As the new government is demanding an expansion of shareholder returns as part of its stock market revitalization policy, domestic companies are actively working to enhance their corporate value.

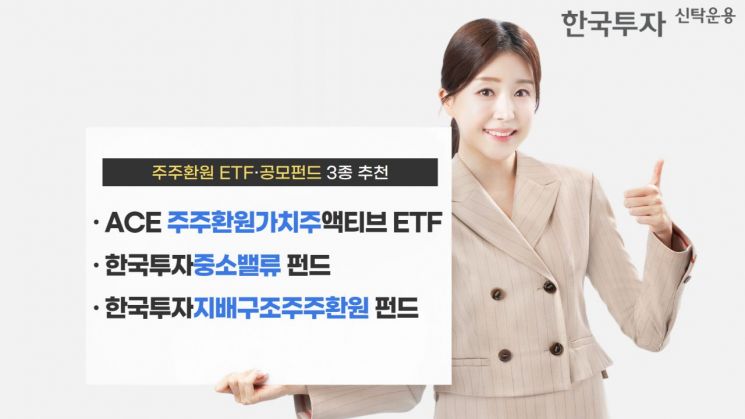

On July 29, Korea Investment Management recommended three funds expected to benefit from the trend of strengthening shareholder returns.

The products expected to benefit from shareholder return policies include: ▲ ACE Shareholder Return Value Active Exchange-Traded Fund (ETF), ▲ Korea Investment Small Value Fund, and ▲ Korea Investment Governance Shareholder Return Fund. The selection of included stocks is based on a comprehensive consideration of corporate intrinsic value, potential for governance improvement, and shareholder return indicators. Each product includes stocks exposed to shareholder return policies, such as small- and mid-cap value stocks and governance improvement stocks.

The ACE Shareholder Return Value Active ETF is a thematic ETF focused on shareholder returns. It invests in undervalued value stocks. The fund is managed by Kim Kibaek, head of ESG Management at Korea Investment Management, who has visited more than 1,300 companies over the past ten years. Based on his extensive experience, Kim identifies lesser-known companies in the market and includes them in the ETF. Since its listing, this ETF has increased its distributions for three consecutive years.

According to ETF Check, the ACE Shareholder Return Value Active ETF attracted 48.5 billion won in inflows from the beginning of the year through July 28, recording the highest inflow among domestically listed "governance" related ETFs. As of the previous day's closing price, the ETF's net assets totaled approximately 73.4 billion won.

The Korea Investment Small Value Fund, launched in 2007, primarily invests in undervalued small- and mid-cap stocks with strong intrinsic value. The fund focuses on identifying undervalued companies through a comprehensive analysis of their financial soundness and price attractiveness. It also employs a buffer strategy against market volatility by including some large-cap stocks. According to FnGuide, as of the previous day, the fund’s one-year and three-year returns were 35.42% and 62.71%, respectively. Since inception, the return has been 106.51%.

The Korea Investment Governance Shareholder Return Fund, launched in June last year, selectively invests in stocks based on the potential for governance improvement, dividend increases, and share buybacks, focusing on the execution of shareholder return policies. As recent legal reforms, such as amendments to the Commercial Act, have come into effect and governance-related premiums are gaining attention in the market, this fund is suitable for investors seeking direct exposure to these keywords. The fund’s returns for the most recent six months and one year were 32.84% and 35.06%, respectively, with a year-to-date return of 39.27%.

Kim Sumin, head of ESG Management at Korea Investment Management, stated, "The new government is introducing policies for minority shareholders, such as separate taxation of dividend income and amendments to the Commercial Act, and is demanding shareholder returns from companies. Domestic companies are responding accordingly." He added, "It is important to use a sophisticated strategy to identify companies with genuine capacity for returns, rather than simply those with low price-to-book ratios (PBR)."

He continued, "If shareholder value increases, funds that include companies with improved governance and undervalued blue-chip stocks are expected to benefit in particular," and emphasized, "The three recommended products are designed to satisfy both value and shareholder returns from a long-term perspective."

As these are performance-dividend products, past performance does not guarantee future results. In addition, principal loss may occur depending on the management outcome.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.