Earnings Outlook: Operating Profit Down 3.7% Year-on-Year

Department Stores: Fashion Segment Performance Slows Due to Weather

Marts: E-Grocery Transfer Costs Lead to Increased Losses

Overseas Markets: Continued Growth in Vietnam and Beyond

Domestic Market: High Dependence, Challenge to Meet Customer Needs

Lotte Shopping is expected to post disappointing results in the second quarter of this year, unable to overcome the impact of the sluggish domestic market. Although the company is showing positive performance in overseas markets, particularly in Southeast Asia, it continues to struggle in the domestic market, which accounts for a significantly larger portion of its sales. Attention is focused on whether visible results will emerge, as Shin Dongbin, Chairman of Lotte Group, who returned as a registered director after five years and took the helm of management after 12 years, has called for business strategies that meet customer needs.

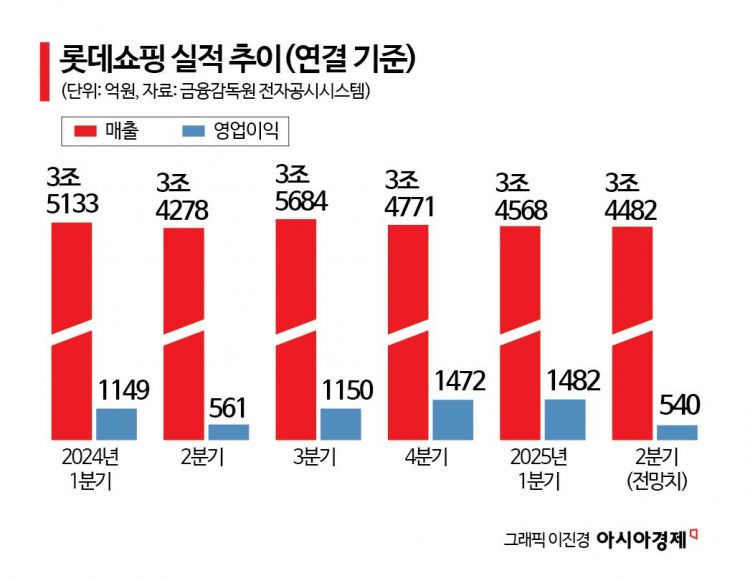

According to the retail and securities industries on July 24, the consensus (market average forecast) for Lotte Shopping's second-quarter results, scheduled to be announced on August 8, projects operating profit at 54 billion won, down 3.7% from the same period last year, and sales at 3.4482 trillion won, up 0.6%. Lotte Department Store increased sales mainly in luxury goods, food, and electronics, but failed to achieve expected results in the high-margin fashion sector due to weather conditions, resulting in a growth rate of less than 1% compared to the same period last year. Operating profit for the domestic department store segment is also expected to decrease by about 4% year-on-year, reaching 57.3 billion won.

Lotte Mart is expected to post sales of 964.1 billion won, down 0.3% year-on-year, and an operating loss of 28 billion won. This reflects 15 billion won in costs incurred when e-grocery was transferred from the e-commerce division to the domestic discount store segment in October last year. In addition, the e-commerce business is expected to post an operating loss of 7 billion won, narrowing the deficit compared to 20 billion won in the same period last year.

The department store and mart segments are partially offsetting weak domestic performance through overseas business. For example, overseas department stores operated in Vietnam, including Lotte Mall West Lake Hanoi, saw first-quarter sales increase by 33.9% year-on-year, and double-digit growth is expected to continue in the second quarter. Lotte Mart, which currently operates 15 stores in Vietnam, recorded sales of 396.5 billion won and operating profit of 32.6 billion won last year, up 9.3% and 28.9%, respectively, compared to the previous year. This upward trend is expected to continue this year, driven by popular products such as K-food and beauty items.

Customers are waiting for the store to open at the entrance of Lotte Mart Zetaflex Seoul Station branch. Photo by Lotte Mart

Customers are waiting for the store to open at the entrance of Lotte Mart Zetaflex Seoul Station branch. Photo by Lotte Mart

However, the share of overseas business in Lotte Shopping's overall performance remains small. As of the first quarter of this year, overseas business accounted for about 500 billion won in sales and 23.5 billion won in operating profit, representing only 15-16% of the total. Lotte Shopping aims to expand overseas sales to 3 trillion won by 2030. At the regular shareholders' meeting in March, Kim Sanghyun, Vice Chairman and Head of Lotte's Distribution Group, stated, "To overcome the growth limitations and consumption slowdown in the domestic market, we plan to establish a local operating company in Singapore and actively foster our overseas business." He added, "We will consider development projects centered on overseas mixed-use complexes and shopping malls, and expand exports of PB (private brand) products to the United States, Singapore, and Southeast Asia."

Nevertheless, a breakthrough in the still highly dependent domestic market is needed. At the '2025 Second Half Lotte VCM (Value Creation Meeting, formerly the Presidents' Meeting)' held at Lotte Human Resources Development Center Osan Campus on July 16-17, Chairman Shin called on Lotte's distribution group to consider ways to meet the diverse needs of customers. This is interpreted as an order to proactively respond to rapidly changing online and offline consumption trends and to seek ways to attract customers.

Accordingly, major business divisions are working to strengthen competitiveness through offline store renovations and the opening of specialized stores. Lotte Department Store plans to remodel its Jamsil branch for the first time in 37 years, aiming to transform it into a department store with annual sales of 4 trillion won by 2027. The main branch will also be refurbished in stages, and the Incheon and Nowon branches will undergo renovations. In addition, after introducing 'Time Villas', a combination of department store and shopping mall, for the first time in Suwon last year, existing stores in Gunsan, Gwangju Suwan, Gimhae, and Dongbusan will be converted into Time Villas, and new Time Villas are planned for Daegu Suseong, Incheon Songdo, Seoul Sangam, and Jeonju.

Lotte Mart is focusing on grocery specialty stores, which are in high demand among offline consumers. Cheonho branch, which opened in Gangdong-gu, Seoul in January as the first new store in six years, allocated 80% of its space to groceries, while the Guri branch, which opened on June 26, devoted about 90% of its space to food items.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.