Muted Reaction Despite Some 'Surprise Earnings' from Companies

"A Sign That Good News Is Already Priced In"

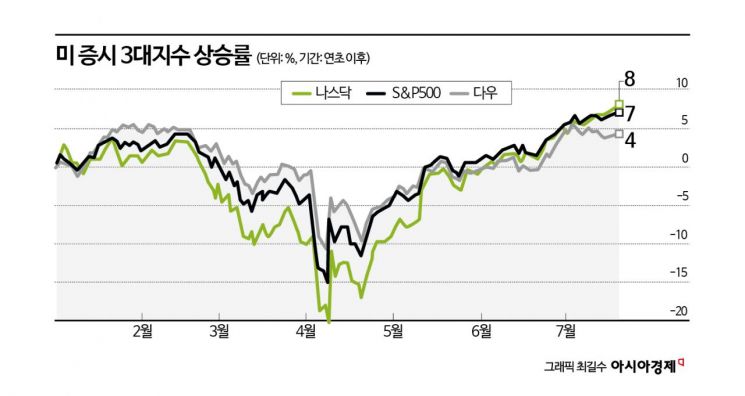

Although the US stock market continues to reach all-time highs, Bloomberg News reported on July 20 (local time) that some on Wall Street are warning that tariff risks are being underestimated. This concern stems from the possibility that high tariff rates could negatively impact the future profits of US companies.

According to estimates by Bloomberg Economics, the average tariff rate paid by US importers has already climbed into the 13% range, more than five times higher than last year. President Donald Trump has postponed the implementation of reciprocal tariffs until after August 1, but the base tariff rate of 10%, as well as item-specific tariffs on products such as steel and automobiles, are already in effect. Additionally, while tariffs on Chinese imports once reached as high as 145% before a 'tariff truce' was reached in high-level US-China talks, an additional 30% tariff is still being imposed.

Wall Street observers believe that these elevated tariff rates will lead to a decline in US corporate profits. Alastair Pinder, Chief Global Equity Strategist at HSBC, pointed out that rising tariff rates could reduce US corporate earnings growth by more than 5%.

In addition to tariff risks, the historically high valuation of the New York stock market is also cited as a market risk factor. The 12-month forward price-to-earnings ratio (PER) of the S&P 500, a benchmark index that recently hit record highs, is around 22 times, the highest level since February. Notably, the PER of the top 10 companies by market capitalization is nearing 30 times, surpassing the 25 times level seen at the peak of the IT bubble in 2000, fueling ongoing concerns about an 'AI bubble.'

Bloomberg News noted, "Regardless of what level President Trump ultimately sets tariffs on trading partners, some prominent figures on Wall Street point out that even considering only the tariffs already in effect, investors are underestimating the risks." The report added, "Due to President Trump's unpredictable nature, there remains a significant risk that tariff levels could rise sharply by the August 1 deadline."

There are also projections in the market that even if major companies report solid second-quarter results, investor reactions may remain subdued. In fact, large banks such as JPMorgan Chase and Goldman Sachs reported results last week that far exceeded market expectations, but the market response was lukewarm. JPMorgan's second-quarter earnings per share came in at $5.24, well above the $4.48 expected by analysts surveyed by LSEG, yet the stock price fell 0.7% on the day of the earnings release. Goldman Sachs, which reported a 'surprise result,' saw its stock rise by only 0.9%. Additionally, Netflix's second-quarter revenue beat Wall Street estimates and its annual revenue guidance was raised, yet the stock plunged by 5.1%.

Bloomberg News explained that the market's muted response to strong earnings is because most of the good news has already been priced in, and investors are reacting harshly to disappointing results. Greg Taylor, Chief Investment Officer at PenderFund Capital Management, analyzed, "At current valuation levels, all positive factors are already reflected in the market."

Paul Nolte, Market Strategist at Murphy & Sylvest Wealth Management, also commented, "The market is currently priced for perfection, so any disappointing results or figures that fall short of expectations could lead to a downward adjustment in stock prices." He added, "Right now, there's a 'balloon waiting for a pin' on Wall Street. No one knows exactly what that pin will be, but negative corporate earnings could be the trigger." He further pointed out, "The market is currently vulnerable to a decline and could fall by more than 20% in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.