Consumer Alert Issued Over Smishing Scams Impersonating the Livelihood Recovery Consumption Coupon

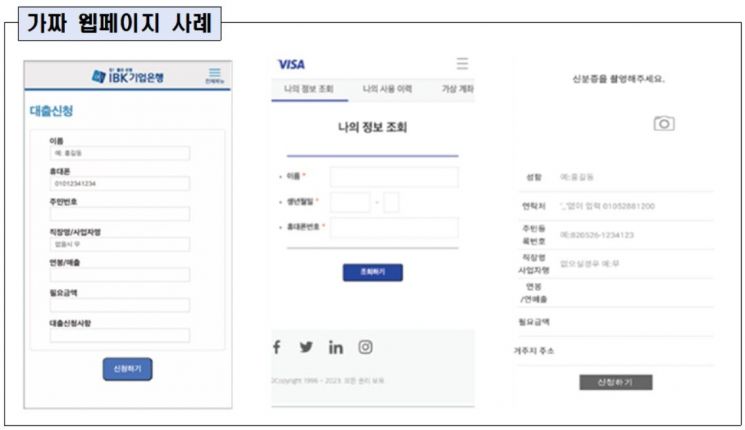

Fake website impersonating the application for the Livelihood Recovery Consumption Coupon. Photo by Financial Services Commission

Fake website impersonating the application for the Livelihood Recovery Consumption Coupon. Photo by Financial Services Commission

With the application and distribution of the Livelihood Recovery Consumption Coupon set to begin on July 21, there are growing concerns about serious smishing (SMS phishing) damage, prompting a call for heightened consumer vigilance.

On July 17, the Financial Services Commission announced that official text messages regarding the Livelihood Recovery Consumption Coupon will not contain any internet addresses (URLs), and issued a consumer alert at the "caution" level.

The Financial Services Commission, anticipating a surge in smishing related to the Livelihood Recovery Consumption Coupon, has instructed banks and card companies not to include URL links in any consumer notifications about the coupon.

The Commission explained that clicking on suspicious URLs could lead to phishing sites or result in the installation of malicious apps, which may expose personal information and cause financial losses.

Financial authorities plan to promptly suspend the use of any phone numbers used to impersonate the Livelihood Recovery Consumption Coupon inquiry or application process. They also intend to strengthen FDS (Fraud Detection System) monitoring in the banking and card sectors to closely monitor the status of consumer damages.

The Financial Services Commission requested that anyone who receives a smishing message report it to the Voice Phishing Integrated Report and Response Center to suspend the use of the sender's phone number.

If financial damage such as unauthorized fund transfers occurs, victims should immediately report it to the financial institution of either their own account or the scammer's account, or to the Voice Phishing Integrated Report and Response Center (112), and request a payment suspension without delay.

In the event of personal information leakage, individuals are advised to use the "Personal Information Exposure Accident Prevention System" on the Financial Supervisory Service's financial consumer information portal "Fine" to prevent further damage. The authorities also strongly recommend actively using the loan and non-face-to-face account opening safety blocking services to preemptively block unauthorized loans or new account openings that may occur without the individual's knowledge due to personal information leakage.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)