Large-Scale Orders for Hanmi Semiconductor TC Bonders

Aggressive Investment Threatens HBM Leadership

Micron's HBM Market Share Surges Rapidly

It has been revealed that Micron Technology in the United States is making large-scale purchases of TC bonders, which are key back-end process equipment for artificial intelligence (AI) semiconductors. Analysts say that Micron is leading a shift in the supply chain landscape through aggressive investment, taking advantage of the relatively stagnant pace of capacity expansion among Korean companies. Recently, Micron has emerged as a formidable competitor to Samsung Electronics and SK hynix, raising concerns that the dominance of Korean companies in high-bandwidth memory (HBM) could be shaken.

According to the semiconductor industry on July 23, Micron is said to have significantly increased its orders for TC bonder equipment from Hanmi Semiconductor this year. Some in the industry predict that the order volume could reach twice that of the previous year. An industry insider stated, "A look at Hanmi Semiconductor's second quarter results this year will make it even clearer that Micron's demand for equipment has entered a full-fledged expansion phase."

Hanmi Semiconductor, the global leader in the TC bonder market, reported that Micron's demand for equipment currently surpasses that of SK hynix. SK hynix had initially planned to further expand its HBM supply this year, but it is known to have partially adjusted its plans due to internal circumstances.

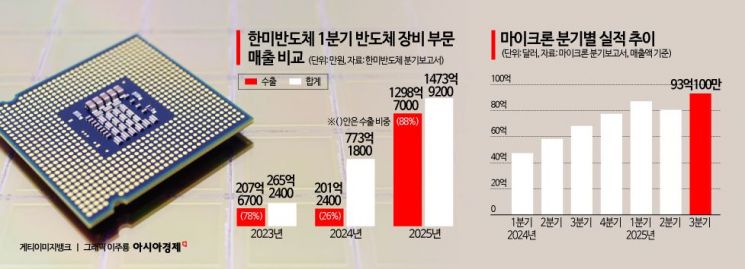

This trend is also evident in Hanmi Semiconductor's export performance. According to disclosures, overseas customers accounted for as much as 90% of Hanmi Semiconductor's sales in the first quarter of 2025. This is a significant increase from the annual export ratio of about 41% in 2024, and is interpreted as a result of a sharp rise in HBM-related orders from global customers, including North American memory companies. Among these, the expansion of Micron's orders is cited as one of the main factors.

The TC bonder is a core semiconductor packaging machine that precisely bonds chips to substrates. It is especially essential for producing high-performance memory such as HBM. HBM is a key component that determines the computational performance of AI semiconductors, and demand for it is rapidly increasing.

Earlier this year, Hanmi Semiconductor Chairman Kwak Dongshin and President Kim Minhyeon attended the groundbreaking ceremony for Micron's new HBM plant in Singapore. The industry views this as a signal of strengthened strategic cooperation with Micron and a shift in Hanmi Semiconductor's status within the global supply chain.

Micron is rapidly expanding its market share in the HBM sector. Earlier this year, it passed quality tests for NVIDIA's fifth-generation HBM3E 12-stack product and has also begun mass production of products to be installed in the AI accelerator "Blackwell Ultra (GB300)." In its fiscal third quarter earnings announcement, Micron reported that HBM sales grew by 50% compared to the previous quarter and set a goal to raise its market share to over 20% by the end of the year.

Micron is supplying HBM in large quantities to four major customers, including NVIDIA and AMD. According to market research firm TrendForce, current HBM supplier market shares are SK hynix at 46-49%, Samsung at 42-45%, and Micron at 4-6%. However, the market expects Micron's growth to accelerate rapidly. Bloomberg Intelligence predicts that Micron's HBM market share will reach 23% by 2033.

The Korean semiconductor industry is closely monitoring Micron's rapid growth. Under the leadership of CEO Sanjay Mehrotra, who combines technological prowess with strong business execution, Micron is expanding its strategic cooperation with NVIDIA. The company is also seen as responding flexibly to policy risks such as tariffs and export regulations, leveraging its close ties with the U.S. political establishment. Some point out that this could pose a burden for Korean companies.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.