Uncertainty Rises for Auto Stocks as Korea-US Talks Are Delayed

Tariff Impact Clearly Reflected in Second-Quarter Earnings

"Stock Prices Expected to Normalize if Tariff Rates Are Lowered"

The recent rebound in automobile stocks has come to a halt as tariff-related uncertainties have resurfaced. This is due to the recent postponement of Korea-US negotiations and the fact that the impact of tariffs is now being clearly reflected in second-quarter earnings. According to securities analysts, stock prices are expected to rebound only after tariff uncertainties are resolved.

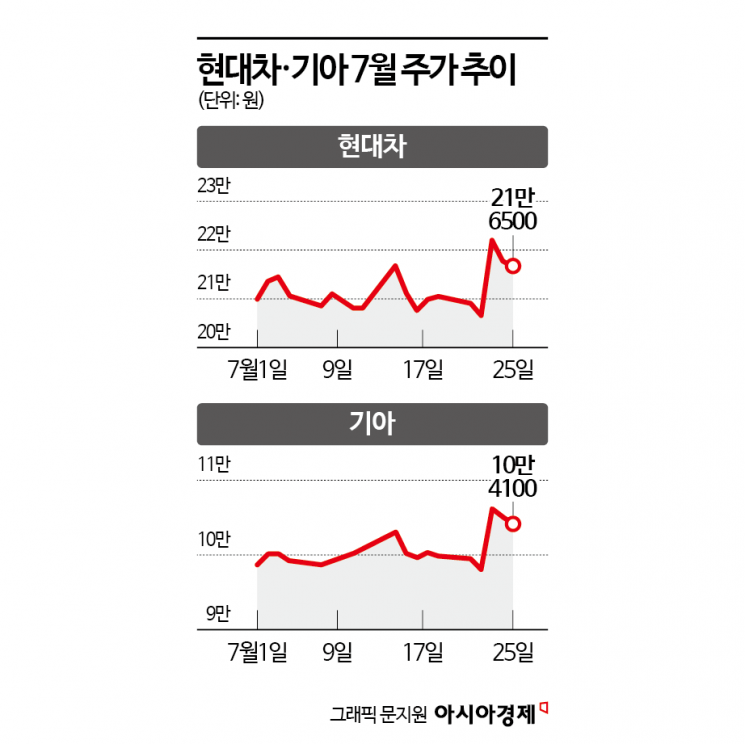

According to the Korea Exchange on July 28, Hyundai Motor's share price dropped from 222,000 won on July 23 to 216,500 won on July 25. Kia also fell from 106,100 won to 104,100 won. Both Hyundai Motor and Kia have declined for two consecutive days. Since hitting their yearly lows of 177,500 won and 82,000 won in April this year, Hyundai Motor and Kia had been on a continuous rebound.

The recent decline in stock prices is attributed to the renewed spread of tariff uncertainties. Previously, automobile stocks had surged following the conclusion of the US-Japan tariff negotiations. Japan, through a trade agreement with the United States, reduced both mutual tariff rates and automobile tariffs to 15%. This led to expectations that Korea would also see tariffs applied at similar levels, resulting in Hyundai Motor rising by 7.51% and Kia by 8.49% on July 23 compared to the previous trading day. However, the sudden cancellation of the '2+2 negotiations' between Korea and the US due to US Treasury Secretary Scott Besant's schedule had a negative impact on stock prices. On July 24, the day after the sharp rise, Hyundai Motor and Kia dropped by 2.03% and 1.04%, respectively.

In particular, the impact of tariffs is now being clearly reflected in second-quarter earnings, adding to the burden. On a consolidated basis, Hyundai Motor and Kia posted operating profits of 3.6016 trillion won and 2.7648 trillion won, respectively, in the second quarter. This represents declines of 15.8% and 24.1%, respectively, compared to the same period last year. Of the second-quarter operating profits, the reductions due to tariffs amounted to 828.2 billion won for Hyundai Motor and 786 billion won for Kia. Lee Sanghyun, a researcher at BNK Investment & Securities, said, "The impact of tariffs is becoming more pronounced," and added, "Since the second quarter did not reflect a full quarter's effect, we expect the impact to be even greater in the second half of the year."

Securities analysts predict that the impact on automakers' earnings will vary depending on the tariff rate. Kim Seongrae, a researcher at Hanwha Securities, said, "If the existing 25% tariff rate is applied, the impact on Hyundai Motor and Kia's operating profits will be 4.9 trillion won in 2025 and 9.1 trillion won in 2026," and added, "If the rate is adjusted to 15%, the reduction will decrease to 1.65 trillion won this year and 3.5 trillion won next year."

However, if the tariff rate is set at the same 15% as Japan, both earnings and stock prices are expected to rebound. Kim emphasized, "Even with a 15% tariff rate, a decline in earnings is inevitable through 2026," but added, "Since the level of decline will be eased compared to 25%, stock prices are expected to normalize."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.