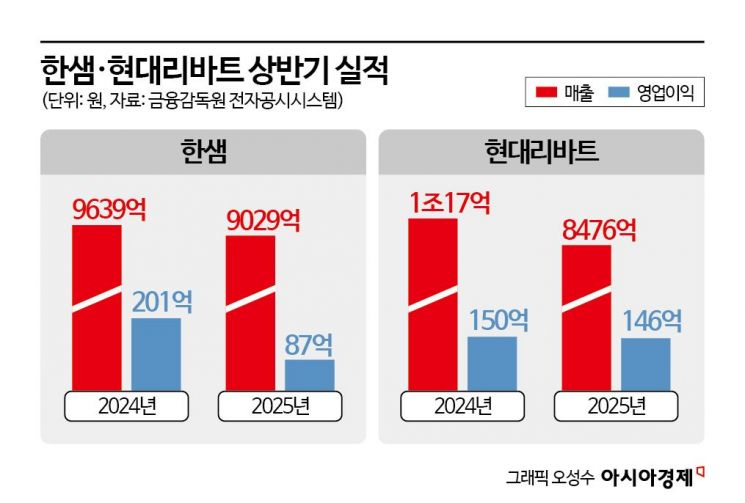

According to the Financial Supervisory Service's electronic disclosure system on August 12, Hanssem's sales for the first half of the year reached 902.9 billion KRW, down 6.3% compared to the same period last year. Hyundai Livart recorded 847.6 billion KRW, marking a 15.4% decrease over the same period. After losing the top spot to Hyundai Livart in the first half of last year, Hanssem regained its lead this year by a margin of 55.3 billion KRW.

Due to the characteristics of the furniture and interior industry, performance is highly sensitive to trends in the construction and real estate markets. The more a company relies on B2B, the more directly it is affected by market conditions. Hyundai Livart, which has a high proportion of B2B sales such as supplying to construction companies, saw a particularly sharp decline. In the first half of this year, furniture business sales dropped 17.7% year-on-year to 530.5 billion KRW, and B2B sales fell 12.9% to 294.4 billion KRW. The built-in segment, which suffered a direct hit from the reduction in new housing supply, saw sales plunge 30.4%.

In contrast, Hanssem, which focuses on B2C (business-to-consumer) sales, performed relatively well. Remodeling and premium furniture sales through its agency and online direct sales channels acted as a buffer, reducing the decline. Nevertheless, due to the collapse in real estate transactions and shrinking demand for interior products, Hanssem's operating profit for the first half of the year fell 56.7% year-on-year to 8.7 billion KRW.

The decline in sales and profitability in the furniture industry is not unique to this year. Since the second half of 2022, the combination of interest rate hikes and a collapse in housing transactions has slowed growth, and the sharp drop in new housing supply in 2023 has further entrenched the downward trend. Both companies experienced declining sales and worsening profitability last year, and this trend has continued into this year.

However, in terms of profitability, Hyundai Livart outperformed Hanssem. Hyundai Livart's operating profit for the first half of the year was 14.6 billion KRW, down just 2.5% year-on-year, while Hanssem's operating profit dropped 56.7% to 8.7 billion KRW during the same period. Hyundai Livart benefited significantly from expanding high-value, high-margin orders centered on major construction companies and from improving its cost structure by avoiding low-price competitive bidding. Hanssem explained, "Sales and operating profit declined due to the prolonged construction market slump and weakening consumer sentiment."

Both companies are making every effort to defend their performance, but there are no clear factors for a rebound in the second half of the year or beyond. In fact, the volume of new housing occupancy is expected to decline for the time being. According to Real Estate R114, the number of apartments scheduled for occupancy in the Seoul metropolitan area (including rentals) will decrease from 145,237 units this year to 111,470 units next year, and to 105,100 units in 2027. Kim Kiryong, a researcher at Mirae Asset Securities, analyzed, "The sharp drop in new housing supply in 2023 and the continued decline in occupancy volume from 2025 onward are expected to lead to a contraction in the B2B furniture segment, which is closely linked to these trends."

For now, both companies are focusing on survival strategies and diversifying their sales channels. Hanssem is targeting the high-end market with new products from its premium kitchen brand "Kitchenbach," which has been renewed for the first time in four years. Hyundai Livart plans to continue profitability improvement efforts across all business divisions, as implemented in the first half of the year, and to expand its influence in the B2C total interior market over the medium to long term by launching new products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.