GM's Second-Quarter Net Profit Drops 30% Year-on-Year

Core Profit Down 1.5 Trillion Won Due to Tariffs

Stellantis Posts First-Half Net Loss of 3.7 Trillion Won

Companies with High Overseas Production Hit Hard by U.S. Tariffs

Hyundai and Kia Expected to See Second-Quarter Operating Profit Fall 17% Each

General Motors (GM) in the United States reported a significant drop of over 30% in its second-quarter net profit. Due to President Donald Trump's tariff measures on imported finished vehicles, the outlook for the second-quarter performance of global automakers such as Hyundai Motor and Kia has turned negative. In particular, there is analysis that these policies, which claim to protect domestic industries, are actually negatively impacting the profitability of American automakers, with expectations that the impact will be even greater in the second half of the year.

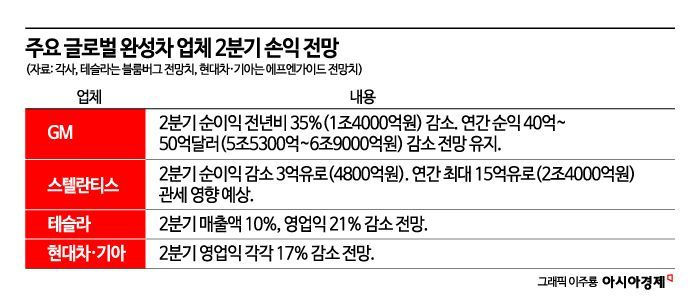

On July 22 (local time), GM announced that its net profit for the second quarter of this year was $1.895 billion (approximately 2.6 trillion won), down 35.4% compared to the same period last year. GM explained that its core profit decreased by about $1.1 billion (about 1.5 trillion won) due to the burden of tariffs on foreign automobiles and parts.

GM, which assembles finished vehicles and produces parts at overseas production bases in countries such as China, Mexico, and South Korea, is cited as a prime example of how U.S. tariff measures have ended up becoming a burden for domestic companies themselves.

Stellantis, which announced its second-quarter outlook the previous day, is facing a similar situation. Stellantis projected a net loss of 2.3 billion euros (3.7 trillion won) for the first half of this year. The company added that the impact of U.S. tariffs is expected to reduce net profit by 300 million euros (480 billion won) in the first half alone. On an annual basis, the impact of tariffs is expected to reach 1 billion to 1.5 billion euros (1.6 trillion to 2.4 trillion won). Since Stellantis has a high proportion of overseas factories in Europe and Mexico, tariffs have directly worsened its profitability.

Hyundai Motor and Kia, which are highly dependent on the U.S. market, are also facing warning signs. According to the securities industry, the consensus for second-quarter operating profit is 3.5331 trillion won for Hyundai and 3.0042 trillion won for Kia, each representing a 17% decrease. President Trump has imposed a 25% tariff on imported automobiles since April and a 25% tariff on imported auto parts since May.

Attention is also focused on Tesla's second-quarter results, which will be announced in the early morning of July 24, Korea time. Tesla previously reported that its global sales volume in the second quarter was 384,000 units, a 13% decrease compared to the previous year. According to the Bloomberg consensus, Tesla's second-quarter operating profit is expected to be $1.26 billion (1.7 trillion won), down 21% from the previous year.

Tesla is actively working to reduce its dependence on Chinese LFP (lithium iron phosphate) batteries by building a battery plant in the United States. The company is constructing an LFP battery plant in Nevada, aiming to begin operations this year. It is also signing long-term contracts for battery materials with companies in Australia and Africa to reduce its reliance on China for materials.

The impact of tariffs is expected to become even more pronounced in the second half of the year. GM expects its annual net profit to decrease by $4 billion to $5 billion (5.5 trillion to 6.8 trillion won) this year. In addition, global automakers are expected to further expand production in the United States. Hyundai Motor and Kia plan to gradually increase the production capacity and operation rate of Hyundai Motor Group Metaplant America (HMGMA) in Georgia in order to raise the proportion of vehicles produced in the U.S. GM has also announced plans to move production of the Chevrolet Blazer and Equinox, previously manufactured in Mexico, to its plants in Tennessee and Kansas.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.