Climate Solution Analysis: Stranded Asset Value Reaches 15 Trillion Won

Surge in Orders After Russia-Ukraine War

LNG Demand Declining as Renewable Energy Expands

There are now claims that the liquefied natural gas (LNG) carrier sector, which had experienced rapid growth, has entered a phase of structural decline due to oversupply. On July 23, Climate Solution, a think tank specializing in climate and energy, announced that, based on an analysis using the latest methodology reflecting the financial impact on the ship finance industry, the current stranded asset value of LNG carriers amounts to $10.8 billion (about 15 trillion won).

Due to large-scale orders placed in 2022 in anticipation of rising market prices, oversupply has intensified, resulting in approximately 60 LNG carriers worldwide currently lying idle and unable to operate. This represents about 10% of the total global LNG fleet. When calculated as stranded assets, this amounts to approximately $10.8 billion.

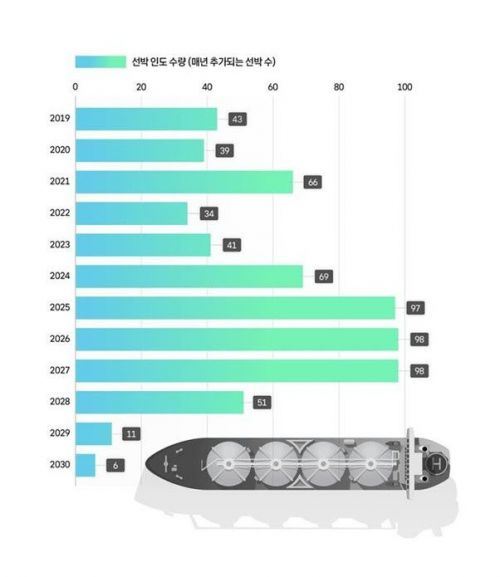

As of July 22, 2025, the number of LNG carriers newly entering the annual market based on LNG vessel order backlog. Data source: Clarksons. Climate Solution

As of July 22, 2025, the number of LNG carriers newly entering the annual market based on LNG vessel order backlog. Data source: Clarksons. Climate Solution

Given that the average price per vessel is $194.6 million (about 270.2 billion won), the total loss from 60 vessels reaches $11.676 billion (16.211 trillion won). After deducting the scrap value of the vessels, estimated at about $318 million (441.5 billion won), the realized stranded asset value of LNG carriers is estimated to be around $11.358 billion (15.7694 trillion won).

Climate Solution explained that these results are based on a methodology developed by the Kuhne Climate Center and the UCL Energy Institute in the UK, which analyzes the financial impact that the shipping industry and ship finance sector will face due to the energy transition.

Charter rates for LNG carriers have also fallen below break-even levels. The one-year time charter rate for the latest TFDE (tri-fuel diesel electric) vessels is around $20,000 per day, a drop of more than 60% year-on-year and the lowest level since 2019. Even the more fuel-efficient two-stroke engine vessels are only fetching around $30,000 per day.

The early scrapping of aging vessels is also accelerating. HMM recently scrapped four LNG carriers built in the early 2000s, selling each for about $19.2 million. On July 17, Hyundai LNG Shipping also scrapped the 'Hyundai Cosmopia', built in 2000, at a scrap price of $580 per ton. As of 2025, eight LNG carriers have already been dismantled, matching the total number scrapped in all of 2024 (eight vessels).

Climate Solution identified "structural imbalances?namely stagnant demand and a surge in supply" as the causes of the collapse in the LNG carrier charter market.

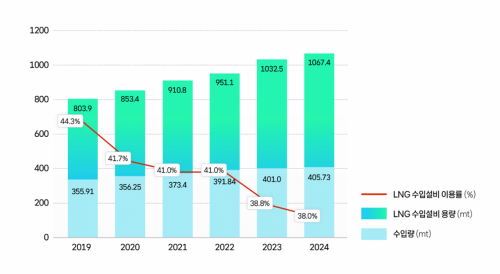

The growth rate of LNG trade volume was only 0.3% in 2024. This is a sharp slowdown compared to the previous period, when annual growth was consistently 6-8%. Trade volume refers to the actual amount of LNG transported, and a low figure means there is insufficient cargo for LNG carriers to transport.

Despite this, on the supply side, vessels continue to flood the market. Although the global transition to renewable energy is progressing rapidly, a large number of LNG carriers were ordered without long-term contracts during the energy crisis following the Russia-Ukraine war between 2019 and 2022. These vessels are being delivered in earnest from the second half of 2024, further exacerbating the oversupply.

According to Clarksons Research, the world’s largest shipping and shipbuilding research firm, there are currently 303 LNG carriers under construction worldwide. Of these, 98 are scheduled for delivery in 2026, and another 98 in 2027.

Meanwhile, concerns over declining LNG demand are growing. Climate Solution pointed out that "the global LNG import terminal utilization rate fell from 44% in 2019 to 38% in 2023."

Shin Eunbi, a researcher in charge of the energy supply chain at Climate Solution, said, "LNG is gradually losing ground in competition with renewable energy, and its lifespan as a fossil fuel carrier is coming to an end. Even if there is a short-term adjustment, the shipbuilding industry must avoid misjudging the market and causing oversupply of LNG carriers."

Oh Dongjae, head of public finance at Climate Solution, stated, "In new businesses such as offshore wind installation vessels, overseas companies have already entered the market and are competing for early dominance. Instead of waiting for financial support for economically uncertain projects such as Mozambique LNG carrier orders during a downturn, Korea should move quickly to secure the next opportunity in shipbuilding."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)