Strong Performance in Emerging Markets such as Myanmar and the Philippines

Despite Weak Domestic Consumption, Beverage and Liquor Segments Decline Together

Lotte Chilsung Beverage managed to perform well in its second-quarter results, buoyed by growth in its overseas segment despite sluggish domestic consumption and cost burdens.

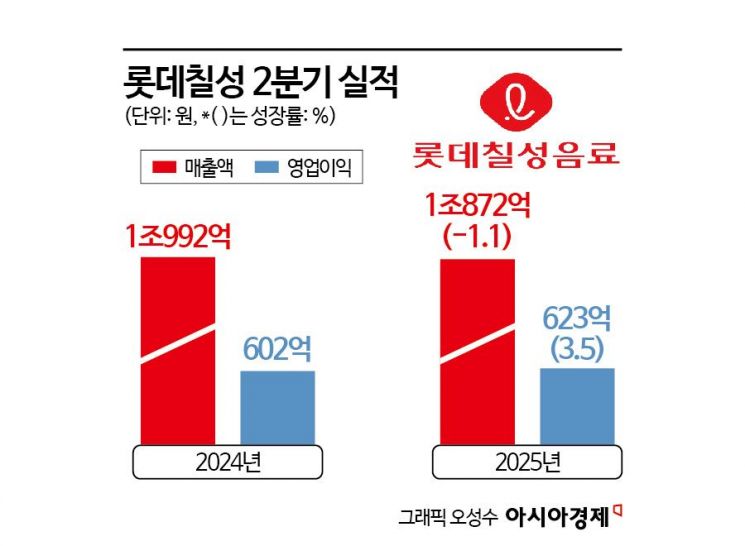

On August 4, Lotte Chilsung announced that its consolidated sales for the second quarter of this year reached 1.0873 trillion won, with operating profit at 62.4 billion won. While sales declined by 1.1% compared to the same period last year, operating profit increased by 3.5%. Net profit for the period surged by 31% to 27.7 billion won. On a cumulative basis for the first half, sales were 2.1979 trillion won and operating profit was 103.7 billion won, representing decreases of 1.9% and 9.9%, respectively.

Strong Growth in Myanmar and the Philippines... Global Segment Supports Performance

The overseas segment recorded second-quarter sales of 443.4 billion won, a 15.2% increase year-on-year, offsetting weak domestic results. Operating profit rose by 70% to 35.8 billion won.

The Myanmar subsidiary resolved import clearance issues, resulting in a 67% surge in sales to 34.4 billion won and a 137.6% increase in operating profit to 14.8 billion won. The Philippine subsidiary (PCPPI) saw sales rise by 6.1% to 303.4 billion won and operating profit grow by 32.6% to 8.8 billion won. The Pakistan subsidiary also achieved sales growth of 8.7% and operating profit growth of 9.1%, driven by strong performance of key brands such as 'Pepsi', 'Sting', and 'Mountain Dew'. The company plans to further strengthen its response to emerging markets in the second half of the year by expanding bottler business regions and production facilities.

Beverage and Liquor Segments Contract... Strengthening Zero and Health-Oriented Strategies

The beverage segment posted sales of 491.9 billion won, down 8.5% year-on-year, and operating profit fell by 33.2% to 23.7 billion won. Various factors, including high exchange rates, rising raw material costs, unfavorable weather, and weakened consumer sentiment, led to contraction across major categories such as carbonated drinks, coffee, juice, and bottled water. However, energy drinks performed relatively well, with sales up 4.8% year-on-year thanks to increased sales of 'Hot Six Zero' launched in 2023 and 'Hot Six The Pro' released in the first quarter of this year. Exports also grew by 6.7%, led by brands such as 'Milkis' and 'Let's Be'.

Lotte Chilsung is accelerating product portfolio diversification by expanding its range of products aligned with health and zero-sugar trends, including 'Pepsi Zero Sugar Mojito Flavor', 'Chilsung Cider Zero Orange', and the 'Oatmond Protein' series.

The liquor segment saw sales fall by 6.5% to 189.1 billion won amid overall stagnation in the domestic market, with operating profit declining by 8.2% to 2.9 billion won. Although the company strengthened its lineup with renewals of 'Chum-Churum' and 'Yeoul', as well as the non-alcoholic 'Kloud Non-Alcoholic', it was difficult to offset the drop in consumption. However, exports performed well, rising by 5.9% in the US and European markets, particularly for products such as 'Soonhari'. In the second half, the company aims to secure growth momentum for the future by refining its portfolio through selective product focus.

For its second-half management strategy, Lotte Chilsung has outlined plans to improve fixed cost efficiency, advance its go-to-market (GTM) strategy, and strengthen its product portfolio centered on high value-added product groups (Value TF). In addition, the company will pursue mid- to long-term investments to optimize the structure of its overseas subsidiaries through the 'Phoenix Project' and to achieve a 30% shareholder return rate on a consolidated basis.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.