Expectations Remain High Despite Concerns Over Trump’s Tariffs

It has been found that investors are flocking to U.S. technology stocks at the fastest pace in 16 years.

According to a monthly survey conducted by Bank of America (BoA) on July 15 (local time), which polled 175 fund managers between July 3 and July 10, asset allocation to technology stocks from April to July this year saw the largest increase since March 2009.

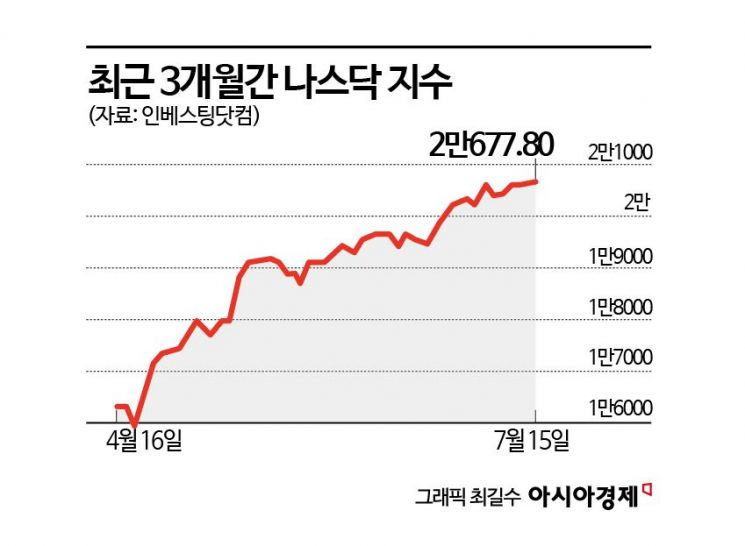

On this day, the tech-heavy Nasdaq index closed at 20,677.8, up 37.47 points (0.18%) from the previous day. This is a rise of about 35% from its lowest point in April.

Bhanu Krishna, Head of U.S. Equity Strategy at Barclays, said, "Big Tech companies have regained leadership."

The Financial Times (FT) assessed, "The recent rebound of technology stocks, which were hit hardest by the sell-off in April, signals that investors are shrugging off President Donald Trump's new tariff threats and are betting on continued rapid earnings growth from the so-called Magnificent 7 (M7), which have driven the stock market's gains in recent years."

Such optimism is rising even further ahead of the second-quarter earnings announcements of major companies including Microsoft (MS), Meta, Alphabet, Amazon, Apple, and Tesla. The leading Big Tech firms already posted positive results in the first quarter of this year, which led to a rebound in their stock prices. Krishna commented, "We expect Big Tech's earnings to exceed expectations," adding, "The key question is how significant the surprise will be."

In particular, the previous day, the U.S. government's easing of semiconductor export restrictions to China has had a positive impact on investor sentiment. Jessica Henry, investment director at Federated Hermes, mentioned this, saying, "Not only Nvidia but the entire semiconductor and artificial intelligence (AI) sectors are showing strength. This is a positive signal that the U.S. government is willing to ease certain regulations to secure technological competitiveness."

According to the BoA survey, the net percentage of fund managers who said they increased their allocation to technology stocks was 14%, a significant jump from last month, when a net 1% said they had reduced their allocation.

Mariya Baitmane, Head of Equity Research at State Street, said, "Technology remains our most preferred sector globally," and added, "It continues to deliver consistently high earnings growth based on high margins and strong cash flow generation."

However, despite the rebound in technology stocks, BoA explained that investor enthusiasm for tech stocks still remains below average. Elias Galu, BoA investment strategist, said, "The biggest concern about tech stocks is valuation," and added, "Fund managers are realizing that they are buying into one of the most expensive markets in the past 100 years."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)