GS Retail and BGF Retail See Decline in Operating Profit

Increased Rainy Days in Spring Impact Outdoor Activities

Slight Revenue Growth Fails to Offset Rising SG&A Expenses

Consumer Coupon Program Expected to Boost Third-Quarter Recovery

GS Retail and BGF Retail, the two leading players in the convenience store industry, were unable to avoid a decline in performance in the second quarter of this year. Despite the outing season, which typically boosts sales, repeated spells of unfavorable weather such as lower temperatures and rain amid the domestic economic downturn led to reduced sales volumes. Both companies leveraged their networks of nearly 20,000 stores nationwide to attract consumers with accessibility, but even this was not enough to offset the shift of customers to online markets, which limited sales growth.

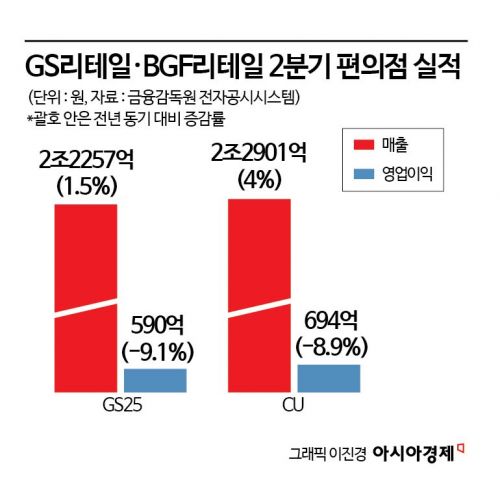

According to industry sources on August 9, GS25, the convenience store chain operated by GS Retail, reported second-quarter sales of 2.2257 trillion won, up 1.5% year-on-year. However, operating profit fell by 9.1% to 59 billion won, indicating deteriorating profitability. GS Retail explained, "The second quarter, spanning spring and summer, is typically a season of increased outdoor activity. However, this year, temperatures during this period were lower than average, and there were many rainy days on weekends and holidays." The company added, "Sales of hit products such as Seoul Milk Dessert, Ice Brulee, Sunyang Oak Soju, and Fresh Fruit Smoothies increased, resulting in a slight rise in revenue. However, this was not enough to offset the increase in selling and administrative expenses, including depreciation and commission fees, leading to a decline in operating profit."

BGF Retail, which operates the CU convenience store chain, also saw its second-quarter sales rise by 4% year-on-year to 2.2901 trillion won, but operating profit fell by 8.9% to 69.4 billion won. These figures are on a consolidated basis, and the standalone sales figures for convenience stores, which will be announced later this month, may be even lower. According to BGF Retail, standalone sales typically account for about 98% of consolidated sales. The securities industry had projected BGF Retail's second-quarter sales at 2.2797 trillion won and operating profit at 72.1 billion won, meaning that while sales met expectations, operating profit fell short.

A BGF Retail representative explained, "The ongoing environment of subdued consumption, driven by sharp price increases and a prolonged economic downturn, combined with unfavorable weather conditions such as low temperatures and more rainy weekends, led to a decline in customer traffic." The representative added, "The increase in sales was not sufficient to fully offset the rise in fixed costs such as depreciation and rent, resulting in a decrease in operating profit."

This sluggish performance is also evident in the same-store sales growth rates. Of the 18,112 GS25 stores nationwide as of last year, sales at existing stores that had been open for more than one year peaked in the fourth quarter of last year, growing 2.3% year-on-year. However, growth slowed to 0.9% in the first quarter of this year and 0.1% in the second quarter. CU, with 18,458 stores nationwide, saw its same-store sales growth rate drop from 1.3% in the fourth quarter of last year to -2.1% in both the first and second quarters of this year, marking negative growth.

In fact, data compiled by the Ministry of Trade, Industry and Energy show that domestic convenience store sales in the first quarter of this year fell by 0.4% year-on-year, marking the first quarterly negative growth since statistics began in 2013. The downward trend continued in April (-0.6%), May (-0.2%), and June (-0.7%). This is the first time in five years, since the COVID-19 pandemic spread in 2020, that the convenience store sector has experienced three consecutive months of negative growth.

The two leading convenience store chains are expecting their performance to improve in the third quarter, thanks to the effect of livelihood recovery consumer coupons distributed since July 21. The securities industry estimates that about 5% of the total 13.2 trillion won in consumer coupons will flow into convenience stores. An industry representative said, "As government livelihood recovery policies are driving up convenience store sales, we plan to strengthen our role as a platform for stabilizing everyday prices by planning large-scale seasonal discount events."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.