President Lee: "Focus on Expanding Investment, Not Just Interest Play"

All Financial Industry Associations Convened for Closed-Door Meeting

The financial authorities are set to announce improvements to the Risk-Weighted Assets (RWA) system as early as the end of August. The risk weight for mortgage loans will be raised from the current level, while the risk weight for corporate loans will be lowered. Through this, the authorities aim to redirect financial supply from real estate to advanced industries. This measure comes in response to President Lee Jaemyung’s recent remark, “I hope you will pay attention not only to interest income but also to expanding investment.”

On the morning of July 28, the Financial Services Commission held a closed-door meeting on “expanding productive finance” with the heads of the Korea Federation of Banks, Korea Life Insurance Association, General Insurance Association of Korea, Credit Finance Association, and Korea Financial Investment Association, presided over by Vice Chairman Kwon Daeyoung, to discuss these matters.

Vice Chairman Kwon stated, “The government will comprehensively review and boldly revise laws, systems, regulations, accounting standards, and supervisory practices that hinder financial companies from actively engaging in productive investment,” and added, “We will swiftly improve overall industry-specific regulations, including prudential regulations such as risk weights that are not in line with current conditions.”

This meeting was not on the original schedule, but was urgently convened by the Financial Services Commission after President Lee referred to the record profits of banks as “interest play” during a senior aides’ meeting on July 24.

At this meeting, it is reported that banks and other financial institutions requested the Financial Services Commission to revise regulations that force them to focus on interest income, such as the high RWA for corporate loans. RWA is a prudential regulation that requires banks to hold additional capital according to the risk level of their loans. The higher the risk, the more capital banks must hold, which becomes a burden for them.

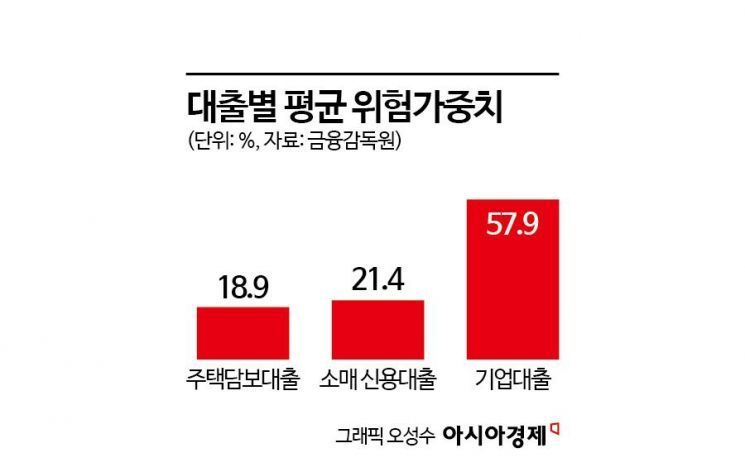

Earlier this year, the Financial Services Commission began discussing improvements to the RWA system to shift banks’ business structure, which is currently focused on mortgage loans (real estate), toward growth industries. The current regulations are more favorable to mortgage loans than to corporate loans. The average risk weight for mortgage loans is 18.9%, but the average risk weight for corporate loans reaches 57.9%.

The slow pace of system improvement is due to Korea’s adherence to the Basel III regulations, which also assign higher risk weights to corporate loans with low credit ratings or insufficient collateral. As the Lee Jaemyung administration is strongly committed to improving the RWA system, the pace of reform is expected to accelerate.

Furthermore, there are reports that structural measures to reduce mortgage loans will also be discussed. The National Planning Committee previously released a report proposing to raise the minimum risk weight for mortgage loans to 25%, similar to Hong Kong and Sweden.

The financial sector has decided to actively cooperate in forming a public-private fund worth 100 trillion won for investment in advanced, venture, and innovative companies, taking this system improvement as an opportunity. Through this, the government aims to shift the direction of financial supply so that the Korean economy can escape structural low growth and discover new growth engines.

An official from the Financial Services Commission said, “We plan to announce system improvements within one or two months that will reduce the risk weight benefits for mortgage loans and ease the penalties for corporate loans in line with the Bank for International Settlements (BIS) principles,” and added, “As Korea has been excessively strict in RWA regulations, we will also improve supervisory practices.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.