The Financial Supervisory Service has urged investors in commodity Exchange-Traded Products (ETPs) to exercise particular caution. This is because commodity prices are highly volatile due to external factors such as war and tariffs, and discrepancies can arise due to the inflow of speculative funds.

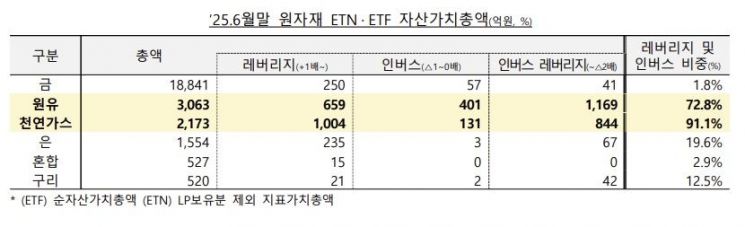

According to the Financial Supervisory Service on August 6, as of the end of June, the total net asset value of commodity ETPs (ETNs and ETFs) stood at 2.7 trillion won, accounting for 1.3% of all ETPs. However, in the case of energy-based products such as crude oil and natural gas, leverage and inverse products account for 72.8% and 91.1% respectively, indicating that speculative fund inflows and outflows are very active.

Recently, oil and copper prices have fluctuated sharply due to the Israel-Iran war and uncertainty over U.S. tariffs. For example, the price of WTI futures surged from $68 per barrel on June 12 to $75.1 on June 18, then plummeted to $64.4 on June 24. Similarly, the price of copper futures rose from $5.08 per pound at the end of June to $5.82 on July 23, before falling to $4.64 on July 30.

The Financial Supervisory Service explained that because leverage and inverse products are structured to track multiples of the underlying asset's price movements, losses can increase rapidly in highly volatile markets. In particular, in markets where prices fluctuate up and down, the "compounding effect" can cause cumulative returns to deteriorate even further compared to the returns of the underlying asset.

Additionally, the agency pointed out that if speculative funds flow in over a short period, the gap (discrepancy rate) between the market price and the intrinsic value of the ETP can widen excessively, which may result in losses for investors who buy at overvalued prices.

A significant positive discrepancy rate means that the market price of the product is overvalued relative to its intrinsic value. If the overvalued market price converges to the intrinsic value and normalizes, investors may incur losses equivalent to the amount of the discrepancy rate.

The Financial Supervisory Service stressed, "Individual investors, including new investors, should fully understand the price volatility and product structure when investing in commodity ETPs and approach with caution," adding, "In the event of heightened trade disputes or geopolitical risks in the future, we will continue to monitor for abnormal signs and respond quickly, including issuing consumer alerts."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.