Intraday High of 59,200 Won Sets New 52-Week Record

600 Won Per Share Quarterly Dividend Confirmed for Q2

Annual Operating Profit Expected to Surpass 2 Trillion Won This Year

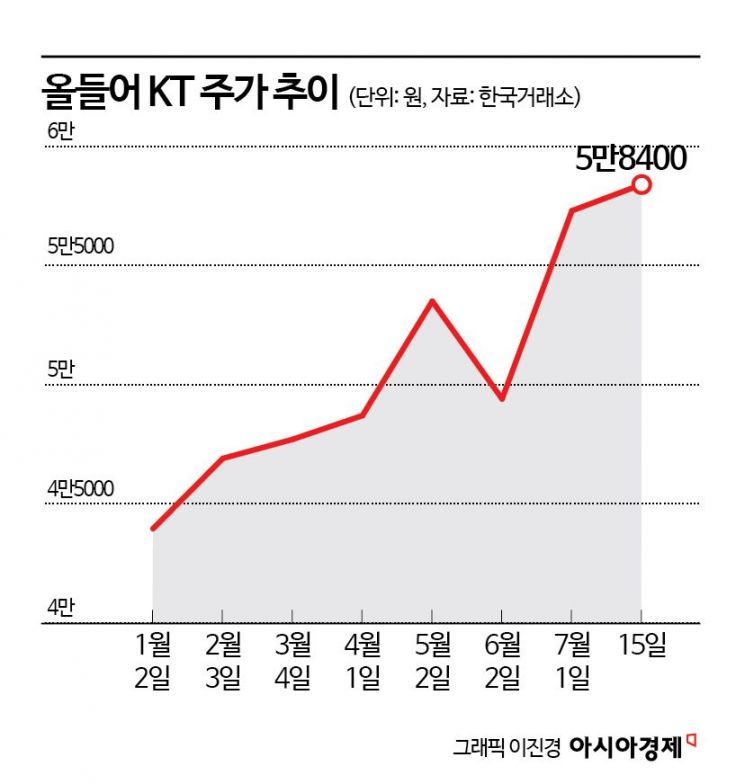

KT is on the verge of breaking the 60,000 won mark, setting new record highs for its share price day after day. The market appears to be responding positively to the company’s solid performance and efforts to enhance shareholder returns.

According to the Korea Exchange on July 16, KT reached an intraday high of 59,200 won the previous day, marking a new 52-week high. KT closed at 58,400 won, up 1.04%, and has risen 4.85% so far this month.

Kim Hoejae, a researcher at Daishin Securities, stated, "KT's share price is at its highest level since the privatization of KT in August 2002, and it has achieved positive returns every year since 2021. In 2021, 2022, and 2024, it outperformed the index," adding, "This year as well, KT is showing strong performance alongside the robust rise of the index, supported by solid earnings and shareholder return efforts."

Efforts to enhance shareholder value are cited as one of the driving forces behind the share price increase. On the previous day, KT announced a quarterly cash dividend of 600 won per common share for the second quarter of this year. Starting this quarter, KT has introduced a "pre-dividend, post-investment" system, allowing investors to confirm the dividend and its amount in advance before making investment decisions. Jang Min, KT's Chief Financial Officer (Executive Vice President), said, "Through a transparent and predictable dividend policy, we will simultaneously achieve the dual goals of sustainable management and enhancing shareholder value," adding, "We will continue to strengthen trust with the market through proactive shareholder return policies."

Solid earnings are also supporting the share price rally. According to financial information provider FnGuide, KT’s consensus earnings estimate for the second quarter of this year is 7.2321 trillion won in revenue and 863.9 billion won in operating profit. These figures represent increases of 10.47% and 74.88%, respectively, compared to the same period last year. The securities industry expects KT’s second-quarter results to exceed consensus estimates. Jung Jisoo, a researcher at Meritz Securities, said, "Second-quarter revenue is expected to increase by 11.2% to 7.2777 trillion won, and operating profit is expected to rise by 88.7% to 932.3 billion won, surpassing consensus. Due to a competitor's hacking incident, KT recorded a net increase of about 280,000 number portings from April to May, and the number of 5G subscribers is expected to reach 10.95 million."

There are also forecasts that annual operating profit will surpass 2 trillion won this year. Jung predicted, "On a consolidated basis, this year’s revenue and operating profit are expected to reach 27.7865 trillion won and 2.5302 trillion won, respectively. The effects of labor cost reduction from the large-scale restructuring at the end of last year have become visible from the second quarter, and the remaining 10% of one-off gains from the Gwangjin-gu Advanced Business Complex project will be reflected in the third quarter and finalized." Kim also projected, "This year, operating profit will reach 2.6 trillion won, up 223% year-on-year, and even excluding real estate gains, operating profit will increase by 162% to 2.1 trillion won, marking the beginning of the 2 trillion won operating profit era."

Reflecting these positive earnings prospects, securities firms are raising their target prices for KT one after another. Meritz Securities raised its target from 60,500 won to 65,500 won, while Daishin Securities increased its target from 67,000 won to 74,000 won. DB Securities raised its target from 65,000 won to 75,000 won, Eugene Investment & Securities from 62,000 won to 66,000 won, Shin Young Securities from 60,000 won to 68,000 won, and NH Investment & Securities from 65,000 won to 75,000 won.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.