Transaction Volume Reaches 6.01 Trillion Won, Up Fourfold Year-on-Year

Clear Preference for Prime Assets Centered on Large-Scale Offices

Gangnam and Gwanghwamun Account for 88% of Total Transactions

Actual Rents in Other Districts Fall by 4.2%

The Seoul office market in the second quarter of this year exhibited an extreme polarization. While the total transaction volume surged nearly fivefold compared to the same period last year, certain districts continued to experience stagnation, with vacancy rates approaching 20%. The divide between high-performing and underperforming areas became even more pronounced.

According to the industry on August 9, real estate consulting firm Acertree recently reported in its "2025 Q2 Seoul and Bundang Office Market" report that the transaction volume for offices with a gross floor area of 3,300 square meters (1,000 pyeong) or more in Seoul and Bundang reached approximately 6.01 trillion won in the second quarter of this year, marking a 380% increase from the same period last year. Compared to the previous quarter, this represents a 21% increase. Of these transactions, 88% involved large-scale offices with a gross floor area of 33,000 square meters (10,000 pyeong) or more.

The report analyzed that, "In the past, the proportion of small and mid-sized transactions increased due to rising interest rates in the second half of 2021. However, recently, the decrease in collateral loan interest rates following rate cuts, as well as a 'flight-to-quality' phenomenon, have been driving transactions."

Gangnam and Gwanghwamun Account for 88%... Concentration on Prime Assets Intensifies

Transaction activity was concentrated in the Gangnam Business District (GBD), including Gangnam and Seocho, and the Central Business District (CBD), including Gwanghwamun and Jongno. The transaction volume in the Gangnam Business District was 2.43 trillion won, while the Central Business District recorded 2.87 trillion won, together accounting for 88% of the total.

The largest transaction among major deals was the SI Tower, a super-large office building on Teheran-ro in Gangnam, which was acquired by IGIS Asset Management from KB Asset Management for 897.1 billion won. The main tenant, Hyundai Mobis, is scheduled to lease the property until 2027.

In the same Gangnam area, the virtual asset exchange Bithumb purchased Gangnam N Tower for 680.5 billion won. Hana Financial Group acquired Taekwang Tower for 175 billion won, and NH Nonghyup REITs Management purchased the HiteJinro Seocho office building for 240 billion won. Shinhan REITs Management acquired the BNK Digital Tower for 457.8 billion won. Hyundai Motor Group additionally acquired a 50% stake in Scale Tower, which it is currently using as its office, for 253.2 billion won (51 million won per pyeong), thereby securing full ownership.

Major deals also continued in the Central Business District. CJ Olive Young completed the transfer of ownership for KDB Life Tower, purchasing it for 674.4 billion won. Koramco REITs & Trust acquired the Crescendo Building, which Kim & Chang plans to use as its office until 2029, for 556.7 billion won, and Daeyeon Investment purchased Susong Square for 522.5 billion won.

In the Yeouido Business District (YBD), transactions involving Hyundai Motor Group affiliates stood out. Koramco Asset Management (Hyundai Motor Securities) purchased the Hyundai Motor Securities Building for 354.8 billion won. In the Bundang and Pangyo area (BBD), Capstone Asset Management acquired the SD Biosensor Bundang Building for 100 billion won.

