After Second-Quarter Earnings Announcement, Target Prices and Investment Ratings See Widespread Changes

Seven Securities Firms Raise Target Price for Poongsan

Three of Them Simultaneously Downgrade Investment Ratings

Target Price Increased to Reflect Defense Sector Value, but Upside Potential Remains Limited

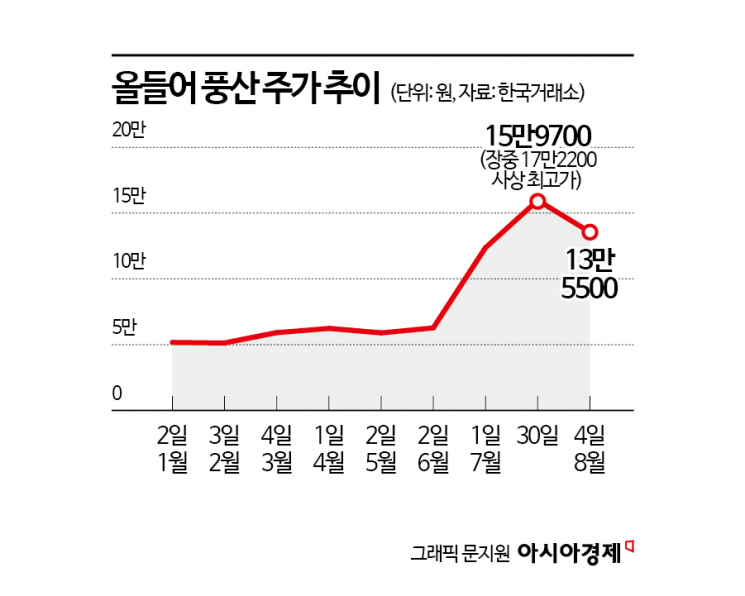

As Poongsan reported second-quarter results that fell short of market expectations this year, it is drawing attention as securities firms offer mixed assessments. While target prices have been raised across the board, investment ratings have been downgraded.

According to financial information provider FnGuide on August 5, seven securities firms raised their target prices for Poongsan this month. Shinhan Investment & Securities raised its target from 85,000 won to 175,000 won, and BNK Investment & Securities increased it from 80,000 won to 140,000 won. Hyundai Motor Securities raised its target from 143,000 won to 165,000 won, iM Securities from 77,000 won to 150,000 won, Yuanta Securities from 74,000 won to 142,000 won, Hana Securities from 80,000 won to 160,000 won, and Samsung Securities from 150,000 won to 155,000 won.

The reason securities firms have been raising their target prices is because Poongsan's defense sector remains relatively undervalued. Park Hyunwook, a researcher at Hyundai Motor Securities, explained, "The value of Poongsan's defense sector is still considered undervalued compared to other major domestic defense companies, and the target price has been adjusted upward to reflect this." Park Kwangrae, a researcher at Shinhan Investment & Securities, said, "The target price was raised to reflect changes in earnings estimates as well as an increase in the defense sector's valuation multiple."

There are also firms that have lowered their target prices. Korea Investment & Securities reduced Poongsan's target price from 228,500 won to 204,000 won. Choi Moonseon, a researcher at Korea Investment & Securities, stated, "The target price was lowered by 10.7% compared to the previous figure due to a downward revision of earnings forecasts, but this is not because of disappointment in the results. Previously unaccounted-for costs have now been recognized, and as these were reflected, the earnings outlook was automatically lowered, which in turn led to a lower target price."

Previously, on August 1, Poongsan announced that its consolidated operating profit for the second quarter was 93.593 billion won, a 42% decrease compared to the same period last year. During the same period, revenue increased by 4.9% to 1.294 trillion won, but net profit was provisionally tallied at 64.2 billion won, down 42.3%. Researcher Choi commented, "Poongsan's second-quarter operating profit was 17.2% below the consensus (the average forecast of securities firms), which was 113 billion won. The figure fell short of consensus by 20 billion won, as ordinary wages were raised through negotiations with the labor union, resulting in a one-time provision for retirement benefits of 15 billion won. In addition, there was a 5 billion won cost related to U.S. sporting ammunition business tariffs, which was not reflected in the consensus."

Some firms have simultaneously raised their target prices and downgraded their investment ratings. BNK Investment & Securities, iM Securities, and Yuanta Securities each downgraded Poongsan's investment rating from 'Buy' to either 'Neutral' or 'Hold.' The downgrade in investment ratings is due to the limited upside potential for the share price. Lee Hyunsu, a researcher at Yuanta Securities, explained, "We raised the target price by adjusting the target price-to-earnings ratio (PER) from 9.0 times to 16.0 times in line with rising valuations among other defense companies, but we believe the upside potential is insufficient, so we are downgrading the investment rating from 'Buy' to 'Neutral.'" Kim Yoonsang, a researcher at iM Securities, also stated, "Since the upside potential relative to the target price is less than 15%, we are lowering the investment rating to 'Hold.'"

There are also projections that the possibility of earnings improvement in the second half of the year is not high, and thus the share price is expected to remain flat for the time being. Kim Hyuntae, a researcher at BNK Investment & Securities, said, "Expectations for second-half earnings should be somewhat lower than for the second quarter. While the continued momentum in defense exports is positive, given the sharp rise in the share price in the short term and the outlook for second-half earnings, it is more likely that the stock will enter a consolidation phase rather than see further gains."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.