Concerns Over Reverse Discrimination if REITs Are Excluded

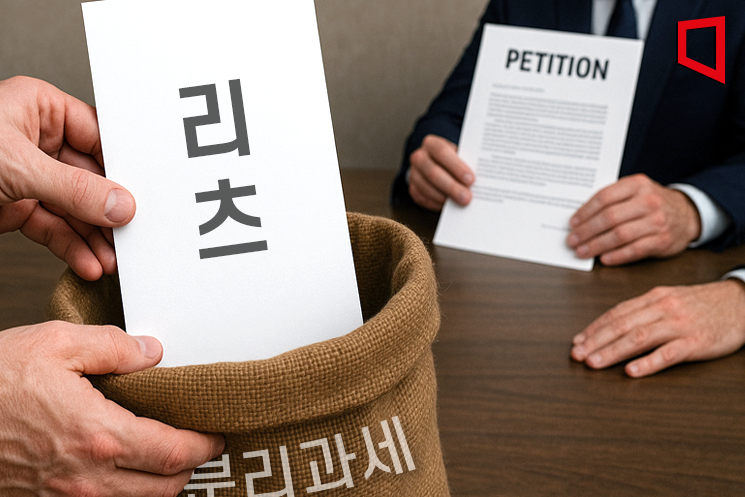

Petition Submitted to Ministry of Economy and Finance and National Assembly Amid Separate Taxation Debate on High-Dividend Stocks

As discussions continue in the National Assembly and the government regarding the separate taxation of dividend income from high-dividend stocks, the Korea REITs Association has raised concerns about fairness as real estate investment trusts (REITs) are increasingly likely to be excluded from the proposed policy.

On July 23, the Association announced that it had submitted a petition to the Ministry of Economy and Finance and the National Assembly's Strategy and Finance Committee, requesting that REITs be included as subjects of separate taxation.

The government is currently reviewing a plan to allow separate taxation, rather than comprehensive taxation, for high-dividend stocks as part of this year's tax law revisions. In April, Lee Soyoung, a member of the Democratic Party, proposed an amendment to the Income Tax Act that would apply separate taxation, instead of comprehensive taxation, to shareholders of listed companies with a dividend payout ratio exceeding 35%, and would lower the maximum tax rate for this separate taxation to 27.5%.

Currently, if the combined annual dividend and interest income exceeds 20 million won, it is subject to comprehensive income taxation, with tax rates reaching up to 49.5%. However, REITs are not included in the proposed bill. As a result, the REITs industry is protesting, stating, "It is difficult to accept that REITs are excluded while benefits are being distributed based on dividend payout ratios."

The Association argued, "REITs are structured to pay out at least 90% of their profits as dividends under the Real Estate Investment Company Act, making them inherently high-dividend vehicles. Since the vast majority of generated profits are returned to investors, REITs should be included in the scope of separate taxation, regardless of whether the standard is dividend payout ratio or dividend growth rate."

The Association further stated, "If taxation standards differ based on investment targets, it creates imbalances among investors. Tax disadvantages could lead to a decrease in new investments in REITs and accelerate the departure of existing investors."

The Association also emphasized, "REITs are a representative indirect real estate investment vehicle that allows stable asset formation without direct investment in physical real estate such as housing. They offer high accessibility to the general public through small-scale diversified investments and also serve a policy function by curbing speculative demand."

The Association concluded, "Given that the policy intent of separate taxation of dividend income is to support high-dividend products, it is inconsistent to exclude REITs, which are legally required to pay high dividends. For the sake of tax fairness among financial investment products and to ensure rational investment choices for the public, REITs must also be included as subjects of separate taxation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.