Key Issues Hinge on Financial Services Commission Restructuring

Signals Slower Than Savings Bank Election

Stablecoin Expertise Needed... "A Special Election"

"A Strong Chairman Is Needed to Convey the Industry's Will to the Authorities"

According to the financial sector on August 5, Chairman Jung's term will end on October 5. There is no specific regulation requiring an immediate election after the expiration date. However, many in the industry argue that a prompt selection of the next chairman is necessary to minimize any vacancy, given the pressing issues such as declining profitability due to sluggish credit sales and the need to respond to the activation of stablecoins.

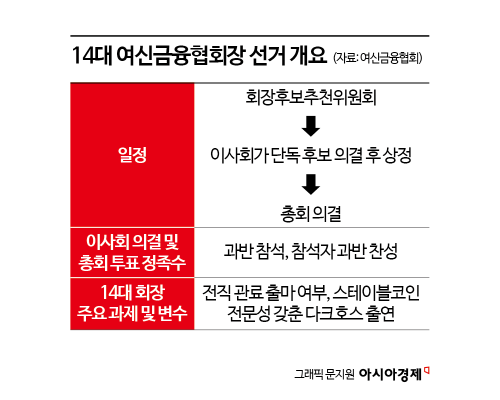

According to the association, the election process proceeds as follows: formation of the candidate recommendation committee, board of directors' approval and submission of a single candidate, and then a general meeting election and approval. Both the quorum for board approval and the election requirement at the general meeting are 'majority attendance and majority approval of those present.' The association's board consists of 16 members, but only 15, excluding Chairman Jung, participate in the decision-making process. The participants include one auditor (Hyundai Card), seven card companies, six capital companies, and one new technology business financier (IBK Capital). An agenda item requires the agreement of at least five directors to be approved, but typically, the single chairman candidate put forward for the general meeting receives near-unanimous support. The 172 member companies then vote on this single candidate at the general meeting, again applying the principle of majority attendance and majority approval. This means at least 44 votes are required for election.

Although some say it is premature since there are still two months left in the chairman’s term, there is a prevailing view that Seo Taejong, former president of the Korea Institute of Finance and a former bureaucrat, is currently the frontrunner. Other potential candidates from the bureaucratic side include Yoo Kwangyeol, former CEO of SGI Seoul Guarantee Insurance, and Kim Geunik, former chairman of the Market Surveillance Committee at Korea Exchange. Among private-sector candidates, Lim Youngjin, former CEO of Shinhan Card, Lee Dongcheol, former vice chairman of KB Financial Group, and Lee Changkwon, head of Digital and IT at KB Financial Group, have been considered strong contenders, but the consensus is that they are unlikely to become the final leading candidates. In particular, Lim Youngjin is considered unlikely due to the fact that Cho Yongbyung, former chairman of Shinhan Financial Group, is currently serving as chairman of the Korea Federation of Banks, and Lim himself is reportedly not very interested in running. Instead, Professor Kim Sangbong of Hansung University’s Department of Economics, who is also a 'Shinhan Man' (from Shinhan Card), is emerging as a dark horse. Professor Kim has a six-year history of advisory work with the Credit Finance Association. Few expect Chairman Jung to seek reappointment.

Within the industry, the biggest variables in the 14th chairman election are considered to be the unofficial signals from the Financial Services Commission and expertise in stablecoins. There were speculative rumors in some quarters that the Financial Services Commission was considering Yoon Changho, former CEO of Korea Securities Finance, among former officials, but Yoon has been completely excluded from the candidate pool after being investigated by the Kim Keonhee special prosecutor team (Special Prosecutor Min Junggi) in connection with the so-called 'Butler Gate' case. Since then, there have been no special signals from the Financial Services Commission.

According to the industry, since the chairman position became a full-time role in 2010, the only case where a private-sector candidate was elected was Kim Deoksu, the 11th chairman (former CEO of KB Kookmin Card). During Kim's tenure, the association was reportedly thoroughly ignored by the Financial Services Commission, and it was so difficult to even schedule minor meetings that the association's business momentum was significantly weakened. For this reason, it is an open secret in the industry that a strong leader skilled in communication with government authorities is desired. This is also why there is ongoing criticism that the shadow of government control still hangs over the Credit Finance Association chairman election.

A representative from a card company’s external cooperation team said, “Unlike the savings bank sector, where the influence of around 60 regional member companies is significant, the credit finance sector does not have many holding company affiliates that control the 'swing votes,' even including the eight dedicated card companies. Therefore, even with two months left before the chairman’s term expires, there is still considered to be time. For the 14th election, there are opinions that, since the fate of the Financial Services Commission’s government reorganization is at stake, there may not be any unofficial signals from the Financial Services Commission, unlike the Savings Bank Association chairman election. However, this is a minority view.” He added, “Rather, there is a stronger demand than ever for a chairman with the authority to properly convey the industry’s opinions to the authorities on issues such as stablecoins.”

There is also a strong opinion that, regardless of background, the next chairman must have expertise in stablecoins. On July 30, the association held its first Stablecoin Task Force (TF) meeting with executives from the eight dedicated card companies (Shinhan, Samsung, KB Kookmin, Hana, Hyundai, Lotte, Woori, BC) to discuss survival strategies for the industry following the introduction of the Digital Asset Basic Act in the political sphere.

A card company official said, “The fate of the industry depends on how we respond to the stablecoin boom, and this is a far more serious issue than the reduction in preferential commission rates and profitability decline due to the recalculation of eligible costs. There is a growing call that, regardless of background, the 14th chairman must be someone with a deep understanding of stablecoins.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.