High Economic Impact of the "Livelihood Recovery Consumption Coupon" Policy

Concerns Remain Over Increased Tax Burden

While most of the Livelihood Recovery Consumption Coupons were used for food and beverages, members of Generation Z tended to spend them on self-improvement. The majority of the public evaluated the economic impact positively, whereas those in their 40s and 50s viewed the coupons as a way to reclaim the taxes they had paid.

Residents visiting the Siheung 1-dong Community Service Center in Geumcheon-gu, Seoul, on the 24th are applying for the livelihood recovery consumption coupons. Photo by Kang Jinhyung

Residents visiting the Siheung 1-dong Community Service Center in Geumcheon-gu, Seoul, on the 24th are applying for the livelihood recovery consumption coupons. Photo by Kang Jinhyung

On July 29, market research firm Embrain Trend Monitor released the results of a survey on perceptions of the Livelihood Recovery Consumption Coupon policy, conducted among 1,000 adults aged 19 to 69 nationwide. The survey found high levels of awareness and intention to participate in the policy.

According to the survey, 78.0% of all respondents said they were aware of the Livelihood Recovery Consumption Coupon policy. Awareness was high regardless of gender (male 79.2%, female 76.8%) and age group (over 70% in all age groups from 20s to 60s). During the actual survey period from July 21 to 24, 34.5% of respondents had already applied for the coupon, and if those planning to apply in the future (62.2%) are included, it is expected that the vast majority of the public will apply for the subsidy.

Embrain Trend Monitor conducted a survey on public perception regarding the "Livelihood Recovery Consumption Coupon." Embrain Trend Monitor

Embrain Trend Monitor conducted a survey on public perception regarding the "Livelihood Recovery Consumption Coupon." Embrain Trend Monitor

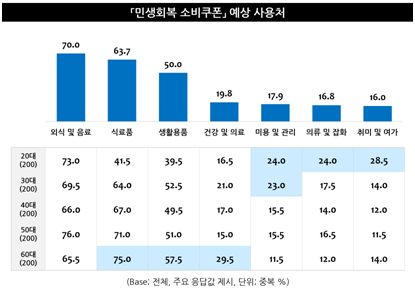

The main areas of coupon usage were ▲dining out and beverages (70.0%), ▲groceries (63.7%), and ▲household goods (50.0%), indicating a focus on items closely related to daily life. Respondents who rated their own socioeconomic status as lower showed a stronger intention to spend on living expenses. However, those in their 20s showed higher response rates for experience-based consumption such as beauty, clothing, and hobbies, reflecting generational differences in consumption patterns.

Expectations for Increased Sales for Small Businesses, But Ongoing Concerns About Tax Burden

The survey results also showed significant concerns about the future national fiscal burden. Embrain Trend Monitor

The survey results also showed significant concerns about the future national fiscal burden. Embrain Trend Monitor

The majority of respondents believed that the Livelihood Recovery Consumption Coupon would have a positive impact on supporting small businesses (81.1%), revitalizing the local economy (77.0%), and improving household finances (70.7%). Satisfaction with the policy was particularly high among middle-aged respondents in their 40s and 50s, who also strongly felt that they were reclaiming the taxes they had paid.

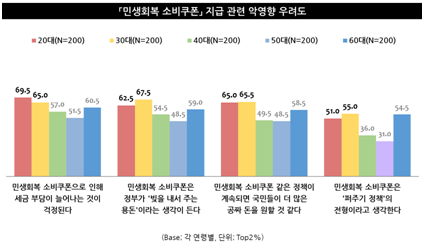

However, separate from expectations for economic effects, there were significant concerns about the future fiscal burden on the country. A total of 60.7% of respondents said they were worried about an increased tax burden due to the coupons, and 58.4% pointed out that it was "pocket money provided by the government through borrowing." Such negative perceptions were particularly pronounced among younger generations, which appears to reflect the generational awareness that they will bear a significant portion of future tax burdens.

There was also a clear generational gap in perceptions regarding the necessity of the policy. The proportion of respondents who said that such a consumption coupon policy would be necessary in the event of a future economic crisis was higher among those in their 50s (61.0%) and 40s (51.0%), while it was relatively lower among those in their 20s (38.5%) and 30s (34.5%). Among those in their 60s, 40.0% said it was necessary.

The Scope and Amount of Distribution Are Appropriate... But Should High-Income Earners Be Included?

On the other hand, the implementation method of the policy was generally evaluated positively. The "day-of-the-week distribution method based on the last digit of birth year" received a positive evaluation from 82.0% of respondents, and the majority also felt that the scope of distribution (67.3%) and the amount distributed (65.6%) were appropriate.

There was majority support (70.7%) for differentiated distribution according to income level, but opinions were divided on whether high-income earners should be included as recipients. Support for including high-income earners was 51.0%, while opposition was 41.9%. In particular, respondents who rated their own socioeconomic status as lower were more likely to oppose support for high-income earners. Among the upper-middle class and above, only 33.3% considered it inappropriate, but among the lower-middle class, 44.1% held a negative view, and among the lower class, 55.1% were opposed.

Opinions were also divided on restricting coupon use to traditional markets and small business-affiliated stores, but support (53.5%) was higher than opposition (40.9%). This suggests that there is a consensus on the policy's aims of revitalizing the local economy and supporting small businesses.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.