Excessive Market Profits Lead to Illegal Applications and Supply Paralysis...

Institutional Limits Reached

President Lee's Direction for "Recapturing Development Gains" Is "Clear"

Hanam Gyosan Prugio The First, a pre-sale complex that recorded an average competition rate of 263.3 to 1 for the first priority. Complex website.

Hanam Gyosan Prugio The First, a pre-sale complex that recorded an average competition rate of 263.3 to 1 for the first priority. Complex website.

As President Lee Jaemyung sets his sights on the so-called 'Lotto Apartment Sales,' the 'pre-sale price ceiling system' (Bunsangje), which is widely considered the root cause, is expected to undergo a comprehensive overhaul.

According to the recently released minutes of the Cabinet meeting held on June 19, President Lee pointed out, "Lotto apartment sales occur because the pre-sale price ceiling creates a significant gap between the set price and the market price, which in turn causes surrounding housing prices to soar," indicating the need for institutional reform. If Bunsangje, which has led to various side effects such as excessive market profits, fraudulent applications, and a contraction in supply, is revised, a major transformation in the pre-sale market is anticipated.

'Illegal Applications' and 'Supply Contraction' Caused by Excessive Market Profits... Institutional Limits Reached

Bunsangje was first introduced in 1977 with the aim of stabilizing housing prices and has since been repeatedly abolished and reinstated depending on market conditions. It is currently applied to private and public housing development sites in regulated areas, including the three Gangnam districts (Gangnam, Seocho, Songpa) and Yongsan-gu in Seoul. By setting the pre-sale price at 60-80% of the market value based on land and construction costs, the system has created artificial market profits, sometimes amounting to billions of won, simply by winning the lottery-style draw.

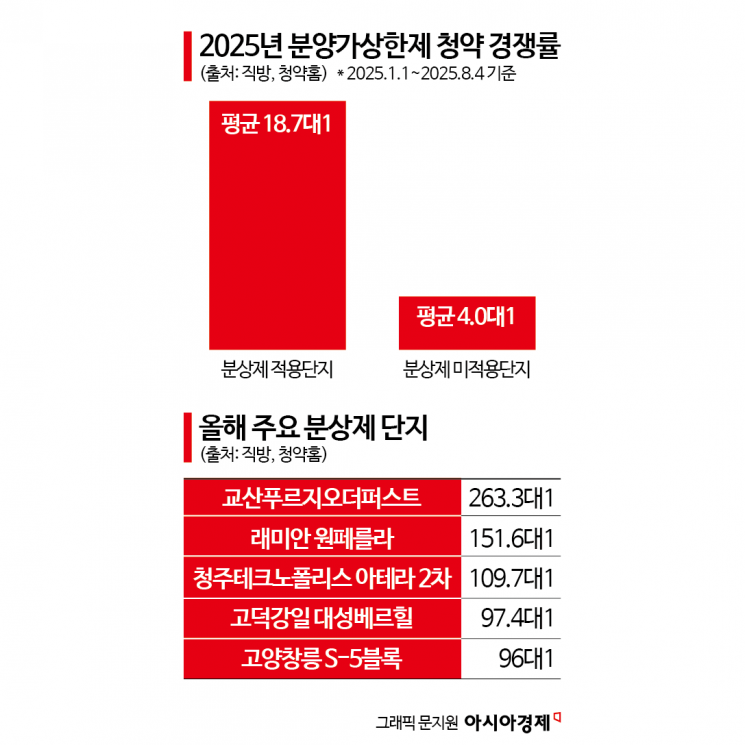

This price distortion has led to abnormal overheating of the market. In fact, according to real estate platform Zigbang, as of August 4, the average competition rate for first-priority applications in Bunsangje-applied complexes this year was 18.7 to 1, more than four times higher than the average competition rate of 4.0 to 1 in complexes not subject to Bunsangje. Raemian One Perla (average 151.6 to 1) and Godeok Gangil Daeseong Verhill (97.4 to 1) are prime examples.

There has also been a surge in illegal applicants seeking to profit from Bunsangje market gains. According to the Ministry of Land, Infrastructure and Transport, of the 166 fraudulent applications detected at six major apartment complexes in Seoul in the second half of last year, 165 were cases of false address registration. As it became virtually impossible to win through legitimate means, illegal attempts to increase application scores became rampant.

At the same time, Bunsangje has produced side effects that paralyze the supply market itself. As construction costs soar due to surging raw material prices while pre-sale prices remain capped, some construction companies, having lost profitability, have abandoned supply projects. A representative case is the developer of the Paju Unjeong 3 District project, who, unable to cover construction costs even after completing pre-sale applications, returned the land to Korea Land and Housing Corporation (LH).

President Lee's Direction for 'Recapturing Development Gains' Is 'Clear'

President Lee has clearly identified 'recapturing development gains' as the fundamental solution to these systemic issues. In the Cabinet meeting, he emphasized, "If we find a way to recover a significant portion of development gains in the public sector, we can prevent the market from becoming so chaotic." This reflects his intention to move away from the current system, where market profits are privatized.

The 'bond bidding system' is emerging as a strong alternative that aligns with the President's vision for recapturing development gains. Under this system, when the pre-sale price of an apartment is set significantly below the market price and a large market profit is expected, applicants are required to purchase a certain amount of National Housing Bonds equivalent to a portion of the anticipated profit. This system was previously applied to Seongnam Pangyo New Town in 2006 and Goyang Ilsan District 2 'Humansia' in 2007. Seo Jinhyung, professor of Real Estate Law at Kwangwoon University, stated, "It is problematic for either the construction company to take all the development gains or for individuals to reap all the market profits as if they won the lottery. Through the bond bidding system, some development gains can be recaptured and used for housing welfare costs, which is desirable."

There are also suggestions to raise the pre-sale price ratio under Bunsangje. Ham Youngjin, head of Woori Bank's Real Estate Research Lab, analyzed, "To prevent excessive profits from being concentrated among buyers while also improving the feasibility for suppliers, it may be more realistic to raise the pre-sale price ratio above the current 60-80% of the surrounding market price." He added, "This method would not only provide momentum for expanding supply, but also help reduce excessive competition and market concentration caused by lotto-style applications."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.