Acquiring Plunging Assets via Public and Court Auctions Through a Personal Corporation

Aggressive Moves Extend to M&As

Pursuing Acquisition of Former KOSDAQ-Listed CNH

Restructuring for Governance? Seen as Solidifying Successor Status

Woo Giwon, the second-generation owner of SM Group and CEO of SM Hi-Plus, has been acquiring real estate across the country through his personal corporation, Najin. Using funds borrowed from SM Group affiliates, he has been actively purchasing assets with sharply reduced prices at court auctions and public institution sales. This approach is seen as following the management style of SM Group founder Woo Ohyun. In addition to real estate, CEO Woo has also been actively pursuing mergers and acquisitions (M&A), leading to analysis that these moves are a preemptive strategy for succession.

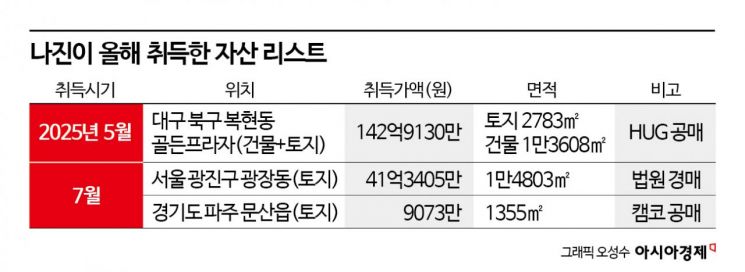

According to the Financial Supervisory Service's electronic disclosure system on July 30, Najin announced on July 27 that it had won a bid for 1,355 square meters of land in Munsan-eup, Paju, Gyeonggi Province, for 90.73 million won through a public auction by Korea Asset Management Corporation (KAMCO). After 25 failed auctions, Najin acquired the property at about 5% of its appraised value of 1.7886 billion won. The land, classified as miscellaneous land, was a seized asset held by KAMCO near Munsan Station.

This is Najin’s second real estate acquisition this month. On July 10, Najin disclosed that it had acquired 14,803 square meters of land in Gwangjang-dong, Gwangjin-gu, Seoul, for 4.13405 billion won through a court auction. This site was previously considered for the ‘Achasan Goguryeo History and Culture Center,’ but after the project was canceled, it failed to sell at multiple auctions and was eventually traded at about one-third of its appraised value.

Najin has been purchasing real estate with sharply reduced asset values regardless of whether it is in the metropolitan area or provincial regions. A representative example is the ‘Golden Plaza (Bokhyeon SKY)’ in Bokhyeon-dong, Buk-gu, Daegu, which Najin won at a HUG (Housing and Urban Guarantee Corporation) public auction in May for about 14.2 billion won, roughly half its appraised value. The site had been abandoned for over 20 years after construction was halted in 1999 and was known as an ‘urban eyesore.’

Najin has also been active in corporate acquisitions. Recently, Najin was designated as the preferred bidder for CNH, which is currently undergoing corporate rehabilitation (court receivership). CNH started as a specialized credit finance company and later expanded into hotels, imported car sales, and the restaurant business. After suffering losses following the COVID-19 pandemic, CNH recorded 3.8 billion won in sales and an operating loss of 110.1 billion won last year. It was also delisted from KOSDAQ. A representative from Samil PwC, the lead manager for the CNH sale, stated, “We are currently awaiting the stakeholders’ meeting, and if the creditors agree, the acquisition will be finalized.”

The ‘funds’ for these acquisitions have come from SM Group affiliates. Since the beginning of this year, Najin has borrowed hundreds of billions of won from major SM Group affiliates such as Kyungnam Corporation (3.164 billion won), SM Asset Development (31 billion won), and Samla Midas (689 million won). As a result, there is analysis that CEO Woo has effectively been chosen as the successor of SM Group, as he is expanding his personal company using SM Group funds.

CEO Woo is the only son of Chairman Woo Ohyun, following his eldest daughter Woo Yeona, CEO of Samra Farm; second daughter Woo Jiyeong, CEO of HN E&C; third daughter Woo Myeonga, CEO of Shinhwa D&D; and fourth daughter Woo Geonhee, CEO of Konis. CEO Woo holds 25.99% of Samla Midas and 3.24% of Samra, both of which are considered the group’s holding companies. After Chairman Woo Ohyun (who owns 74.01% of Samla Midas and 91.76% of Samra), CEO Woo holds the second-largest stake in the group’s holding affiliates. He also serves as CEO of SM Hi-Plus, one of the group’s core affiliates.

SM Group has a complex governance structure with circular shareholding and cross-affiliate ownership. In order to complete the succession process and push for group restructuring, it is essential to reorganize and exchange shares among affiliates. Accordingly, there is speculation that Najin, which is 100% owned by CEO Woo, could be used in restructuring the holding company’s governance structure. If Najin expands its scale through asset acquisitions and then proceeds to acquire or merge with major affiliates, it could become the key to the succession structure.

Meanwhile, an SM Group official commented, “CEO Woo’s asset acquisitions and succession process are being conducted separately, and nothing has been decided yet regarding the succession structure.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.