[Real Estate AtoZ]

Seoul Apartment Price Growth Slows for 5 Consecutive Weeks

Impact of "6.27 Household Debt Management Plan" Continues

Major Areas Including Three Gangnam Districts See Reduced Increases

Overall Metropolitan Area Growth Rate Declines

Regional Downtrend Persists, but Rate of Decline Narrows

The upward trend in Seoul apartment sale prices has slowed for five consecutive weeks. The "6·27 Household Debt Management Plan," which includes measures such as capping mortgage loans at 600 million won, appears to be continuously impacting the market.

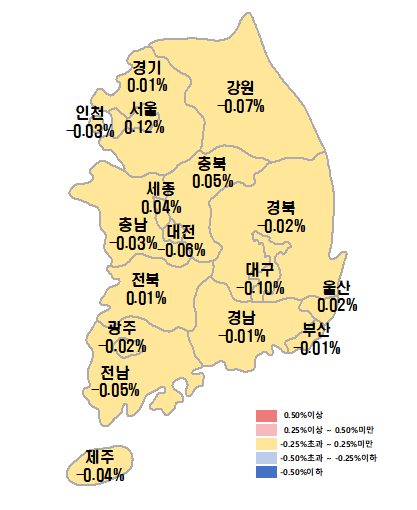

According to the "Weekly Apartment Price Trends for the Fourth Week of July (as of the 28th)" released by the Korea Real Estate Board on July 31, Seoul apartment sale prices rose by 0.12%, a decrease of 0.04 percentage points from the previous week's 0.16%. As a result, the pace of increase in Seoul apartment prices has continued to slow for five consecutive weeks since the announcement of the 6·27 measures.

The Korea Real Estate Board analyzed, "While there have been localized increases in transactions, particularly in complexes with reconstruction issues, the overall demand has contracted due to continued wait-and-see sentiment among market participants, leading to a reduced rate of increase across Seoul."

By region, the rate of increase slowed in Seocho-gu (from 0.28% to 0.21%) and Gangnam-gu (from 0.14% to 0.11%), both part of the three major Gangnam districts. Songpa-gu, which had seen a larger increase the previous week, also saw its growth rate decrease (from 0.43% to 0.41%). Other key areas such as Gangdong-gu (from 0.11% to 0.07%) and Yangcheon-gu (from 0.27% to 0.17%) also experienced a reduction in the rate of increase.

In contrast, Dobong-gu was the only district in Seoul where the rate of increase expanded (from 0.02% to 0.04%), and Gangbuk-gu maintained the same rate as the previous week (0.03%). Although it remains to be seen, some analysts suggest that a "balloon effect" may be occurring, with demand shifting to the outer areas of Seoul where lending regulations have less impact.

The overall rate of increase for the greater Seoul metropolitan area was 0.04%, down from 0.06% the previous week. Gyeonggi Province saw a 0.01% increase, while Incheon recorded a 0.03% decrease. Non-metropolitan areas continued a downward trend for the 61st consecutive week at -0.02%, though the rate of decline narrowed compared to the previous week's -0.03%. Daegu declined for the 88th consecutive week at -0.10%.

Meanwhile, nationwide apartment jeonse (long-term lease) prices rose by 0.01%, the same rate as the previous week. In Seoul, jeonse prices increased by 0.06%, maintaining the same rate as last week, as shortages of available listings persisted in complexes with good residential conditions, such as those near subway stations and large-scale developments.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)