Vacancy Rate Reaches 20% in Magok and Other Areas... Actual Rents Decline

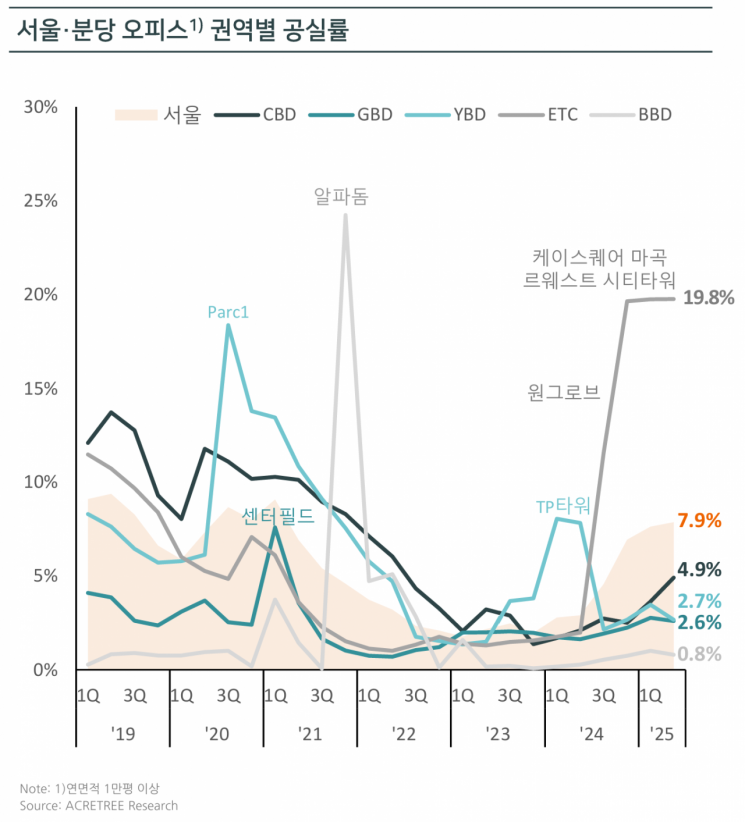

In contrast to the heated transaction market, vacancy rates became increasingly polarized. The average vacancy rate in Seoul for offices larger than 10,000 pyeong in the second quarter was 7.9%, up 0.3 percentage points from the previous quarter. The Central Business District recorded a vacancy rate of 4.9%, the Gangnam Business District 2.6%, and the Yeouido Business District 2.7%, indicating stability in these three traditional core districts. However, the ETC (Etcetera) area, which includes all other regions of Seoul such as Seongsu and Magok, had a high vacancy rate of 19.8%. The Bundang and Pangyo area recorded a low vacancy rate of 0.8%.

The report stated, "Some vacancies in the Magok area were resolved as large new buildings were supplied and tenants such as Onegrove, Air Incheon, the National Institute for Lifelong Education, and the Academic Credit Bank Support Center moved into K Square Magok. However, since East Pole Tower, supplied in the previous quarter, remains vacant, there has not been a significant change in the overall vacancy rate." The report further noted, "If companies such as DL Construction, which have signed contracts for the second half of the year, move in and Coupang, which plans to fully occupy East Pole Tower, relocates, the Magok area is expected to gradually stabilize."

Rental rates also showed clear regional differences. The average nominal rent in Seoul was 115,000 won per pyeong, up 6.4% from the previous year. The Central Business District recorded 133,000 won (up 9.5%), the Gangnam Business District 129,000 won (up 7.9%), and the Yeouido Business District 112,000 won (up 3.6%). The ETC area was recorded at 79,000 won (up 10.3%). In the ETC area, incentives such as longer rent-free periods and support for interior costs increased, resulting in an actual rent of 63,000 won, which is a 4.2% decrease from the previous year.

Continuous Supply of New Buildings in Magok and Seongsu... Leasing Market Faces Downward Pressure on Prices

In the second half of the year, large-scale new supply is scheduled for Magok and Seongsu, including the new headquarters of IICOMBINED (9,222 pyeong), Musinsa S1 (7,657 pyeong), and Centerpoint Seongsu (3,008 pyeong). From next year through 2030, new buildings such as Krafton Seongsu (65,973 pyeong), Stick Alternative Asset Management Office Facility (7,266 pyeong), SK D&D Seongsu-dong Mixed-Use Development (13,145 pyeong), and Seoul Forest Office (5,840 pyeong) will be introduced.

This wave of new construction could have a direct impact on the leasing market. If prime-grade office buildings extend rent-free periods or lower rents to attract initial tenants, older and mid-grade buildings in the vicinity may be forced to change their leasing terms or reduce rents to prevent tenant outflow. There is a high possibility that competition in leasing terms will spread across entire districts.

An official from the real estate industry stated, "In districts with concentrated supply, initial leasing competition is inevitable and may affect the re-leasing and renewal terms of existing buildings. We need to watch whether the stability of the three traditional core districts will continue, and whether the volatility in other areas will spread to different regions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.