-Consumer Insight Survey on Used Goods Platforms Among Mobile Phone Users

-90% of Users with Experience in the Past Year Have Tried "Danggeun"

-Bungaejangter Rises to Second Place, Surpasses Junggonara

A recent survey has found that Danggeun Market is maintaining a "super-gap" lead as the number one platform in the used goods trading market. Nine out of ten people with experience in used goods transactions have used "Danggeun," and eight out of ten primarily use it.

On August 4, the mobile communication research agency Consumer Insight announced the results of its 41st "Mobile Communication Planning Survey" (first half of 2025), which is conducted twice a year (once each in the first and second halves, with a sample size of about 30,000 per survey). The agency asked 3,109 mobile phone users aged 14 and older about their experiences with used goods trading platforms and analyzed the trends over time. The platforms presented to respondents were Danggeun, Bungaejangter, Junggonara, HelloMarket, DanawaJangter, AuctionUsedMarket, LuxuryRare (formerly MarketJjin), FruitsFamily, and online used bookstores (such as Kyobo Bookstore, Aladin, etc.), totaling nine platforms. Of these, only the three platforms with a usage rate of 5% or higher (Danggeun Market, Bungaejangter, Junggonara) were compared.

Danggeun in Overwhelming First Place... Bungaejangter on the Rise, Surpasses Junggonara

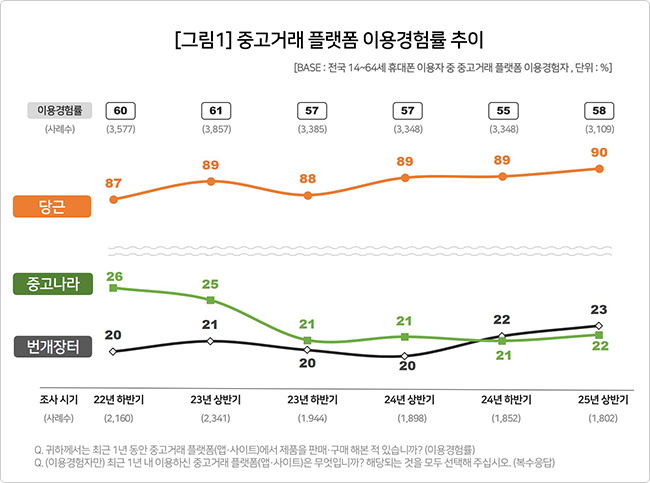

In this year's first half survey, the rate of experience using used goods trading platforms was 58%. This means that three out of five respondents had bought or sold items on a used goods trading app or website in the past year. Since the second half of 2022 (60%), the market has been in a "saturated state," fluctuating between 55% and 61% over six surveys. While quantitative growth in new users has stopped, qualitative growth such as transaction frequency and amount continues. The proportion of users who use the platforms at least once a week increased from 46% in the first half of 2023 to 51% in the first half of 2024, and again to 52% in the first half of this year. The proportion of users spending more than 100,000 KRW annually also increased from 40% to 41% to 43% over the same period.

Danggeun's position has become even stronger. In the first half of this year, its experience rate (multiple responses allowed) was 90%, far ahead of Bungaejangter (23%) and Junggonara (22%). This is a 3 percentage point increase compared to the second half of 2022 (87%), widening the gap with the second-tier group. Bungaejangter, which was in third place with a 20% experience rate in the second half of 2022, behind Junggonara (26%), managed to surpass Junggonara as its usage rate began to rise in the second half of last year. Danggeun was also the clear leader in "main usage rate" (the platform primarily used, single response), with an 82% share, overwhelmingly ahead of Bungaejangter (8%) and Junggonara (4%). While Danggeun has shown a gentle upward trend, Junggonara is declining, and Bungaejangter has remained stagnant. The report analyzed that Danggeun's "uncontested dominance" is likely to continue in the future.

Danggeun Transforms into a Comprehensive Local Life Platform... Lags Behind Bungaejangter in Satisfaction Ratings

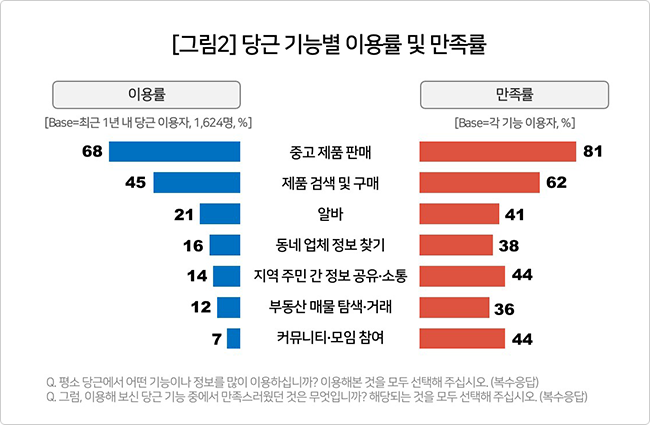

Based on its overwhelming dominance in "used goods trading," Danggeun is attempting to transform into a "comprehensive local life platform." One or two out of ten Danggeun users have tried features such as ▲"Danggeun Alba" (a job search and recruitment service, 21%), ▲"Neighborhood Businesses" (finding local store information, 16%), ▲"Neighborhood Life" (exchanging information with local residents, 14%), and ▲real estate listing search and transactions (12%). About 40% of those who used these services reported being satisfied. The usage rates (68%, 45%) and satisfaction rates (81%, 62%) for its core services, ▲"selling used products" and ▲"searching for and purchasing products," are much higher, but these figures still show potential for growth in new areas.

An interesting aspect was user satisfaction by platform. Among the four items used to evaluate satisfaction, Danggeun led Bungaejangter in "overall platform" satisfaction (64% vs. 61%). However, for the other three items?▲"convenient transaction methods," ▲"product variety and quality," and ▲"payment safety and reliability"?Danggeun lagged far behind Bungaejangter. This is interpreted as a result of Danggeun focusing on hyperlocal, face-to-face transactions, while Bungaejangter offers nationwide service, a wide range of items including high-value and rare goods, and a non-face-to-face transaction environment.

Consumer Insight stated, "Danggeun has been working to overcome these disadvantages by expanding product categories, introducing non-face-to-face transactions, and implementing safe payment (escrow) functions. However, the gap in the three items other than overall satisfaction has not improved for several years. Danggeun, which grew through innovation with its location-based algorithm, is now on the verge of a new leap as a 'comprehensive local platform.' It is time for a second wave of innovation to provide 'an even more advanced user experience.'"

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.