Exchange Rate Surges Above 1,400 Won for First Time in Two and a Half Months

Daily Fluctuation Reaches 22.9 Won on August 1

Tariff Effects, Dollar Movements, and Economic Recovery

Key Factors Shaping Future Exchange Rate Trends

On the first trading day of August, the won-dollar exchange rate surged above 1,400 won for the first time in two and a half months based on the weekly closing price, but then dropped back to the 1,380 range during overnight trading, showing a roller-coaster pattern. The daily fluctuation of the won-dollar exchange rate reached 23 won. Experts remain divided on the direction of the exchange rate for the second half of the year. There are projections that the results of successive U.S. tariff negotiations and their impact on various countries, the movement of the global dollar, and the extent of economic recovery due to increased domestic fiscal spending will be key factors influencing the future direction of the exchange rate.

According to the Economic Statistics System (ECOS) of the Bank of Korea on August 4, the weekly closing price (as of 3:30 p.m.) of the won-dollar exchange rate on August 1 was 1,401.4 won, up 14.4 won from the previous trading day. This is the highest level in two and a half months since May 14, when it reached 1,420.20 won. The strong dollar was influenced by expectations that inflation concerns due to the U.S. tariff hike would lead to a continued freeze in policy rates for the time being. The selling trend by foreign investors in the domestic stock market, stemming from disappointment over the tax reform plan, also contributed to the sharp rise in the exchange rate. The dollar index, which measures the value of the dollar against the currencies of six major countries, had been weak but closed above the 100 mark last week. This is the first time since May 20 (100.005).

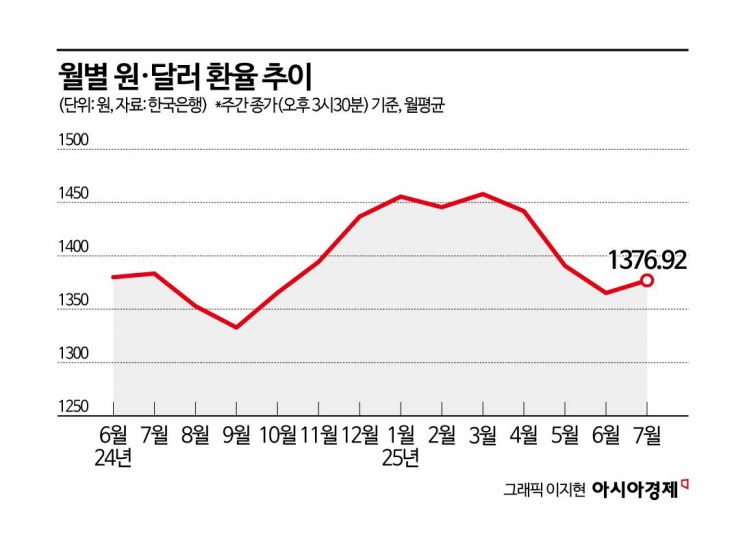

However, during overnight trading on the same day, the won-dollar exchange rate fell back to the 1,380 range due to the impact of a U.S. employment shock. According to the U.S. Department of Labor's employment report, nonfarm payrolls in July increased by 73,000 compared to the previous month. This is significantly below the 100,000 forecast by experts surveyed by Dow Jones. As a result, market expectations resurfaced that the U.S. Federal Reserve (Fed) could cut policy rates in September. The daily fluctuation of the won-dollar exchange rate on August 1 reached 22.9 won. The monthly average won-dollar exchange rate dropped for three consecutive months?from April (1,441.92 won) to May (1,390.7 won) and June (1,365.15 won)?but began to rise again in July, reaching 1,376.92 won.

On the 1st, an index was displayed on the status board of the Hana Bank dealing room in Jung-gu, Seoul.

On the 1st, an index was displayed on the status board of the Hana Bank dealing room in Jung-gu, Seoul.

Experts believe that, for the time being, the won-dollar exchange rate will move within a box range around the high 1,300-won level as the actual impact of successive tariff negotiations on each country is assessed. Lee Jinkyung, a researcher at Shinhan Investment Corp., said, "Ahead of the mutual tariff implementation scheduled for August 7, this period will be used to gauge related effects. The Trump administration in the U.S. has lowered mutual tariff rates for major countries such as Japan, the European Union (EU), and Korea, while imposing high mutual tariff rates on emerging Asian countries to block indirect export routes. The supply shock from the tariffs will act as a downward factor for the dollar through price channels, making it relatively unfavorable for the U.S." According to projections, although foreign investors' net buying in the domestic stock market may slow due to the results of trade negotiations?acting as an upward factor for the won-dollar exchange rate?this effect is expected to be offset by continued expectations for economic stimulus measures such as the 2026 budget plan.

Forecasts for the year-end exchange rate level remain divided. Those expecting a further decline are pinning their hopes on economic recovery driven by expanded fiscal spending and increased inflow of foreign investment funds due to global liquidity expansion. Oh Jaeyoung, a researcher at KB Securities, said, "The Korean economy appears to be turning around from the bottom starting in the second quarter. If the upward trend in the domestic stock market continues, the inflow of funds into Korea will likely push the won-dollar exchange rate down further to the low-to-mid 1,300-won range." The average won-dollar exchange rate for the second half is expected to be around 1,360 won.

On the other hand, there are views that, despite the inflow of foreign funds into the domestic stock market, the increase in onshore dollar demand will heighten upward pressure on the exchange rate. Successive announcements of U.S. investment by major countries are also expected to accelerate capital inflows into the U.S., contributing to a medium- to long-term strengthening of the dollar. Min Kyungwon, an economist at Woori Bank, said, "I expect the year-end won-dollar exchange rate to be around 1,400 won." He added, "Thanks to the recovery in demand for Korean won risk assets, the financial market's dollar balance has recorded a surplus for three consecutive months. However, with the resumption of U.S. stock investments by residents in July, the dollar balance surplus is likely to converge toward equilibrium in the future. Despite achieving a trade surplus for five consecutive months, the absence of follow-up selling by exporters, as well as increased corporate dollar demand for overseas investments by pension funds and for current transactions, will also act as upward pressure on the exchange rate."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.