Paradise, GKL, and Lotte Tour Development

July Sales and Visitor Numbers Up Year-on-Year

Rising Share of Chinese VIPs Drives Growth

Visa-Free Entry Begins Next Month... Local Marketing Efforts Intensify

Distribution Industry, Including Duty-Free Sector with Declining Performance, Sees Growing Hopes

The government has decided to temporarily allow visa-free entry for Chinese group tourists (Youke) from August 29 to June 30 next year. In this context, the three foreigner-only casinos?considered the biggest beneficiaries of this policy?posted both increased sales and a rise in Chinese VIP visitors last month, signaling a strong performance for the third quarter. The duty-free, department store, and fashion sectors?both online and offline?are also anticipating an increase in Chinese visitors to Korea, heightening expectations and prompting efforts to attract more customers.

Foreign Casinos See Strong July Sales... Rise in Chinese VIPs

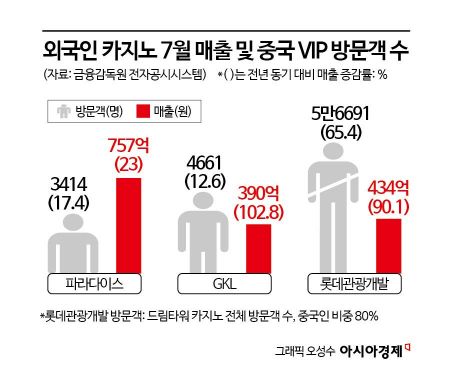

According to the securities industry and casino sector on August 6, Paradise, which operates foreigner-only casinos at four locations?Walkerhill in Seoul, Paradise City in Yeongjongdo, Incheon, as well as in Busan and Jeju?recorded casino sales of 75.7 billion KRW last month, a 23% increase year-on-year. In terms of visitor composition, the mainstay Japanese VIPs numbered 6,686, up by about 500 from 6,105 a year earlier, while Chinese VIPs totaled 3,414, a 17.4% increase over the same period last year.

Grand Korea Leisure (GKL), which operates Seven Luck casinos in three locations?Gangnam and Yongsan in Seoul, and Busan?posted casino sales of 39 billion KRW last month, more than doubling (up 102.8%) from the same period last year. During this period, Japanese VIP visitors increased by about 600 to 3,828, while Chinese VIPs also rose by over 500 to reach 4,661, supporting the sales growth. A GKL representative explained, "Marketing activities targeting new customers from Taiwan, Hong Kong, and Macau led to an increase in Greater China visitors. In addition, VIP inflow from regions other than Japan and China also grew, resulting in balanced sales growth."

Lotte Tour Development, which operates the Jeju Dream Tower integrated resort, achieved net casino sales (after deducting agent commissions and other expenses) of 43.4 billion KRW last month, marking the highest monthly performance since opening in 2021. The total number of visitors to Dream Tower Casino last month was 56,691, a 65.4% increase year-on-year. The casino does not separately disclose the number of VIP entrants.

Since June 2022, Jeju has resumed 30-day visa-free entry for foreigners after COVID-19, making it a popular destination for Chinese visitors. More than 80% of Dream Tower Casino guests are from Greater China, including China itself. A Lotte Tour Development official stated, "Historically, the second half of the year sees peak sales in August, followed by September, October, and July. Considering the July results at the start of Q3, we expect sales and visitor numbers for the remaining period to surpass those of the previous quarter."

Previously, Lotte Tour Development saw both Dream Tower Casino and its hotel post strong results, with consolidated operating profit for Q2 this year reaching 33.1 billion KRW?a 461% increase over the same period last year and the highest quarterly figure since the company's founding. Revenue for the period was 157.7 billion KRW, up 35.8%, and net profit turned positive at 5.9 billion KRW for the quarter.

An industry insider commented, "With the implementation of visa-free entry, the entry barrier for Chinese group tourists will be lowered, which is expected to significantly boost inbound tourism demand and help expand the domestic tourism market. We are considering expanding local marketing to attract these tourists to casinos."

Duty-Free Sector in the Red Steps Up Youke Marketing

The duty-free industry, which posted a combined loss of 280 billion KRW last year across the four major players?Lotte, Shilla, Shinsegae, and Hyundai?expects the new visa-free policy to help revive the influx of Youke that previously drove duty-free growth. In response, companies are ramping up promotions to capture group tourism demand from China.

Lotte Duty Free is collaborating with major inbound travel agencies to offer exclusive travel packages that combine shopping and sightseeing, also providing beauty classes and K-content experiences. To facilitate payments for Chinese customers, Lotte is strengthening partnerships with major payment platforms such as WeChat Pay and Alipay, and offering special benefits to Chinese shoppers.

Shilla Duty Free is working with its China office and local travel agencies to target high-value-added demand such as MICE (Meetings, Incentives, Conferences, and Exhibitions) and incentive tours, resulting in more than 20,000 group tourists from China and Southeast Asia visiting each month. In April, Shilla also appointed Jin Young, formerly of B1A4, as a promotional model to attract overseas customers with a multinational fan base, focusing on Greater China.

Shinsegae Duty Free aims to secure over 50,000 customers through its incentive group tour programs by the end of the year, and plans to attract an additional 10,000 Chinese tourists if the visa-free policy is implemented, targeting a total of over 60,000 customers. To achieve this, the company will strengthen product curation by expanding customized marketing and exclusive brand offerings. Hyundai Duty Free, considering the rising popularity of the Gangnam area (including COEX) among foreign independent travelers (FITs) and the characteristics of its customer base, is exploring the development of group tour products that combine Chinese MICE group attraction with tourism facilities such as aquariums.

Additionally, department stores are also anticipating increased Youke traffic, particularly in the Myeongdong shopping district, and plan to offer discounts and convenient payment services to attract shopping demand. For example, Lotte Department Store is holding events at its flagship store’s K-content platform, Kinetic Ground, where Chinese customers can receive various goods such as keyrings. The store also plans to enhance the instant discount promotions run with global payment apps last month. These promotions include giving an 88-yuan discount coupon for purchases of 2,500 yuan or more with Alipay, and a 50-yuan coupon for purchases of 1,000 yuan or more with WeChat Pay at all stores. Lotte is also considering introducing exclusive packages for foreign group tourists at signature events such as the Christmas Market, which has been very popular.

Shinsegae Department Store has signed an MOU with the Korea Tourism Organization and is leveraging the VISITKOREA platform, which receives 40 million annual visits, to offer instant discount coupons?5,000 KRW off for F&B purchases over 30,000 KRW, and 10,000 KRW off for fashion and accessories purchases over 100,000 KRW.

An industry official stated, "The visa-free policy for Chinese group tourists is expected to be a turning point for the recovery of Korea's tourism industry. We anticipate increased visits from group tourists from China and other parts of Asia, leading to higher foot traffic and greater purchasing power."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.