Interview with Ahn Sanghee, Head of Governance Consulting Center at Daishin Economic Research Institute

"Balanced Development of Shareholder Rights and Control Rights Is Needed"

Corporate Strategies... "Demonstrate Willingness to Communicate"

A wave of 'Commercial Act amendments' is sweeping through the capital market. The first round of amendments, centered on expanding the fiduciary duty of directors, has already been implemented, and an even stronger amendment, designed to further restrict the power of controlling shareholders, is on the horizon. The business community is voicing growing concerns over threats to management rights, but it appears unlikely that this major trend can be stopped. The question now is how companies should respond in this new era of amended Commercial Act, where failure to adapt may mean falling behind.

Ahn Sanghee, Head of the Governance Consulting Center at Daishin Economic Research Institute, expressed both understanding of the business community’s concerns and the need for a balanced development between shareholder rights and control rights during an interview with Asia Economy on the 4th. Ahn stated, “It cannot be dismissed as mere exaggeration that the business community is worried about threats to management rights from external forces such as overseas funds and pension funds.” He specifically pointed out that a series of events triggered by the appointment of a candidate for auditor proposed by Align Partners at SM Entertainment’s annual general meeting three years ago have caused significant concern among companies.

Ahn Sanghee, Head of the Governance Consulting Center at Daishin Economic Research Institute, is being interviewed by Asia Economy at the Daishin Finance Center on the 4th. Daishin Securities

Ahn Sanghee, Head of the Governance Consulting Center at Daishin Economic Research Institute, is being interviewed by Asia Economy at the Daishin Finance Center on the 4th. Daishin Securities

This case is considered a pioneering example where a candidate recommended by minority shareholders secured a full-time auditor position at a major listed company by utilizing the '3% rule' (which limits the voting rights of the largest shareholder and their special affiliates to 3% when appointing auditors or audit committee members). The 3% rule, which had previously applied only to the appointment of full-time auditors and internal directors serving as audit committee members, has now been expanded to include outside directors serving as audit committee members. As a result, the burden felt by management and boards of directors is expected to increase.

Ahn remarked, “If the influence of auditors and audit committee members?who have access to internal company documents?continues to expand, and if cumulative voting is also introduced, the impact will be even greater.” He argued, “To achieve sustainable improvement in corporate value, it is important to level the playing field between control rights and shareholder rights in a balanced way.”

Expanding the Director Pool and Keeping Records

With the second round of Commercial Act amendments imminent, what strategies should companies adopt? Ahn suggested two approaches. The first is 'documentation.' He advised that whenever management decisions are made that may involve conflicts of interest among shareholders, or when the board makes significant decisions, the entire discussion process should be recorded in the meeting minutes. Ahn emphasized, “The institutionalization of value-up disclosures ultimately stemmed from outside shareholders’ complaints that they had no idea what the board was doing or where it was operating. Strengthening communication was the answer.” He added, “It is important to demonstrate a willingness to communicate with shareholders by recording the board’s discussions and decisions.”

The second strategy is to diversify the pool of director candidates. He advised that companies should manage a sufficient list of candidates who meet shareholders’ expectations, establish strict qualification standards, and implement a systematic verification process for appointed directors. Ahn explained, “Financial companies, albeit formally, are required to regularly evaluate their boards of directors and disclose the results. Non-financial companies should also establish such board evaluation systems. That way, if proposals for reappointment or compensation limits for directors face opposition or even litigation, the company can use these evaluations as evidence that it has fulfilled its fiduciary duty to shareholders.”

Willingness to Communicate with Shareholders Is Risk Hedging

Ahn also spoke about the value-up (corporate value enhancement) program, which marked its first anniversary this May. He noted that value-up disclosures, which began as a way to strengthen communication with shareholders, have also contributed to rising stock prices. Ahn pointed out, “Among companies participating in value-up disclosures, those that provided additional updates on their progress after the initial disclosure saw even better stock performance. The fact that companies showing a strong willingness to engage with shareholders have achieved better results is highly significant.”

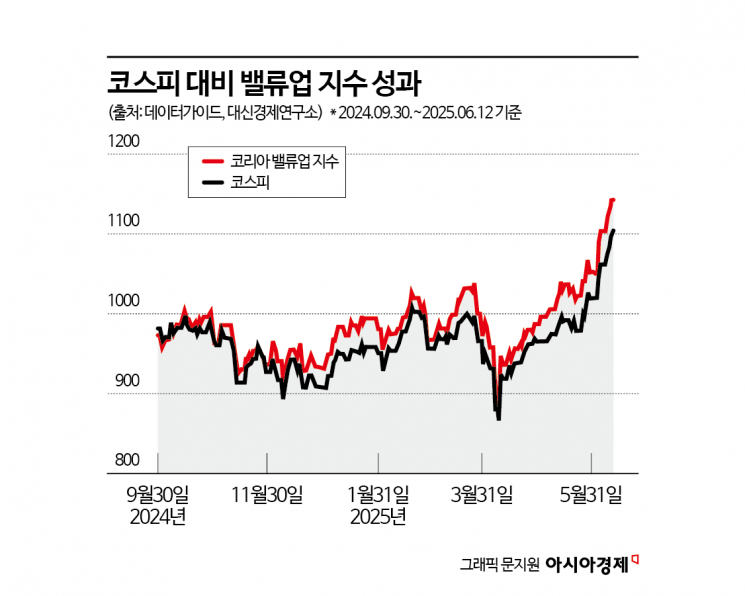

The Korea Value-Up Index, introduced in September 2023, rose by 35.8% from the beginning of this year through last month. This slightly exceeded the KOSPI index’s 35.3% increase over the same period. On the 15th of last month, it reached an all-time high of 1306.37 since its inception.

However, several limitations have also been pointed out. According to Daishin Economic Research Institute, from September 30, 2024, when the value-up index was first published, to June 12, 2025, the day before rebalancing, only 47 out of 105 stocks (44.8%) in the value-up index outperformed the KOSPI. Nevertheless, the fact that the value-up index outperformed the KOSPI overall suggests that the index’s performance was highly dependent on a few specific stocks.

Ahn further noted, “In addition, Korea’s value-up program, modeled after Japan’s, has focused on improving the price-to-book ratio (PBR), but has relatively neglected measures to enhance corporate profitability, such as return on equity (ROE), which are essential for shareholder returns.” He stressed, “To truly resolve the ‘Korea discount’ (the undervaluation of the Korean stock market), not only amendments to the Commercial Act but also improved corporate awareness of shareholder rights and enhancements to the value-up program must all work together in a comprehensive manner.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.