Gold and Private Equity Likely to Be Included

FT: "Executive Order to Be Signed This Week"

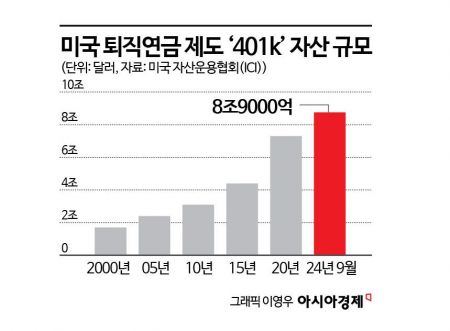

Management Scale Reaches $9 Trillion... Industry Expectations Rise

President Donald Trump of the United States plans to expand the range of investments allowed in the country's flagship retirement account, the 401k, to include not only stocks and bonds but also Bitcoin, private equity, and gold, according to a report by the Financial Times (FT) on July 17 (local time). It is expected that a portion of the massive retirement funds, which currently total about $9 trillion (approximately 12,517 trillion won), will flow into these alternative asset markets.

FT, citing multiple sources familiar with the matter, reported that President Trump is expected to sign an executive order reflecting these changes within this week. The White House effectively acknowledged the report, telling FT, "President Trump promises to restore prosperity for all Americans and protect their economic future. The true official decision will be the president's announcement."

The 401k is a defined contribution (DC) retirement plan that is often cited as the reason for the emergence of "retirement millionaires" in the United States. Introduced in 1981, it has significantly contributed to the retirement security of American workers alongside the growth of the U.S. stock market. According to the U.S. Department of Labor, the annual average return on 401k retirement accounts reached 8.6% over the past 20 years (2001?2020). With $3 trillion to $4 trillion in new funds flowing in each year, it serves as a "safety net" for the U.S. stock market. It is evaluated as a "win-win" structure that benefits both investors and the market.

The upcoming executive order is expected to include provisions that ease 401k investment regulations for a variety of alternative asset classes, including not only virtual assets but also gold, private equity, private credit, and infrastructure investments. It is also expected to direct relevant agencies?including the Department of Labor, the Department of the Treasury, the Securities and Exchange Commission (SEC), and the Federal Retirement Thrift Investment Board (FRTIB)?to carry out administrative procedures for further regulatory improvements.

During last year's U.S. presidential election, President Trump, who branded himself as the "crypto president," has been working since the beginning of his term to establish legal frameworks that allow retirement funds to be invested in Bitcoin. A notable example is the Department of Labor's announcement in May that it would lift the ban on Bitcoin investments in retirement accounts. Previously, former President Joe Biden had banned such investments in 2022, citing the risks of theft and loss associated with virtual assets. The Trump administration's reversal of this decision marks a significant policy shift.

Moreover, expectations for virtual assets have risen as three major crypto-related bills, including the Stablecoin Act, began passing the House of Representatives on this day. Market sentiment has become more bullish, with Ripple (XRP) reaching an all-time high and Bitcoin rising by more than 1% compared to the previous trading day. The private equity industry is also highly optimistic, according to the Wall Street Journal (WSJ). Large private asset managers such as Apollo Global Management and Blackstone are seen as likely beneficiaries. As major institutional investors, including public pension funds, approach their existing private equity investment limits, these asset managers are in urgent need of new channels for capital inflows.

However, there is a prevailing view that lowering the investment threshold for higher-risk assets such as private equity, compared to stocks and bonds, will require further discussion and broader social consensus. Martin Small, Chief Financial Officer (CFO) of BlackRock Asset Management, stated during a meeting with analysts on July 16 that "allowing access to private equity in 401k accounts would require litigation reform in the United States, or at least revisions to investment advisory regulations," according to the WSJ.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)