Innovative Growth Industry Loan Target Set at 20 Trillion Won

16.6 Trillion Won Executed by June

"Annual Loan Targets Continue to Grow and Are Surpassed"

Support for Advanced Industry Companies Including Semiconductors

Strengthening Export Competitiveness Through U.S. Transaction Support

Amid expectations that the external export environment will remain challenging due to U.S. tariff policies and other factors, the Export-Import Bank of Korea (Korea Eximbank) is increasing its support for Korean companies, with a particular focus on innovative growth industries. In addition to loan offerings, Korea Eximbank plans to introduce various measures to strengthen the export competitiveness of Korean businesses.

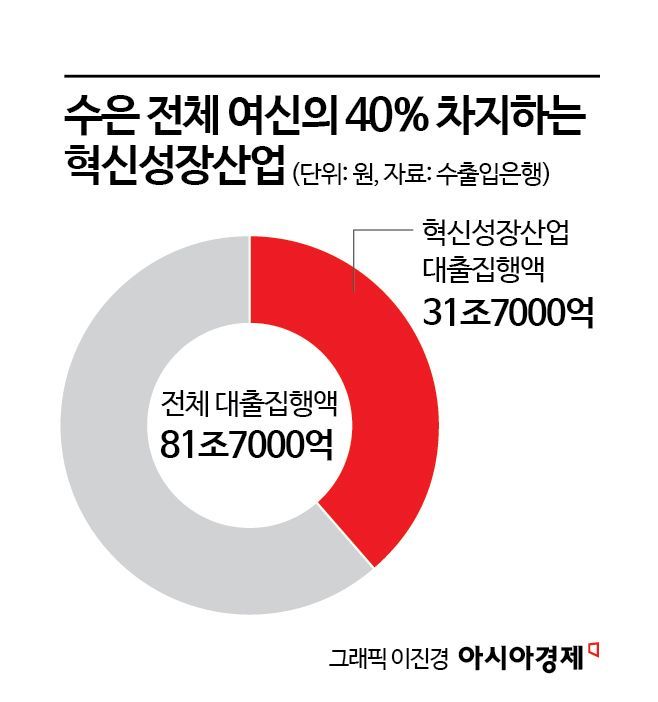

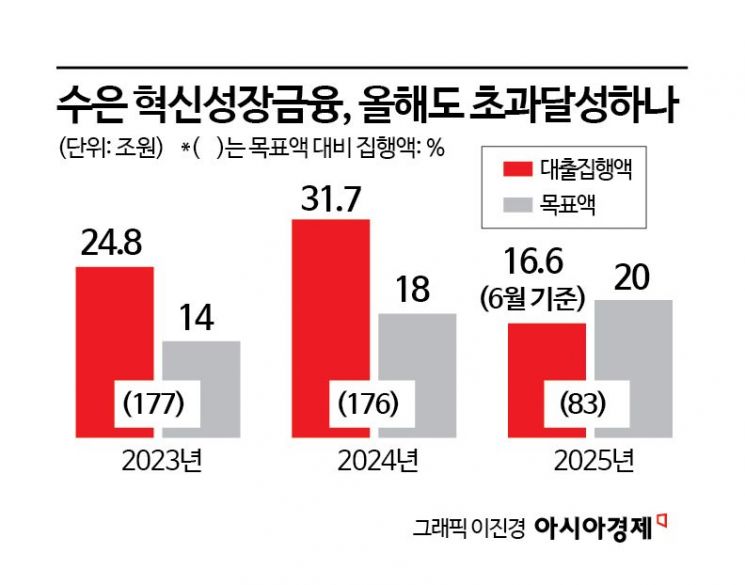

According to the financial sector on July 25, Korea Eximbank has set its innovative growth industry loan target for this year at 20 trillion won. As of the end of last month, the bank had executed 16.6 trillion won, which is 83% of its annual target. Korea Eximbank has steadily increased its annual target, from 14 trillion won in 2023 to 18 trillion won last year. Each year, the bank has exceeded its loan execution targets, with 24.8 trillion won executed in 2023 and 31.7 trillion won last year, representing 177% and 176% of the respective targets. Loans to innovative growth industries now account for approximately 40% of the bank’s total loan execution, which stood at 81.7 trillion won.

Innovative growth finance, which includes loans related to innovative growth industries, began in earnest after the establishment of the Innovative Growth Policy Finance Council in March 2019. At that time, the government created a council comprising major ministries and 11 policy finance institutions to ensure systematic policy finance support. The innovative growth industries are designated by the council based on analysis of domestic and global trends and in accordance with policies to foster advanced and promising industries. At the beginning of this year, the names of nine industry sectors were changed (for example, Advanced Manufacturing·Automation was changed to Manufacturing·Mobility), or replaced with new sectors (for example, Sensor·Measurement was replaced by Artificial Intelligence). Specifically, the structure was revised from nine sectors (themes), 46 fields, and 284 items to nine sectors, 31 fields, and 240 items. Innovative growth finance not only provides loans to companies in these sectors but also offers preferential support in areas such as interest rates, guarantee fees, and loan limits. For Korea Eximbank, preferential interest rates of up to 1 percentage point are offered to small and medium-sized enterprises (SMEs), while mid-sized companies receive up to 0.7 percentage points and large companies up to 0.4 percentage points.

Looking at last year’s sector-specific innovative growth finance support by Korea Eximbank, the Manufacturing·Automation sector accounted for the largest share, with 17.4 trillion won executed. This sector includes new manufacturing processes, robotics, aerospace and defense industries, and next-generation power systems. The Energy sector, which includes renewable energy companies, followed with 6.6 trillion won, and the Electrical·Electronics sector, which covers next-generation semiconductors, accounted for 3.1 trillion won.

Among these, support for the battery, semiconductor, mobility, and bio sectors is also increasing. Through its Advanced Strategic Industry Preferential Support Program, Korea Eximbank provided 8.2 trillion won in 2023 and 9.2 trillion won last year to companies in these sectors. The preferential benefits under this program are greater than those for general innovative growth industries. While the maximum preferential interest rate for SMEs remains at 1 percentage point, mid-sized companies can receive up to 0.9 percentage points and large companies up to 0.7 percentage points under this program. By sector, 2.9 trillion won was provided for batteries, 2 trillion won for semiconductors, 1.4 trillion won for mobility, 1.3 trillion won for advanced electronics, and 1.2 trillion won for bio.

Korea Eximbank stated that, with the overall export environment expected to change due to U.S. tariff policies and other factors, it plans to prepare various measures to support Korean export companies in addition to loan offerings. The bank explained, "U.S. tariff policies will have different effects by industry, and will impact not only Korea but also competitors, as well as our companies' production bases in Southeast Asia and Mexico, thereby affecting the overall export environment." However, it added, "We also expect opportunities, such as securing industry leadership through preemptive entry into the global market via expanded investment in the U.S., boosting exports of intermediate goods and equipment and construction orders through the establishment of a Korea-U.S. supply chain." The bank further stated, "We plan to strengthen the export competitiveness of Korean companies by expanding support for strategic U.S. transactions, such as establishing local production systems (including joint entry with partner companies) and local mergers and acquisitions (M&A), as well as by enhancing support for research and development (R&D) and actively supporting new business initiatives."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.