Korbit Research Center, under the virtual asset exchange Korbit, announced on August 5 that it has published a report titled "Structural Differentiation of Stablecoins: Functional Division of Labor in the On-Chain Economy," which provides an in-depth analysis of the on-chain usage patterns of stablecoins by asset and blockchain.

This report examines the roles that stablecoins play within the structure of the on-chain economy and explores how the economic structures of different blockchains are becoming differentiated in the process.

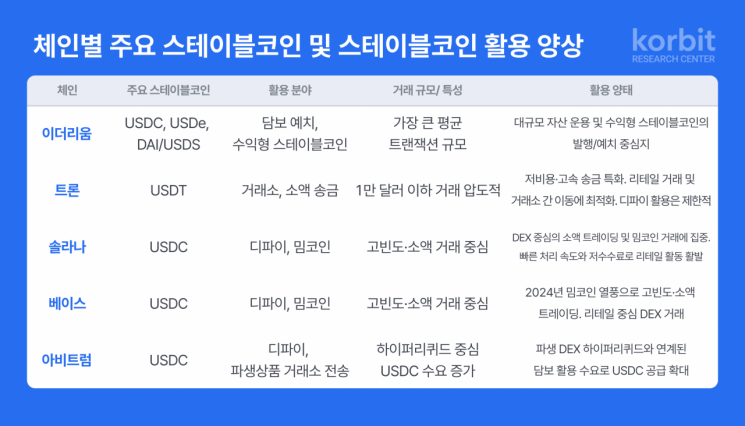

According to the report, the functions of stablecoins on-chain are clearly differentiated by asset type. USDT, the representative fiat-collateralized stablecoin, is primarily used for remittances on Tron and as a settlement instrument between centralized exchanges. USDC is used as collateral and a trading asset in DeFi on Ethereum, Solana, and Arbitrum. In contrast, crypto-collateralized stablecoins such as USDe and USDS/DAI function as assets for deposits, lending, and yield distribution within DeFi.

Korbit Research Center analyzed that the use of stablecoins varies distinctly depending on the characteristics of each blockchain.

Ethereum, based on its high security and large capital scale, is notable for its use as DeFi collateral assets. Tron, with its low fees and high-speed transfers, is specialized for remittance and payment purposes. The report explains that stablecoins are evolving into infrastructure assets with specific functions that operate in line with the economic structure of each blockchain.

The report diagnoses that the stablecoin market is not a monolithic structure centered on a single demand or function, but is instead becoming differentiated along three axes: use cases, revenue structures, and blockchain infrastructure.

Kang Donghyun, a research fellow at Korbit Research Center, stated, "Currently, stablecoins are used overwhelmingly more in the on-chain economy and the virtual asset market than in the real economy," adding, "The differentiation into on-chain financial infrastructure, yield-seeking assets, and real economy payments will simultaneously expand both opportunities and risks across the entire virtual asset ecosystem in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.