Subsidiary Acquired in January 2020 Continues to Post Losses

Performance Worsens Amid Brexit and COVID-19

Modular Business Expansion to Continue Despite Subsidiary Liquidation

A bird's-eye view of the Camp Hill project ordered by Elements in July 2023. Provided by GS Construction

A bird's-eye view of the Camp Hill project ordered by Elements in July 2023. Provided by GS Construction

The "modular business" initiative driven by Hyunhong Heo, CEO of GS Engineering & Construction, has hit a roadblock. GS Engineering & Construction recently decided to liquidate its overseas modular subsidiary, which had been the core of its off-site strategy?building homes in factories and assembling them on-site. Not only did the losses far exceed the acquisition price, but the company also faced difficulties in selling the subsidiary, ultimately leading to the initiation of liquidation procedures. While GS Engineering & Construction maintains its intention to continue the modular business, this liquidation has inevitably dealt a blow to its future growth strategy.

According to industry sources on July 16, GS Engineering & Construction has begun liquidation proceedings for Elements Europe, its UK-based modular subsidiary.

Elements was a key company at the heart of GS Engineering & Construction's modular business, which is a core new business area for the company. Modular construction is a building method in which most of the construction processes, such as the basic framework and electrical wiring, are completed in a factory, and the components are assembled on-site like Lego blocks. Elements supplied steel-frame modular homes in the UK, focusing mainly on mid- and high-rise buildings such as hotels, apartments, and dormitories.

At the time of the acquisition, CEO Heo was serving as President of the New Business Division and personally traveled to the UK to attend the signing ceremony for the acquisition agreement. In January 2020, GS Engineering & Construction invested 34.2 billion KRW to acquire a 75% stake in Elements. The company aimed to target the European market, where demand for modular housing is high, by utilizing both Elements and its Polish subsidiary, Danwood S.A. This year, GS Engineering & Construction further strengthened its modular business by reorganizing and separating the organization under the New Business Division into a Prefab (prefabricated housing) division in the first quarter.

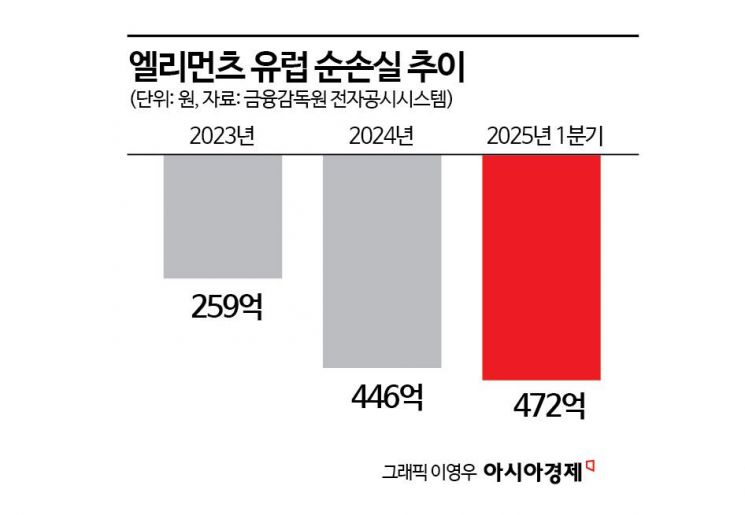

However, Elements' performance plummeted after the acquisition. The challenges began the month after the deal was completed. The UK's decision to leave the European Union (Brexit) blocked the supply of foreign labor. In addition, the COVID-19 pandemic led to rising raw material and labor costs, further increasing the financial burden. While the company posted a net profit of 4 million KRW in the first year after the acquisition, it recorded net losses of 2 billion KRW in 2022 and 25.9 billion KRW in 2023. Last year, net losses surged to 44.6 billion KRW. In 2024, the company has already posted a net loss of 47.2 billion KRW in the first quarter alone.

As the scale of losses continued to grow, selling the subsidiary became increasingly difficult. GS Engineering & Construction decided to proceed with the liquidation of Elements, even if it meant incurring costs of approximately 100 billion KRW. Lee Taehwan, a researcher at Daishin Securities, predicted, "Despite generating sales of around 50 billion KRW in Vietnam, the New Business Division is expected to record a deficit, as the costs related to the liquidation of Elements will be included in operating expenses."

Despite this liquidation, GS Engineering & Construction remains committed to expanding its modular business. A company representative stated, "We plan to continuously expand our influence in both the domestic and overseas modular markets, leveraging the technology and experience gained from operating Elements. The construction industry is one of the sectors most affected by demographic decline and climate change. Prefabricated construction is a future-oriented solution that can help overcome these challenges, and we will continue to pursue this business going forward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.