Ice Cream Exports Hit Record High in First Half of the Year

K-Food Craze Drives Growth in Frozen Treat Exports

Binggrae and Lotte Wellfood Accelerate Push into Overseas Markets

In the first half of this year, Korea's ice cream exports reached an all-time high. Interest in Korea has now extended to K-ice cream, and with demand expected to further increase during the peak summer season, it appears likely that annual exports will exceed $100 million for the first time ever this year.

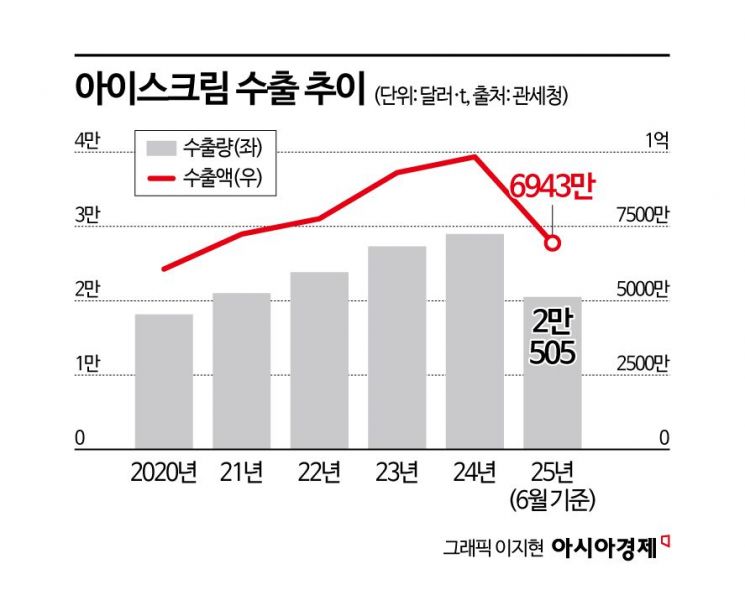

According to export and import trade statistics from the Korea Customs Service on July 22, ice cream exports in the first half of this year totaled $69.43 million (approximately 96.7 billion won), a 22.1% increase compared to the same period last year ($56.87 million).

Binggrae is conducting a 'Melona' promotion in New York, USA.

Binggrae is conducting a 'Melona' promotion in New York, USA.

Domestic ice cream companies have been rapidly increasing their export volumes in recent years. In 2020, annual exports stood at $60.67 million, similar to this year's first-half figure, but by last year, exports had surged to $98.41 million, marking a rise of over 60% in just four years. This year, exports are expected to surpass $100 million for the first time ever, setting a new record. Export volume also exceeded 20,000 tons in just six months, reaching 20,505 tons?a 21.2% increase compared to the same period last year (16,912 tons). This means the amount exported in half a year has already surpassed the total annual export volume from five years ago.

Growing demand for Korean food in overseas markets appears to be leading to increased ice cream exports by domestic companies. In particular, the expansion of Korean ice cream products into major retail chains in key export countries has played a significant role. The largest export market is the United States. In the first half of this year, exports to the US amounted to $25.41 million, accounting for 36.6% of the total. This was followed by the Philippines ($5.67 million), China ($5.51 million), Canada ($4.99 million), and Russia ($3.91 million).

However, both Lotte Wellfood and Binggrae, the two leading domestic ice cream companies, are unlikely to be celebrating just yet. Despite strong overseas business, weak domestic demand is expected to result in lackluster second-quarter earnings. The overall pace of demand recovery has been slow, and unseasonably cool weather in April and May this year compared to previous years has also affected ice cream sales. Lotte Wellfood's food business has struggled due to continued pressure from rising raw material costs, and ice cream sales are also estimated to have declined. Binggrae is expected to see only modest growth.

According to financial data provider FnGuide, Lotte Wellfood's second-quarter sales this year are projected to reach 1.082 trillion won, a 3.6% increase year-on-year, but operating profit is expected to fall 25.7% to 47.1 billion won. Binggrae's sales are also expected to rise 2.3% to 416.9 billion won, but operating profit is forecast to decrease 11.7% to 39.7 billion won.

However, with the onset of the peak season as the heat intensifies this month, the situation for ice cream companies is expected to improve thanks to expanding domestic and international demand. The fact that summer temperatures have been higher than average for several years is also a positive factor for the industry. In addition, the government's 'Livelihood Recovery Consumption Coupon' program is expected to help boost demand, especially at convenience stores, once subsidies are distributed.

Another positive development is the stabilization of cocoa prices, which had been one of the main cost pressures. Until now, ice cream companies have managed inventories by reducing production of chocolate products in order to avoid fully passing on higher cocoa prices to consumers. Kim Taehyun, a researcher at IBK Investment & Securities, said, "In the second quarter of this year, cocoa futures prices fell 18.5% compared to the same period last year. Although there may be some time lag before this is reflected in inventories, cost relief effects are expected to appear from the third quarter."

With clear limits to growth in the domestic market, ice cream companies are accelerating their overseas business efforts. Lotte Wellfood recently completed the merger of its Indian subsidiary, Lotte India, with local ice cream company Havmor. The company plans to maximize synergies between the two firms and grow Lotte India into a '1 trillion won annual sales' company by 2032. Lotte Wellfood is also making large-scale investments to expand production capacity and introduce new brands. The new ice cream factory in western Pune, built with an investment of 70 billion won, began full-scale operations in February. The 'Pig Bar' produced there surpassed 1 million units in cumulative sales within just three months of its launch, demonstrating its competitiveness in the local ice cream market.

Binggrae, which exports ice cream products to 30 countries, recently began exporting 'Melona' to Mexico and is introducing plant-based Melona in markets such as Europe and Australia, where dairy exports are difficult. Binggrae plans to continue expanding its product portfolio and pioneering new markets. To this end, the company is developing specialized products tailored to local consumer tastes and expanding halal certification for its major products.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.