Change of Largest Shareholder to Asia Strategy

Concerns Over Increased Stock Price Volatility Due to Short-term Surge

Similar Cases Follow with Bridge Biotherapeutics and Hyper Corporation

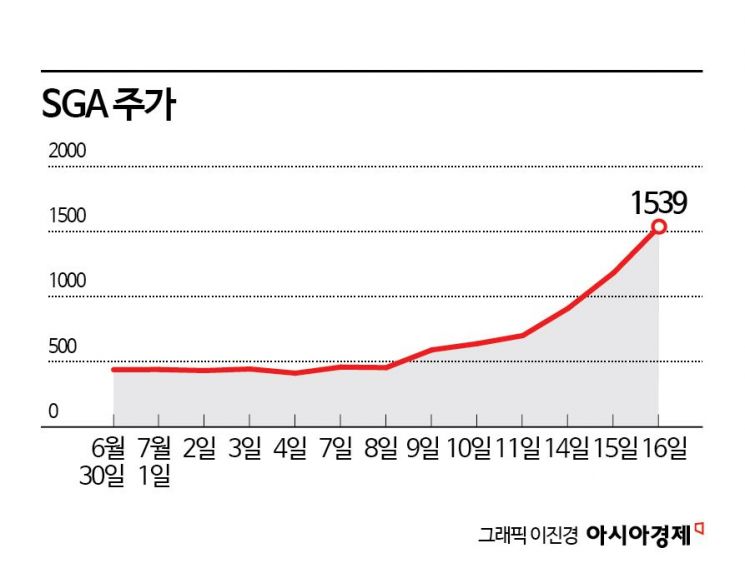

The stock price of SGA, a system integration (SI) company, has surged dramatically this month. News of a change in the largest shareholder has served as a catalyst for the stock's rise.

According to the financial investment industry on July 17, SGA's stock price closed at 1,539 won the previous day, up 251% from 439 won at the end of last month.

Previously, on July 14, SGA held a board meeting and resolved to issue new shares worth 34.5 billion won through a third-party allotment. Asia Strategy Partners, KCGI, Pathfinder Holdings, and Simon Gerovich, CEO of Metaplanet, are among those participating in the capital increase.

The payment date is set for September 10, and once the capital increase is completed, SGA's largest shareholder will change to Asia Strategy. Jason Fang, CEO of Asia Strategy, is the founder of Sora Ventures. Sora Ventures, a blockchain-focused venture capital firm, generates profits by teaching companies how to strategically add Bitcoin to their asset portfolios and by acquiring stakes in those companies.

The financial investment industry expects that SGA will use the funds raised through the capital increase to acquire Bitcoin. Previously, on June 5, Jason Fang attended 'Bitcoin Seoul 2025' held at Signiel Seoul in Songpa-gu, Seoul, and explained, "A new trend is emerging in Asia, where companies in countries with strict regulations on virtual assets are adopting Bitcoin financial strategies and attracting investment."

Immediately after the resolution for the capital increase, SGA announced that it would sell 18.85 million shares of SGA Solutions to SGA Holdings. The sale amount is 13.7 billion won. SGA Solutions, a KOSDAQ-listed company, previously issued new shares through a third-party allotment to SGA Holdings last month. As a result of the capital increase, the largest shareholder changed from SGA to SGA Holdings. Considering this series of events, it can be inferred that SGA has been preparing for the capital increase for several months.

Recently, there has been an increase in cases where KOSDAQ-listed companies are acquired for the purpose of virtual asset investment in the domestic stock market. Parataxis Korea Fund has secured management rights of Bridge Biotherapeutics. Parataxis Korea Fund is known as a special purpose company (SPC) under Parataxis Holdings, an affiliate of Parataxis Capital Management, a U.S.-based hedge fund specializing in virtual assets. In addition, Hyper Corporation's largest shareholder will also change to Panatic Strategic Holdings, a Singapore-based SPC. Panatic Strategic Holdings is also a company that invests in virtual assets.

As the price of Bitcoin recently hit an all-time high again, interest in cryptocurrency investment companies has grown. It has become common to see the stock prices of related listed companies surge and then undergo corrections. Stock market experts have expressed concerns about the risk of losses for individual investors due to increased volatility. An official from the financial investment industry advised, "Recently, there have been a series of changes in the largest shareholder through third-party allotments. Since the methods of investing in cryptocurrencies and plans for raising funds are not clearly disclosed, it is difficult to make investment decisions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.